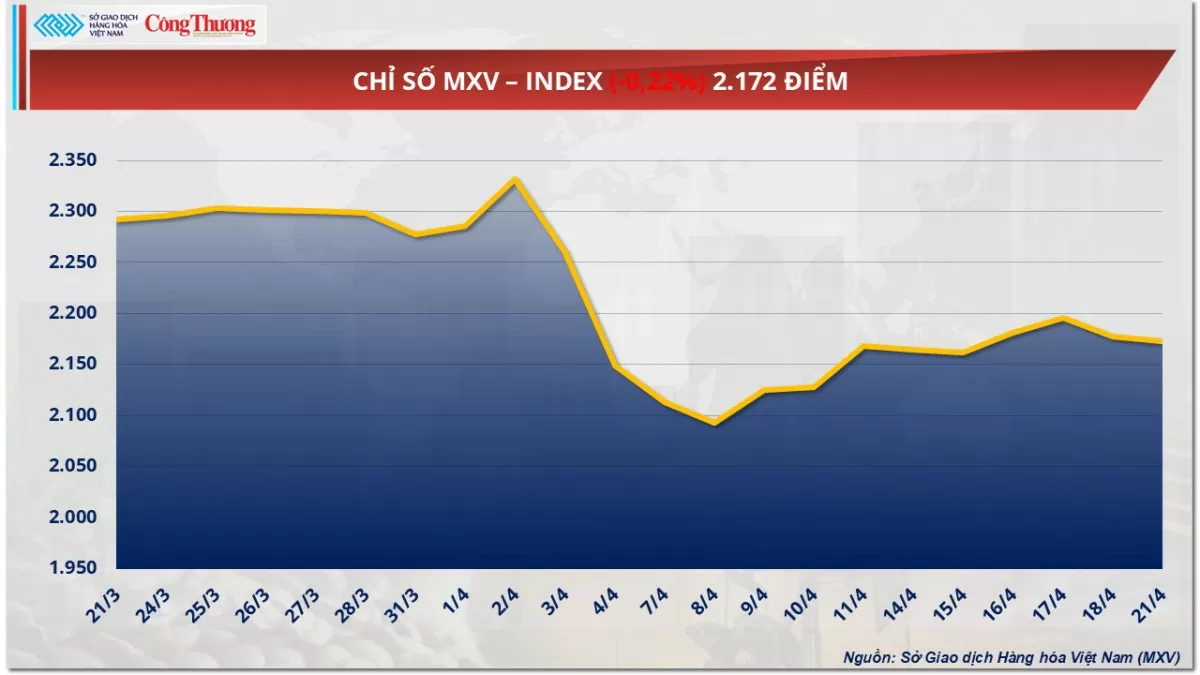

The Vietnam Commodity Exchange (MXV) said that the world raw material market was relatively volatile in the first trading session of the week (April 21). At the close, the MXV-Index weakened by 0.2% to 2,172 points. With 6 out of 7 commodities simultaneously decreasing in price, the agricultural market attracted attention in yesterday's trading session. In addition, the metal group was clearly differentiated in the context of supply and demand moving in opposite directions.

|

| MXV-Index |

Soybean prices closed in reverse

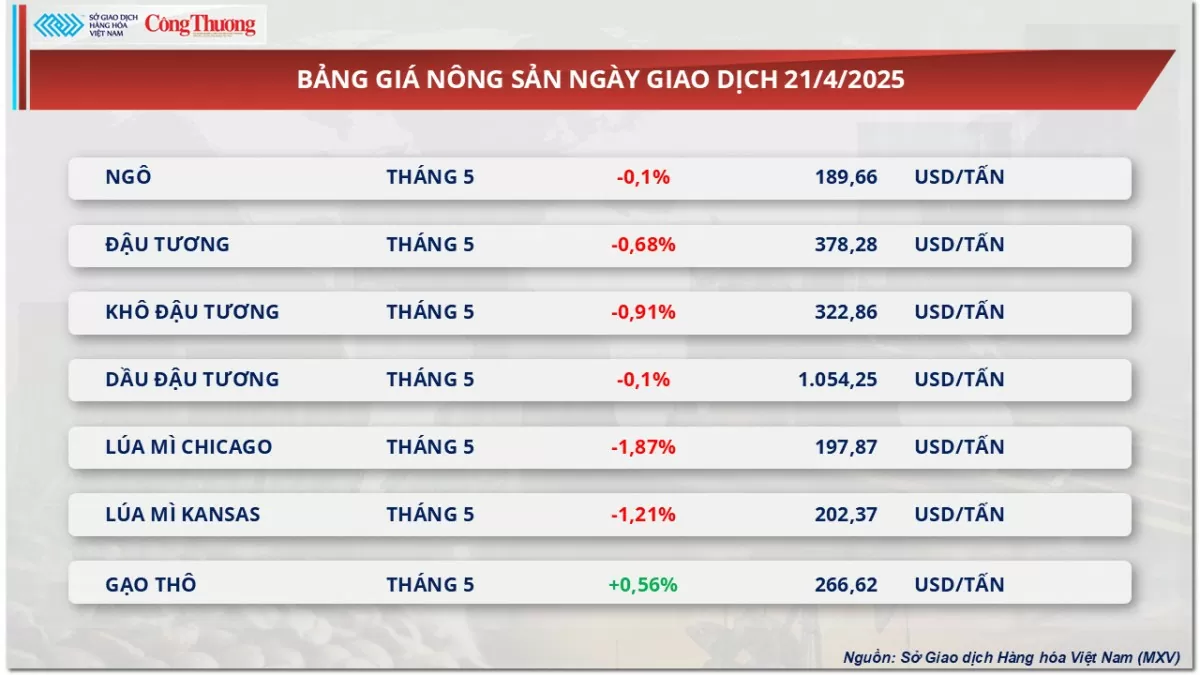

According to MXV, soybean prices recorded a slight decrease of 0.68% to 378 USD/ton in the first trading session of the week. The market could not maintain its upward momentum in the early session, as prices quickly turned to weaken following the general trend of agricultural products.

|

| Agricultural product price list |

Weather in the US has had little impact on the market. Heavy rains over the weekend in Texas, Oklahoma and Missouri have improved soil moisture in dry areas, supporting planting progress in the Midwest. While some areas may experience delays due to rain, the market is still viewing this as a short-term risk and not a concern at this time.

China imported 2.44 million tonnes of US soybeans in March, up 12% year-on-year and bringing total first-quarter imports to 11.6 million tonnes, 62% higher than a year earlier, according to data from the General Administration of Customs.

However, experts predict that Brazilian soybeans will dominate the market in the coming months as the country’s harvest season peaks. In addition, China’s domestic soybean production is expected to increase by 2.5% this year, indicating a long-term trend of decreasing dependence on imports. This factor has contributed to the downward pressure on prices.

Meanwhile, some positive trade news has emerged but not enough to turn the market around. These include the US and India reaching a bilateral trade agreement, and the proposed Section 301 fee on Chinese ships being amended to exclude agricultural products, minimizing risks to soybean exports. Japan is also said to be considering increasing soybean imports from the US, but no specifics have been released.

Similar to soybeans, the two finished products, soybean meal and soybean oil, both weakened. Soybean oil prices decreased slightly by 0.1%, indicating that sellers have returned to the market after five consecutive sessions of increase. The lack of clarity on the US biofuel support policy continued to weaken the expectation of the country's soybean oil consumption, putting pressure on prices.

Metal market moves in opposite directions

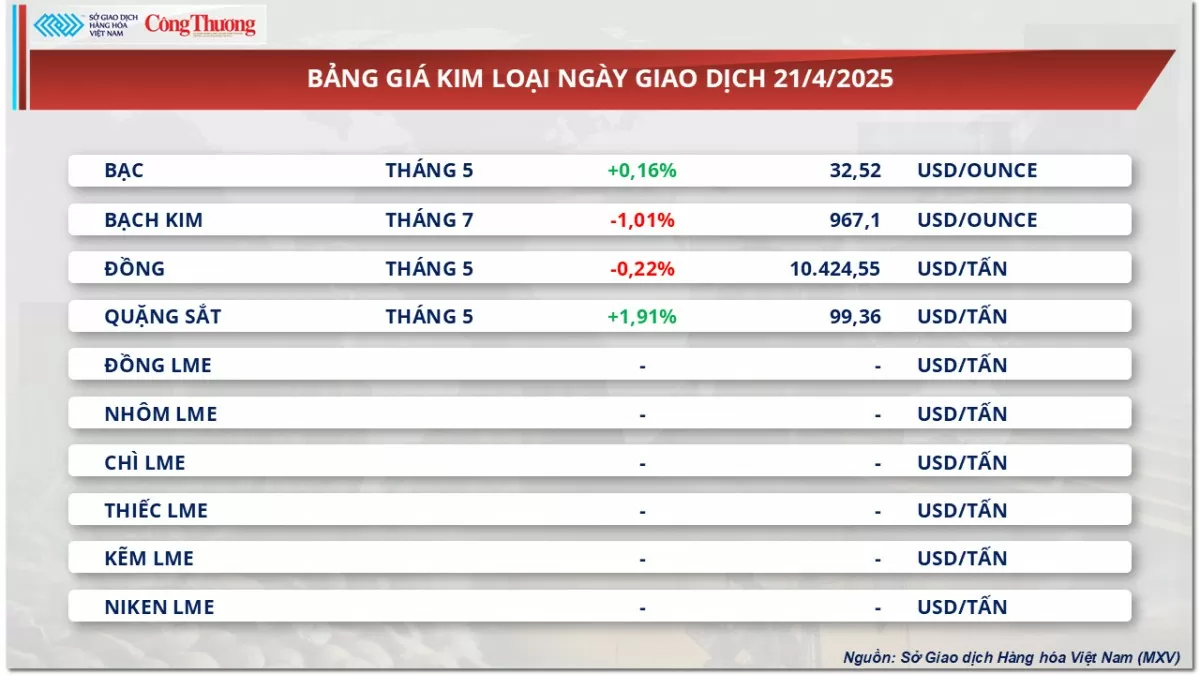

The first trading session of the week witnessed a clear divergence in the metal market. In the precious metals market, silver prices closed up 0.16% to $32.52/ounce. Meanwhile, platinum prices turned to weaken 1.01% to $967.1/ounce.

|

| Metal price list |

Investors’ need for financial protection has driven money into the precious metals market, including silver, in yesterday’s trading session. Recently, China has taken new steps in trade to compete with the US in the global commodity market by reducing crude oil imports from the US by 90%, while buying a record amount of oil from Canada and increasing soybean imports from Brazil. In addition, the Dollar Index has fallen below 100 points - the lowest level in more than three years. At the same time, the US 10-year bond yield remains high at over 4.4%. These factors have benefited precious metals, including silver.

On the other hand, platinum prices are under pressure as the outlook for auto consumption in the US becomes less positive, which could reduce demand for platinum in the production of auto catalytic converters. According to Cloud Theory, an organization that tracks car prices in the US, new car prices here have increased beyond the $50,000 mark and are expected to continue to increase. The sharp increase in car prices has made consumers more cautious in their purchasing decisions. Meanwhile, since February, many car manufacturers and dealers have proactively cut incentives and promotions, weakening purchasing power in the auto market.

For the base metals group, COMEX copper prices reversed and decreased by 0.22%, falling back to 10,424 USD/ton. Meanwhile, iron ore continued to increase by 1.91%, reaching 99.36 USD/ton.

Copper prices are under pressure as supply in China surged in March. According to data from the National Bureau of Statistics (NBS), refined copper output reached 1.25 million tonnes in March, up 8.6% year-on-year, surpassing the previous record of 1.24 million tonnes set in December last year. The increase in output was mainly due to higher prices for by-products such as gold and sulfuric acid, which helped improve already-squeezed profit margins and allowed mills to ramp up production.

Elsewhere, iron ore extended its rally thanks to positive steel export figures in China. According to data from China Customs, in the first three months of this year, China's steel rebar exports totaled 4.1 million tons, up 48.5% year-on-year. Meanwhile, wire rod exports reached 660,000 tons, up 7.8% year-on-year. Meanwhile, L- and U-shaped steel exports reached 1.6 million tons, up 24.4% year-on-year.

Source: https://congthuong.vn/gia-dau-tuong-giam-nhe-068-ve-muc-378-usdtan-384261.html

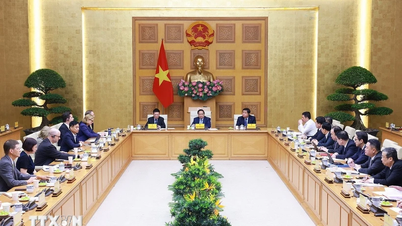

![[Photo] Prime Minister Pham Minh Chinh meets with US business representatives](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/13/5bf2bff8977041adab2baf9944e547b5)

![[Photo] President Luong Cuong attends the inauguration of the international container port in Hai Phong](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/13/9544c01a03e241fdadb6f9708e1c0b65)

Comment (0)