After Typhoon Yagi hit Vietnam, domestic rice prices were expected to increase as supply was reduced due to the severe consequences of the storm. However, India has recently loosened its export restrictions, raising concerns that Vietnamese rice will face fiercer competition amid falling prices and lower domestic supply.

| Vietnam earned 4.37 billion USD from rice exports in 9 months. Agricultural, forestry and fishery exports in 9 months reached over 46 billion USD. |

|

Vietnamese rice faces difficulties as India boosts exports

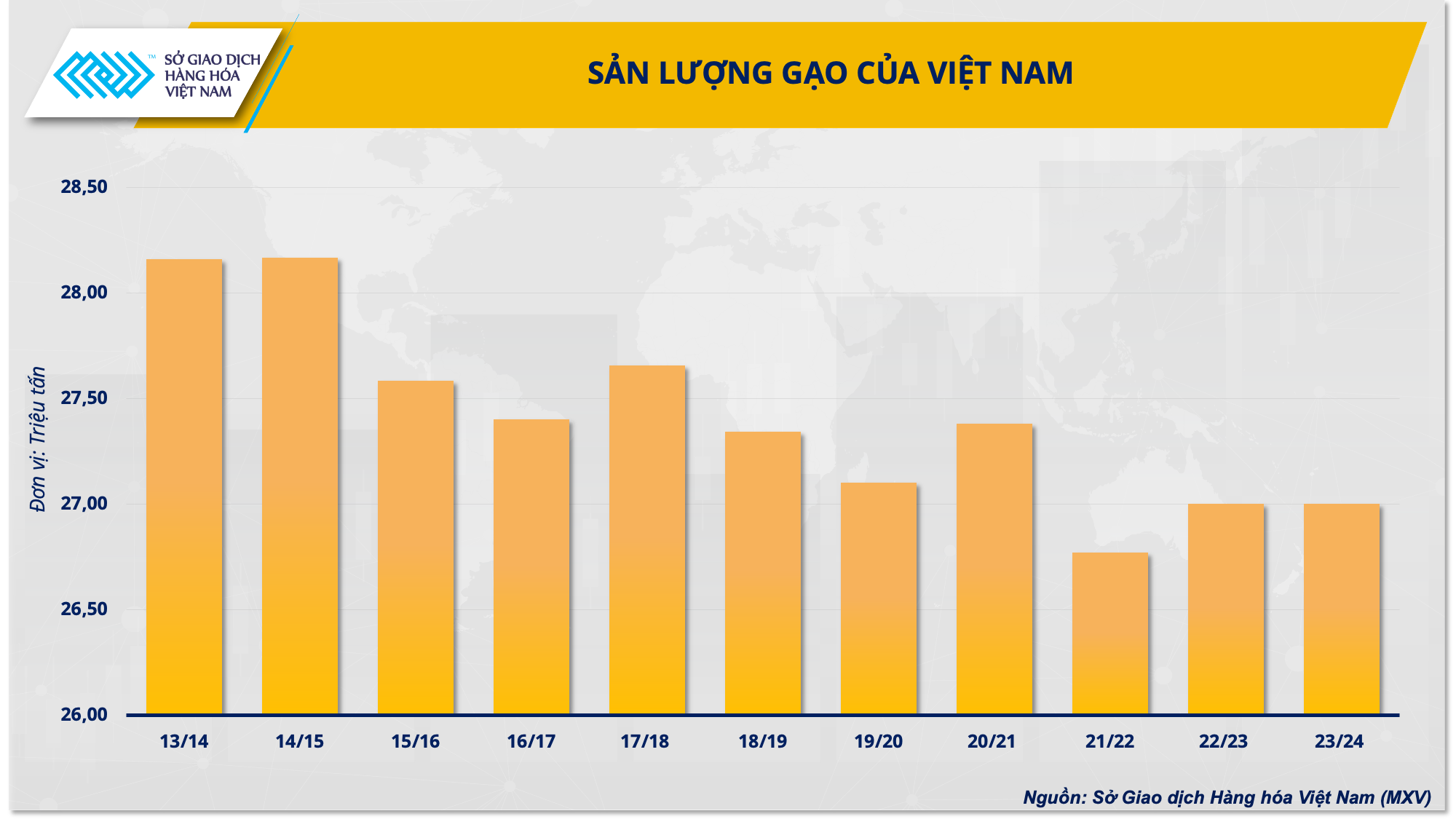

Typhoon Yagi is a historic storm with terrifying power when it made landfall in the North of our country. According to statistics from the Ministry of Agriculture and Rural Development, many rice and crop areas were affected. This storm caused over 190,300 hectares of rice to be flooded, with damage concentrated in the cities of Thai Binh, Hanoi, Hai Duong and Hung Yen. Although these are not the main rice granaries of our country, however, serious damage in these areas will also significantly impact the country's rice production.

|

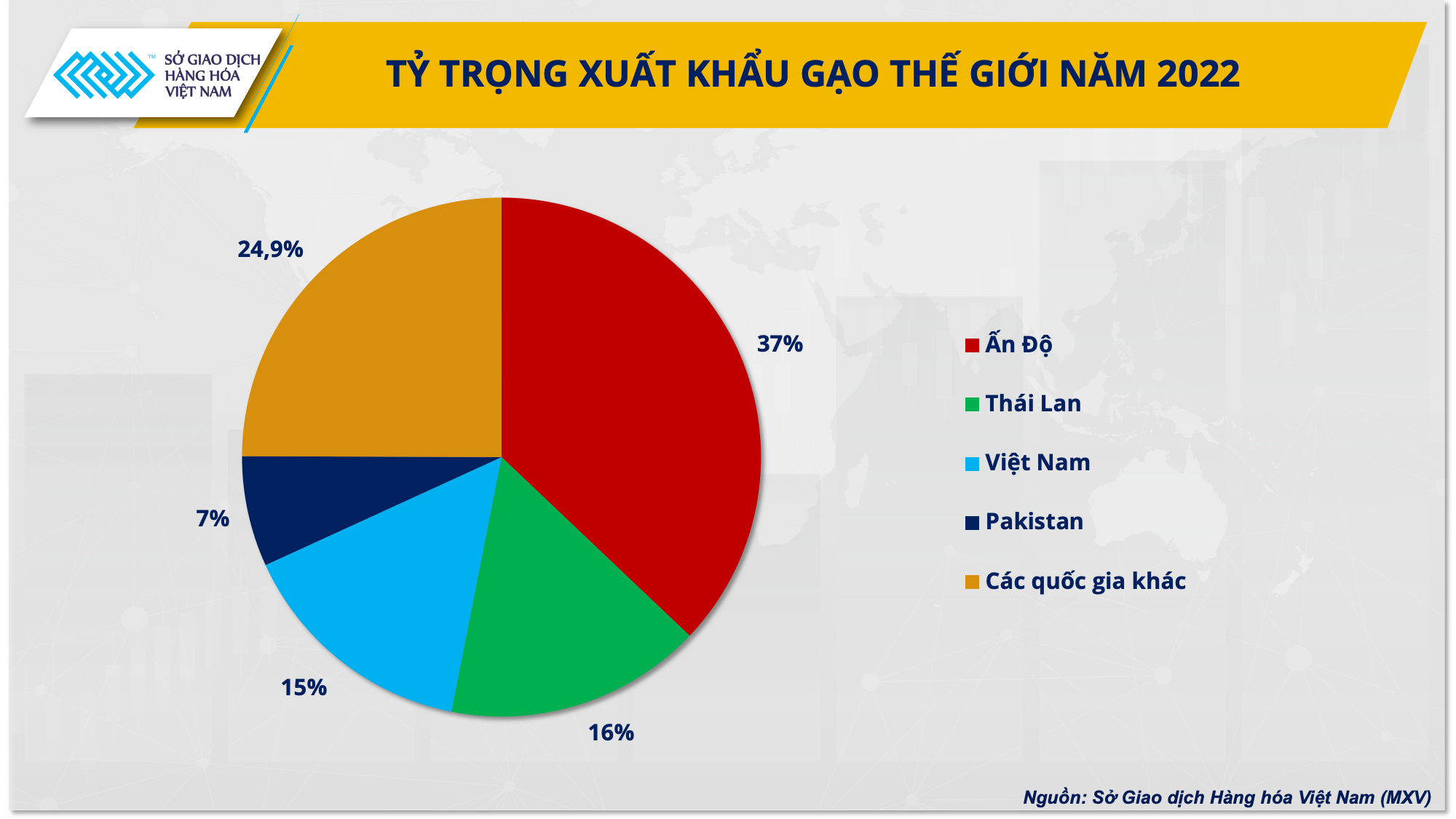

In this situation, domestic rice prices are expected to increase in the context of limited supply. History also shows that when our country's rice cultivation activities are affected by natural disasters and floods, rice prices in the domestic and export markets often increase sharply. However, this year, the situation is in the opposite direction when the Indian government officially allows the resumption of non-basmati white rice exports. Despite restricting exports in 2023, India is still the world's largest rice exporter and a strong competitor to Vietnamese rice. In 2022, the country exported a record 20.2 million tons of rice, accounting for 37% of global exports of 55.6 million tons.

|

India has been a major player in the global rice market, as its exports are often larger than the combined exports of the next four largest exporters, Thailand, Vietnam, Pakistan and the United States. Therefore, India’s resumption of exports will undoubtedly increase competition with other rice exporters, including Vietnam. However, the impact may be indirect, as the two countries have different traditional import customers. The largest importers of non-basmati white rice from India are Benin, Bangladesh, Angola, Cameroon, Djibouti, Guinea, Ivory Coast, Kenya and Nepal. Meanwhile, Vietnamese rice is often exported to neighboring countries and Southeast Asian countries, such as the Philippines, China, Malaysia and Indonesia, thanks to its favorable geographical location in the ASEAN region.

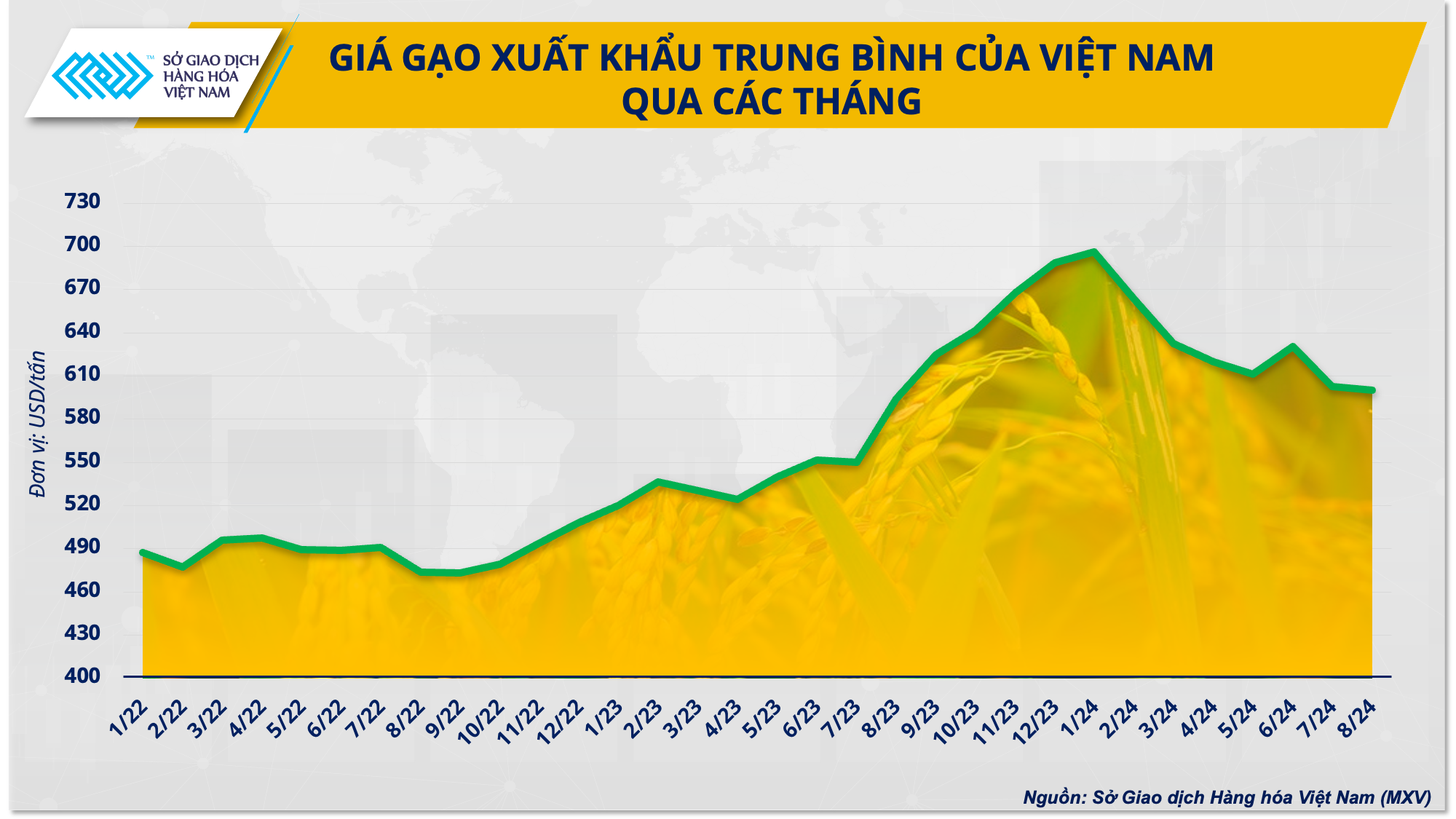

However, despite the differences in the two countries’ import market segments, the Vietnamese rice industry benefited from rising prices and high demand due to concerns about a supply shortage when India banned the export of non-basmati white rice in July last year. This year, India’s return to the market could reverse the situation, increasing competitive pressure on Vietnam’s rice exporters.

Mr. Nguyen Ngoc Quynh, Deputy General Director of the Vietnam Commodity Exchange (MXV), said that India's move to loosen and boost exports at this time could put more pressure on the country's rice industry, which is already facing many difficulties due to the consequences of Typhoon Yagi. The decrease in domestic rice output and the increase in Indian rice supply in the market will create challenges in achieving the target of exporting 8 million tons of rice this year.

How will rice prices fluctuate?

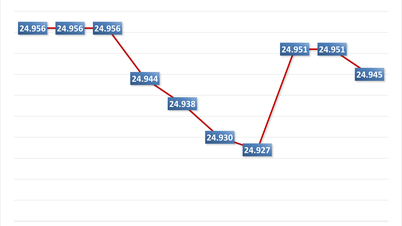

According to the Vietnam Food Association (VFA), in the first week of October, rice export prices of some Asian countries fell sharply after India eased its rice export restrictions, increasing competition among countries in the region. On October 9, the price of 5% broken rice from Thailand fell by more than 30 USD/ton, and the price of 25% broken rice from this country also lost 23 USD/ton compared to early October. Similarly, the price of 5% broken rice from Pakistan also fell below 500 USD/ton; the price of 100% broken rice from this country also fell below 400 USD/ton.

At the same time, the price of 5% broken rice in Vietnam was at 538 USD/ton, down nearly 20 USD/ton compared to last week; 25% broken rice was at 510 USD/ton; 100% broken rice was at 440 USD/ton. Due to the impact of increased supply from India, rice prices are expected to weaken in the coming months. However, Mr. Nguyen Ngoc Quynh expects that the price of Vietnamese rice will not decrease too much when demand from our country's traditional markets such as Indonesia, the Philippines, Singapore, etc. is increasing.

|

Indonesia, Vietnam’s second largest rice importer, has just opened a tender to buy 450,000 tons of rice, with delivery required in October and November. According to forecasts, Indonesia may import up to 4.3 million tons of rice this year, exceeding the 3.6 million tons announced at the beginning of the year. The reason is that the country’s rice output in the first 8 months of this year decreased by nearly 10% compared to the same period last year.

Meanwhile, the Philippines, one of the world's largest rice importers, also lowered tariffs and is expected to increase rice imports from 4.2 million tons to about 4.5 - 4.7 million tons in 2024.

Commenting on the future price of rice, Mr. Quynh said that in the last months of the year, the price of 5% broken rice and 25% broken rice from Vietnam may continue to decrease but not below 500 USD/ton due to supply pressure from India.

However, in the context of high demand from our country's export markets and domestic demand expected to increase during the Lunar New Year, our country's rice prices may recover in the late this year and early next year.

For sustainable development, our country's rice industry needs to focus on building a value chain from production, processing to consumption. In addition, localities also need to develop raw material zoning plans and develop brands in the direction of "ecological rice" and "low-emission rice" to increase the value of exported rice.

Source: https://thoibaonganhang.vn/gia-gao-giam-den-co-nao-khi-an-do-thuc-day-xuat-khau-tro-lai-156599.html

![[Photo] General Secretary To Lam meets and expresses gratitude to Vietnam's Belarusian friends](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/c515ee2054c54a87aa8a7cb520f2fa6e)

![[Photo] General Secretary To Lam arrives in Minsk, begins state visit to Belarus](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/76602f587468437f8b5b7104495f444d)

![[Photo] General Secretary To Lam concludes visit to Russia, departs for Belarus](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/0acf1081a95e4b1d9886c67fdafd95ed)

Comment (0)