|

| Vietnam's rice export prices have increased again. |

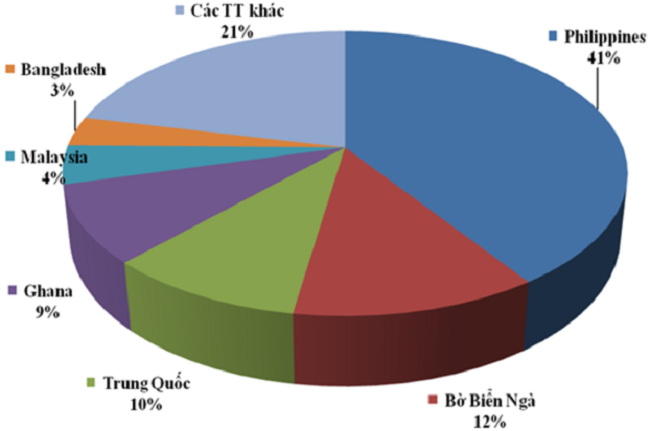

According to the General Department of Customs, in March 2025, Vietnam's rice exports increased by 54.82% in volume and 48.06% in value compared to February 2025, but the export price of rice decreased by 4.37%. In March 2025, Vietnam exported the most rice to the Philippines, reaching 438,805 tons, equivalent to 204.51 million USD; followed by China with 159,021 tons, equivalent to 79.8 million USD; Ghana with 62,908 tons, equivalent to 37.38 million USD.

In the first quarter of 2025, the country's rice exports reached nearly 2.309 million tons, worth nearly 1.21 billion USD, up 5.82% in volume, but down 15.53% in value compared to the same period in 2024. The average export price of rice in the first quarter of 2025 was 522 USD/ton, down 20.18% in price compared to the first quarter of 2024.

RICE EXPORT PRICES HAVE RISED AGAIN

In the first quarter of 2025, the Philippines market ranked first, accounting for 42.7% of the total volume and 40.6% of the total rice export turnover of the country, reaching 985,941 tons, equivalent to nearly 488.77 million USD, price 495.74 USD/ton, down 2.52% in volume, down 24.69% in turnover and down 22.74% in price compared to the first 3 months of 2024.

Ivory Coast ranked second, reaching 293,296 tons, equivalent to 143.49 million USD, price of 489.25 USD/ton, accounting for 12.7% of the total volume and 11.9% of the total rice export turnover of the whole country, a sharp increase of 218% in volume, an increase of 138.39% in turnover, but a decrease of 25% in price compared to the first 3 months of 2024. China ranked third with 232,136 tons, equivalent to 115.69 million USD, an average price of 498.35 USD/ton, accounting for 10.1% of the total volume and 9.6% of the total turnover, a sharp increase of 184.31% in volume, an increase of 140% in turnover but a decrease of 15.56% in price compared to the first 3 months of 2024.

|

| Vietnam's rice export markets in the first quarter of 2025. Source: Customs Department. |

According to the Vietnam Food Association (VFA), since the beginning of April 2025, Vietnam's rice export prices have been recovering. Compared to the leading rice exporting countries, Vietnam's 5% broken rice export price has returned to the number 1 position, at 397 USD/ton. Meanwhile, the price of 5% broken rice from Thailand is 395 USD/ton, Pakistan is 387 USD/ton and India is 376 USD/ton. Many Vietnamese traders have exported 5% broken rice at prices exceeding 400 USD/ton.

Mr. Do Ha Nam, Chairman of VFA, commented that the current increase in rice prices is due to the end of the winter-spring rice harvest, so the rice supply is not much left, while traditional customers always have high and stable demand for Vietnamese rice.

Citing a report from the Vietnam Trade Office in the Philippines, VFA said that in 2025, the Philippines' rice import demand will remain high, forecast at around 4.9 million tons, even over 5 million tons. Vietnamese rice will still be the Philippines' main import source.

According to the April 2025 market analysis report of the US Department of Agriculture (USDA), African countries will become the world's largest rice importers in 2025. Specifically, Ghana is the largest rice importer in Africa, forecast to import 2.5 million tons of rice in 2025. Ivory Coast is the second largest rice importer in Africa, forecast to import 1.8 million tons of rice in 2025.

According to VFA, both Ghana and Ivory Coast are countries importing rice from Vietnam. In 2024, Ivory Coast imported 483,000 tons of rice from Vietnam, and was the 5th largest rice buyer of Vietnam. In the first quarter of 2025, Ivory Coast with a market share of 16.3% rose to become the 2nd largest rice buyer of Vietnam, after the Philippines with 42.1%. In 2024, Ghana was the 4th largest rice buyer of Vietnam with a volume of 613,000 tons. In the first quarter of 2025, Ghana with a market share of 10.2% of the total rice export value from Vietnam, ranked fourth, after China.

VIETNAM'S SPECIALTY RICE ALSO HAS THE HIGHEST EXPORT PRICE

According to VFA, the export prices of Vietnamese specialty rice are currently far higher than those of Thai and Indian specialty rice. Of which, the export price of ST25 rice is up to 1,200 USD/ton (FOB price at Ho Chi Minh City port), due to the low output of ST25 rice in the last winter-spring crop, and the high domestic demand for this product. Meanwhile, the export prices of Thailand's highest-quality fragrant rice at present: Jasmine rice is priced at only 1,050 USD/ton; Hom Mali rice is priced at only 1,100 USD/ton. The export price of Indian Basmati rice is currently only about 900 USD/ton.

For the sticky rice segment, which is mainly exported to the Chinese market, Vietnam's export price of sticky rice is currently fluctuating around 580 - 590 USD/ton, much higher than at the beginning of the first quarter. Currently, sticky rice prices in Vietnam are high and supply is scarce because the winter-spring crop has ended, the remaining amount of sticky rice is mainly in the warehouses of mills and suppliers. Farmers do not have much sticky rice left to sell to the market, leading to high prices of sticky rice.

However, the high prices have caused the Chinese market, which had been buying heavily in February and March, to stop importing at this point. “China had been buying heavily in March when the price was still low, ranging from 568 to 571 USD per ton. However, when the price increased to 585 to 590 USD, they immediately stopped buying. The contracts for delivery in April are mainly from orders signed in February and March,” said Mr. Nguyen Van Don, Director of Viet Hung Company Limited.

In Thanh Hoa, Lam Son Sugarcane Joint Stock Company is expanding its investment outside the sugar industry. Recently, it has cooperated with foreign enterprises to introduce new high-quality rice varieties for testing and replication. Through this, the company has introduced the Japanese Japonica J02 rice variety into large-scale production with 500 hectares of land in Thieu Hoa district. To improve quality, the company has applied advanced production standards and has been recognized as a 4-star OCOP product at the provincial level.

In November 2024, Lam Son Sugar Joint Stock Company exported 300 tons of rice for the first time, worth 200,000 USD, to Singapore. Mr. Tran Xuan Trung, Deputy Director in charge of import and export trade, Lam Son Sugar Joint Stock Company, said that the company has basically completed the procedures with its partner, Kematsu Company of Japan, and is expected to export the first batch of rice to the Japanese market in June 2025. Also in 2025, the company signed a contract with a partner to export from 1,200 tons to 1,500 tons of rice to the markets of Singapore and Australia.

Mr. Do Ha Nam, Chairman of VFA, said that although the price of Vietnam's standard 5% broken rice in the first quarter fell below 400 USD/ton, and the price of 25% broken rice was even lower, the average export price of rice still reached 522 USD/ton, thanks to fragrant rice and specialty rice accounting for a high proportion of exports.

“Vietnamese rice is in the upper-middle segment and is aiming for a higher segment with value and brand. In this segment, demand is very high, especially in Japan, the US and the EU. For example, the unprecedented rice price fever in Japan has lasted since the end of last year and shows no signs of cooling down. However, the amount of rice exported from Vietnam to the US has only reached 30 thousand tons/year and to the Japanese market is much less. This is a huge potential for Vietnam to expand production and export of specialty rice and fragrant rice," Mr. Nam emphasized.

According to vneconomy.vn

Source: https://baoquangngai.vn/kinh-te/202504/gia-gao-xuat-khau-cua-viet-nam-tro-lai-vi-tri-so-1-56202af/

![[Photo] Prime Minister Pham Minh Chinh chairs a special Government meeting on the arrangement of administrative units at all levels.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/9/6a22e6a997424870abfb39817bb9bb6c)

![[Photo] Magical moment of double five-colored clouds on Ba Den mountain on the day of the Buddha's relic procession](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/9/7a710556965c413397f9e38ac9708d2f)

![[Photo] General Secretary To Lam and international leaders attend the parade celebrating the 80th anniversary of the victory over fascism in Russia](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/9/4ec77ed7629a45c79d6e8aa952f20dd3)

![[Photo] Russian military power on display at parade celebrating 80 years of victory over fascism](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/9/ce054c3a71b74b1da3be310973aebcfd)

Comment (0)