Coffee exports are priced well.

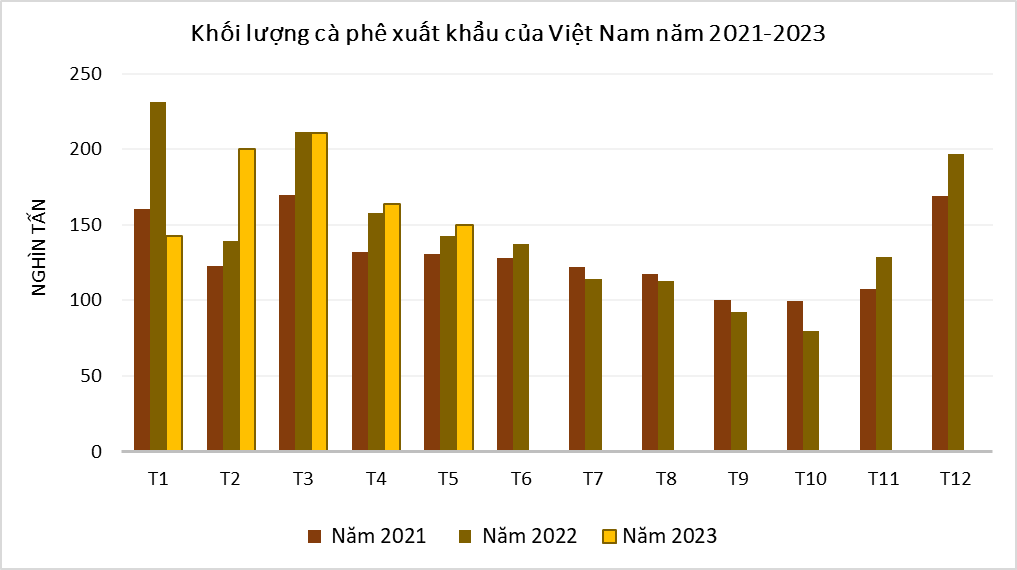

According to statistics from the General Department of Customs, in the first 5 months of the year, Vietnam's coffee exports reached 866,121 tons, worth more than 2 billion USD, down slightly by 3.9% in volume and 0.4% in value compared to the same period last year. In May alone, the volume of coffee exports decreased by 10% compared to April but increased by 5% compared to the same period last year.

Source: Hoang Hiep compiled from data of the General Department of Customs

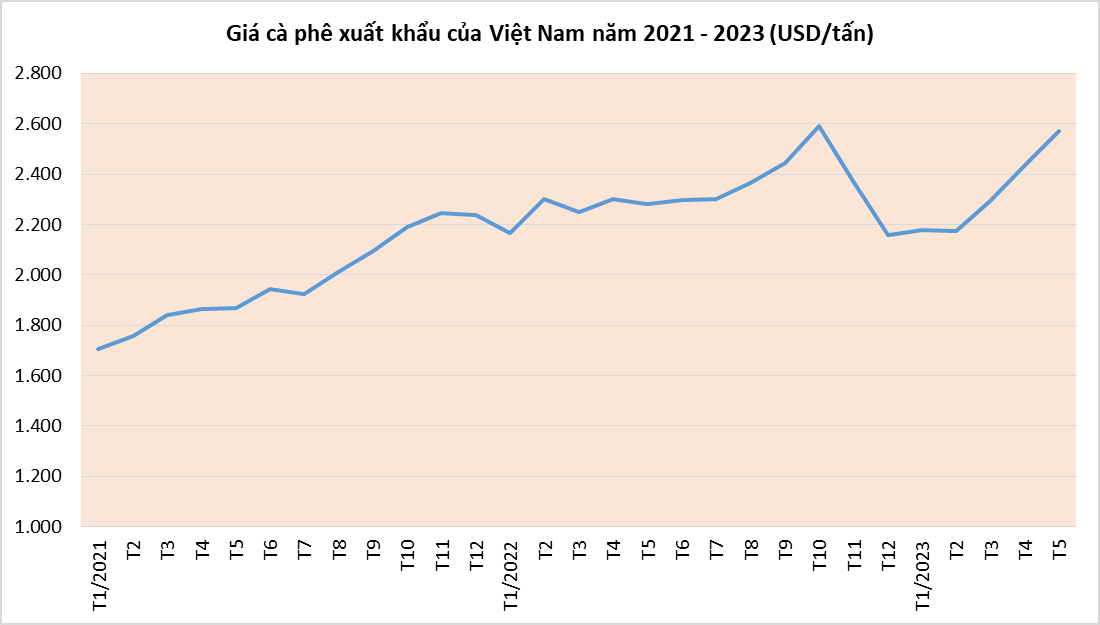

Coffee export prices in May rose to a seven-month high of $2,570 per ton, up 5.5% from the previous month and 12.8% year-on-year. The price is close to the peak of $2,591 per ton reached in October last year, while the upward trend has not stopped.

In the first five months of the year, coffee export prices increased by 3.6% to an average of 2,323 USD/ton.

Source: Hoang Hiep compiled from data of the General Department of Customs

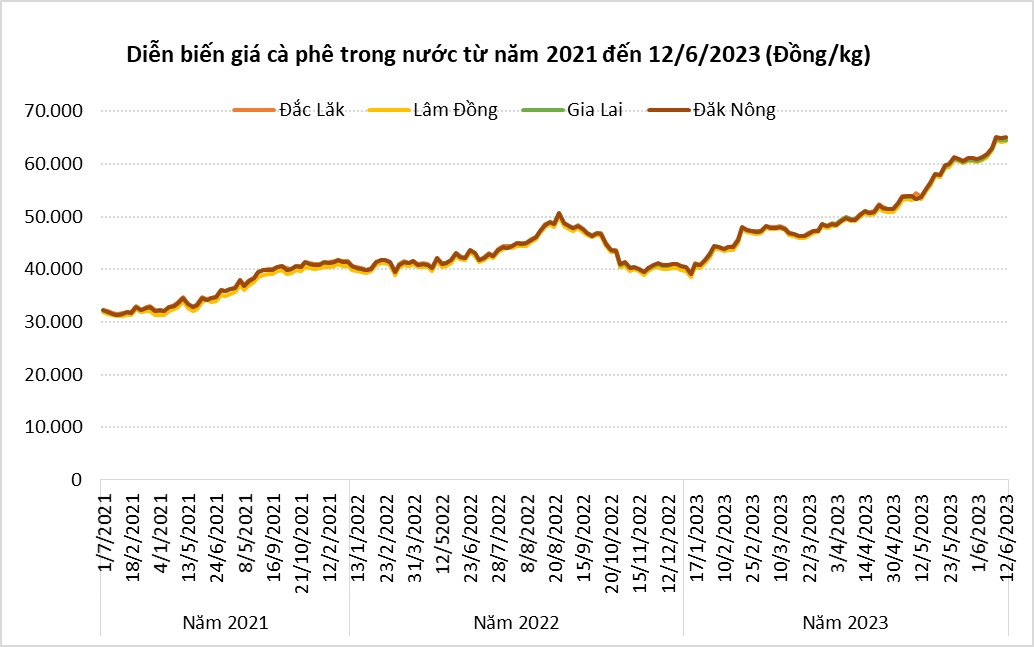

In the domestic market, as of June 12, the price of raw robusta coffee beans in the Central Highlands provinces reached a record of 64,400 - 65,000 VND/kg, an increase of more than 60% (equivalent to 24,200 - 24,700 VND/kg) compared to the beginning of this year.

Hoang Hiep synthesis

In the world market, the price of robusta coffee for July delivery on the New York floor also increased to a new record of 2,760 USD/ton, up 47.4% compared to the beginning of this year.

Arabica coffee prices also rose but by a smaller margin, up about 18.5% to 191.1 US cents/pound for near-term delivery.

Domestic and world robusta coffee prices continuously set new records due to high demand while supply tends to decrease.

Mr. Thai Nhu Hiep, Chairman of the Board of Directors, Director of Vinh Hiep Company Limited - the largest coffee exporter in Vietnam, and Vice Chairman of the Vietnam Coffee and Cocoa Association (VICOFA), said that the demand for robusta coffee is increasing because consumers around the world are having to "tighten their belts" due to the impact of inflation and economic recession.

Meanwhile, drinking coffee every day is a hard habit to give up but Arabica beans are too expensive for them. Therefore, they look for cheaper Robusta beans to mix with Arabica beans to reduce costs.

Mr. Hiep commented that domestic coffee prices could reach up to 70,000 VND/kg, and establish a new level of around 50,000 VND/kg after a long period of maintaining around 30,000 - 40,000 VND/kg.

Because, in the current context, the supply-demand balance has gradually shifted to a deficit as people switch to growing fruit trees, causing the coffee area to shrink. Meanwhile, input costs such as fertilizer, electricity and labor have all increased.

The International Coffee Organization (ICO) also made a similar assessment, saying that robusta coffee prices are benefiting from market fundamentals, especially from the demand side. In the first 7 months of the 2022-2023 crop year (October 2022 to April 2023), global robusta coffee exports increased by 0.7% while arabica decreased by 10.4%.

The mixed fluctuations in export volumes reflected a shift in instant coffee blends from arabica to robusta due to rising living costs due to inflation.

At the same time, robusta coffee prices are also strongly supported by supply, mainly due to concerns about supply in Vietnam, Brazil and Indonesia.

The Vietnam Coffee and Cocoa Association (VICOFA) estimates that Vietnam's robusta coffee output in the 2022-2023 crop year is expected to decrease by 10-15% compared to the previous crop year to about 1.5 million tons due to the impact of unfavorable weather and the wave of crop conversion to fruit trees, especially durian, avocado and passion fruit.

The US Department of Agriculture (USDA) also forecasts that Vietnam's coffee output in the 2022-2023 crop year will decrease by about 6% to 29.7 million bags (60 kg/bag).

Meanwhile, supplies from Brazil, the second largest producer of robusta, are also significantly lower, with exports reaching just 0.4 million bags in the first four months of 2023 compared to 0.49 million bags in the same period in 2022 and 1.24 million bags previously.

Coffee output in Indonesia, the world's third-largest coffee producer, could fall as much as 20% in 2023 to 9.6 million bags due to heavy rains in key growing areas.

The El Nino weather phenomenon, which is expected to develop globally in the second half of this year, also poses a risk to robusta. The weather phenomenon will disrupt rainfall and temperature patterns, which could further tighten supplies and boost robusta prices.

The world’s two largest robusta coffee producers, Vietnam and Brazil, could suffer yield losses if El Nino develops strongly, analysts and weather experts say. The advantage lies with big businesses.

The advantage still belongs to FDI enterprises.

Although coffee prices have reached record highs, farmers and exporters have not benefited much because farmers have almost sold all their coffee in advance, while concerns about high financial costs have prevented many businesses from stocking up.

Currently, most of the coffee is in the warehouses of foreign businesses with strong financial potential, so these businesses are considered the main beneficiaries of the record price increase.

Figures from the General Department of Customs also show that in the first five months of this year, coffee export turnover of domestic enterprises decreased by 6.1% compared to the same period last year, down to 1.29 billion USD. In contrast, export turnover of FDI enterprises increased by 11.6% to 724.7 million USD.

The proportion of FDI enterprises in the country's total coffee exports has accordingly increased to 36% compared to 32% in the same period, while the proportion of domestic enterprises has narrowed from 68% to 64%.

Source: Hoang Hiep compiled from data from the General Department of Customs

Market demand fluctuates in opposite directions.

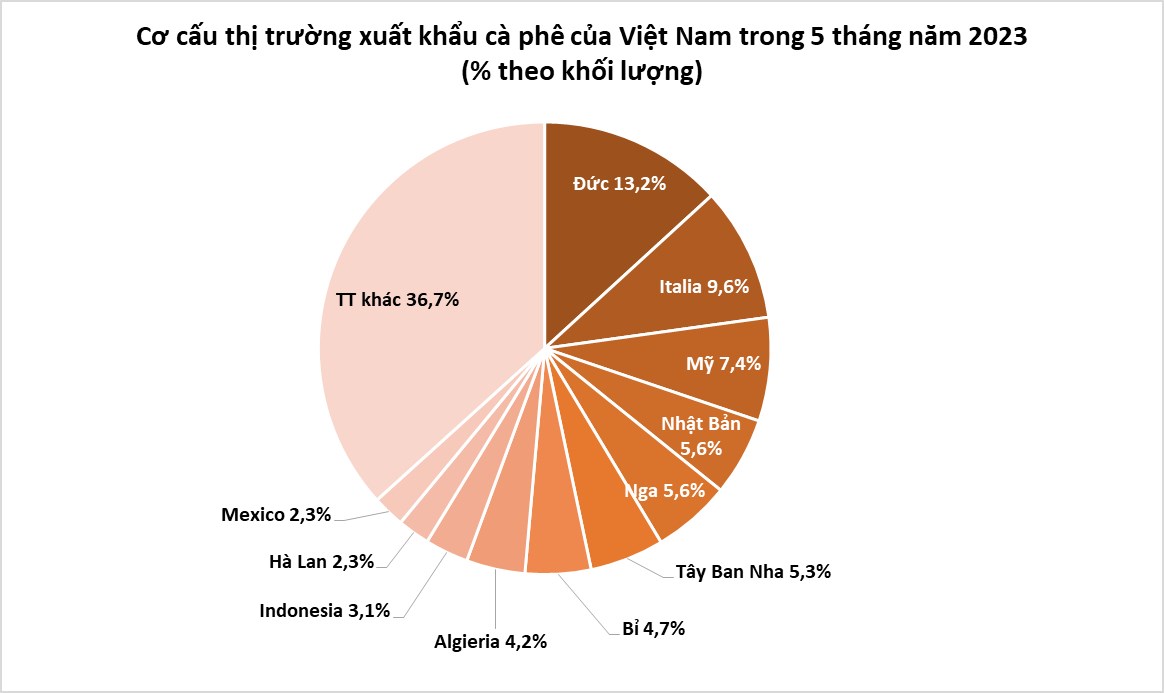

Regarding export markets, the European Union (EU) continued to be Vietnam's largest coffee consumer market in the first five months of the year, accounting for 39% of total export volume with 338,389 tons, worth over 751 million USD, down 10.3% in volume and 8% in value compared to the same period last year. Slowing economic growth and high inflation have somewhat affected Europe's coffee demand.

In the EU, coffee exports to Germany, Spain and Belgium decreased by 1.4%, 29.9% and 52% respectively, reaching 114,072 tons, 45,665 tons and 41,092 tons. However, some other markets increased their coffee imports from Vietnam such as Italy (+26%), the Netherlands (+9.3%), France (+22.1%)...

In addition, coffee exports to other markets such as the UK, Japan, China and the Philippines also decreased significantly compared to the same period last year.

However, coffee exports to the second largest consumer market, the US, increased sharply by 27.7% to 64,493 tons and accounted for 7.4% of the market share.

Similarly, the amount of coffee exported to the Russian market also increased by 32.5% to 48,376 tons; Algeria increased by 106.1%, reaching 36,104 tons. Notably, exports to some other coffee growing and producing countries increased very strongly, such as Indonesia increased by 3.2 times (reaching 26,600 tons), Mexico increased by 2.7 times (reaching 19,875 tons), India increased by 41.3%...

Source: Hoang Hiep compiled from data of the General Department of Customs

Source

![[Photo] Readers line up to visit the photo exhibition and receive a special publication commemorating the 135th birthday of President Ho Chi Minh at Nhan Dan Newspaper](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/17/85b3197fc6bd43e6a9ee4db15101005b)

![[Photo] More than 17,000 candidates participate in the 2025 SPT Competency Assessment Test of Hanoi National University of Education](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/17/e538d9a1636c407cbb211b314e6303fd)

![[Photo] Prime Minister Pham Minh Chinh chairs meeting on science and technology development](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/17/ae80dd74c384439789b12013c738a045)

![[Photo] Nearly 3,000 students moved by stories about soldiers](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/17/21da57c8241e42438b423eaa37215e0e)

Comment (0)