Tax officials guide businesses on tax procedures

Empowering business

According to businesses, the policy of extending the deadline for paying land rent in 2021-2024 has had a positive impact on the country's economy . Continuing to implement the policy of extending tax and land rent payments will help businesses reduce financial burdens, enhance their ability to respond to global economic risks, thereby contributing significantly to realizing the 8% growth target in 2025.

Mr. Dam Cong Tra, representative of DSVINA Company Limited (Bac Tan Uyen district), said that the company highly appreciated the continued extension of taxes and land rents for businesses in 2025. According to Mr. Dam Cong Tra, the total amount of value added tax, corporate income tax and land rent each year of the company is billions of dong. Implementing this policy helps businesses have more financial resources to solve immediate difficulties in capital. Businesses have more resources to continue maintaining production and have conditions to find new markets, thereby stabilizing production and business, contributing to the economic growth of the whole country.

Textile and garment enterprises in the province said that in recent times, the textile and garment and footwear industries have created jobs for hundreds of thousands of workers, contributing a large amount of revenue to the state budget. In the current context, continuing to implement tax payment extension policies helps enterprises reduce financial pressure and have more resources to adapt to global economic fluctuations.

It is noted that, in order to support businesses and people to overcome difficulties due to the adverse impacts of the world economic situation, the Ministry of Finance has proactively submitted to the Government and the National Assembly many policies from extending the deadline for payment of some types of taxes, fees, land rents to tax exemptions and reductions, with amounts up to hundreds of thousands of billions of VND. These are policies issued very promptly and appropriately. After many years of implementation, the policy of extending the tax payment deadline is considered a very effective solution in supporting businesses. Land rent alone is a significant expense, especially in the context of businesses facing difficulties.

Many beneficiaries

According to Decree No. 82/2025/ND-CP, the Government agrees to extend the tax payment deadline for value added tax payable for the tax period from February to June 2025; for land rent, the deadline is extended from February to June 2025; for corporate income tax, the tax payment deadline is extended for the first and second quarters of the 2025 corporate income tax period. Thus, the decree applies to taxpayers, tax authorities, tax officials, and related State agencies, organizations and individuals.

The beneficiaries of the extension policy include enterprises, organizations, households, business households and individuals operating in the fields of agriculture, forestry and fishery; food production and processing, textiles, leather production, wood processing, paper production, rubber, plastics, metals, mechanics, electronics, automobiles, construction, oil and gas exploitation, chemicals, motorcycles, motorbikes, drainage and wastewater treatment. In addition, enterprises operating in the fields of transportation, warehousing, accommodation, catering, education, healthcare, real estate, tourism services, entertainment, arts, sports, cinema, radio, television, information technology and mining support are eligible for the extension policy. Enterprises producing priority supporting industrial products or key mechanical products are also eligible for incentives, along with small and micro enterprises according to current laws.

According to the Regional Tax Department XVI, the extension procedure is quite simple. Taxpayers only need to submit the first or replacement extension request (if errors are detected) electronically, submit a paper copy directly or by post to the tax authority. Taxpayers need to self-determine and be responsible for whether they are eligible for an extension or not. In case the request is sent after May 30, 2025, the extension policy will not be applied. If during the inspection and examination process, the State agency discovers that the taxpayer is not eligible for an extension, they will have to pay the full amount of tax, land rent, along with fines and late payment fees to the State budget. Importantly, during the extension period, taxpayers will not be charged late payment fees for the extended amounts. If the tax authority has miscalculated the late payment fees, they will adjust them for the taxpayer...

Decree No. 82/2025/ND-CP takes effect from the date of signing (April 2) to December 31, 2025. This is one of the important fiscal measures to support the business community and people to continue to recover and develop production and business in the new period.

Every year, the Government issues a decree stipulating the extension of tax and land rent payment deadlines to support businesses and business households. Accordingly, in 2022, the amount of tax to be extended is about VND 107,000 billion; in 2023, about VND 97,000 billion; in 2024, about VND 78,000 billion. In 2025, the expected amount of tax to be extended is nearly VND 102,000 billion; of which the expected value-added tax to be extended is VND 62,000 billion, the expected corporate income tax to be extended is about VND 36,000 billion, the expected land rent to be extended is about VND 3,600 billion, the tax to be extended for business households and individuals is about VND 350 billion. |

THANH HONG

Source: https://baobinhduong.vn/gia-han-thue-tien-thue-dat-don-bay-ho-tro-doanh-nghiep-ho-kinh-doanh-a345081.html

![[Photo] Nearly 3,000 students moved by stories about soldiers](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/17/21da57c8241e42438b423eaa37215e0e)

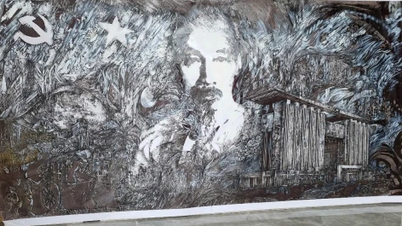

![[Photo] Readers line up to visit the photo exhibition and receive a special publication commemorating the 135th birthday of President Ho Chi Minh at Nhan Dan Newspaper](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/17/85b3197fc6bd43e6a9ee4db15101005b)

Comment (0)