| Coffee export prices rise as supply from Vietnam is expected to fall by 20% Shortage in Vietnam pushes up coffee export prices |

In the second quarter, the addition of new crop coffee from Brazil and Indonesia is expected to help cool down the price increase...

Prices continue to exceed peaks amid concerns about supply shortages

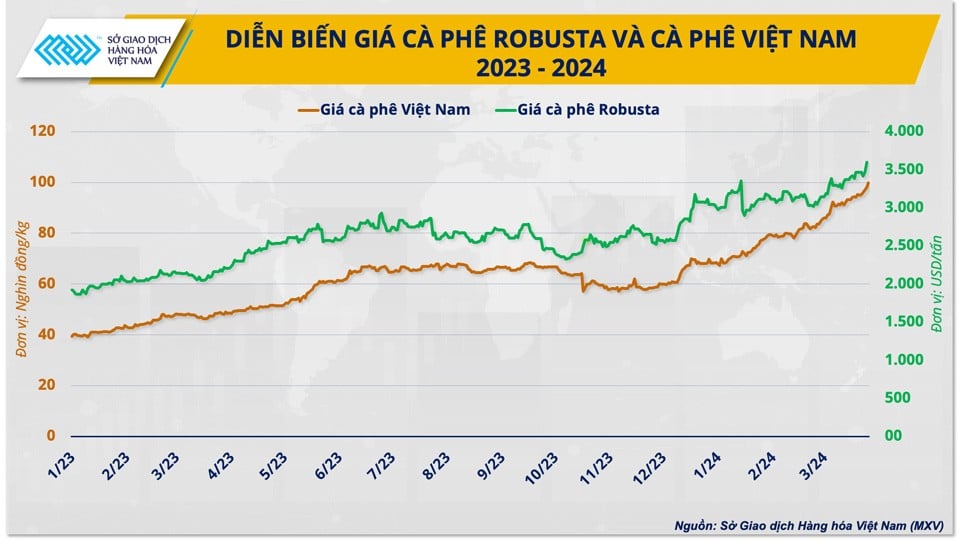

The first three months of 2024 are considered a "golden" period for Robusta coffee prices, as they continuously set unprecedented peaks in history.

According to the Vietnam Commodity Exchange (MXV), Robusta coffee prices on the Intercontinental European Exchange (ICE-EU) reached a 30-year high on March 27, up 30% and 70% respectively compared to early 2024 and the same period in 2023.

Similarly, information from giacaphe.com shows that the price of green coffee beans in Vietnam also set a new historical peak, approaching 100,000 VND/kg, the highest price ever recorded up to the present time.

|

| Price developments of Robusta and Vietnamese coffee |

Low supplies in major exporting countries, combined with strong demand in leading import markets, created double support for the upward momentum of coffee prices in the first months of the year.

Tensions in the Red Sea have disrupted the vital supply route for Robusta coffee from Asia to major consumer markets such as the US and Europe since late 2023 and early 2024. Increased transportation times and costs have caused local supply shortages in consumer markets. In addition, depleted inventories have pushed up demand for coffee. According to a report from the European Coffee Federation (ECF), the amount of Robusta stored in warehouses in the region as of the end of February 2024 had dropped to 114,117 tons, the lowest level since 2019, when statistics began for each coffee variety.

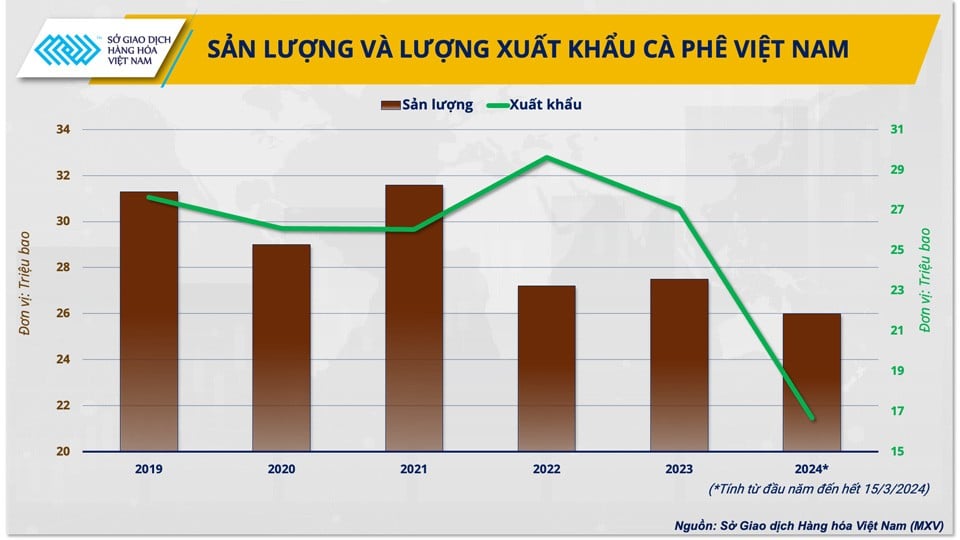

In addition, low coffee supplies in major exporting countries have also contributed significantly to the sharp price increase in recent months. Accordingly, El Nino has made the weather in the main coffee producing areas of Vietnam and Indonesia drier than usual. Unfavorable growing conditions have led to a decrease in output. In Vietnam, the Vietnam Coffee and Cocoa Association (VICOFA) forecasts that the output of the 23/24 crop will decrease by another 10% compared to the previous crop, to about 1.6 million tons (equivalent to 26-27 million 60kg bags). Meanwhile, Indonesia's Robusta output has dropped to a 12-year low, with about 8.4 million bags in the current crop year.

New crop supplies added from Brazil and Indonesia

After months of low supply, the coffee market is starting to receive new signals from harvesting activities in Brazil and Indonesia.

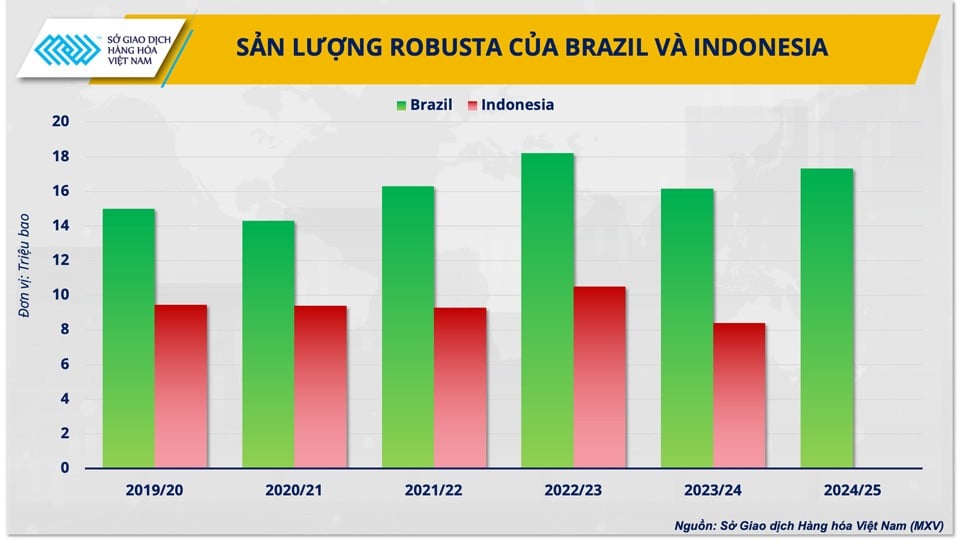

In Brazil, some early Robusta growing areas in Espirito Santos will begin harvesting coffee in the first quarter of 2024. According to the forecast of the Brazilian government 's Crop Supply Agency (CONAB), Robusta production in crop 24/25 will reach nearly 15 million bags, up more than 7% compared to the previous crop. Of which, Espirito Santos continues to be the main growing area, accounting for 65% of the country's total Robusta output.

With improved crop 24/25 coffee production, Brazil is likely to continue to boost exports of bitter-tasting coffee varieties, extending its recent record streak. From the beginning of crop 23/24 (July 2023) to the end of February 2024, Brazil exported about 5 million bags of Robusta beans, a 5-fold increase over the same period last year. Currently, Brazil has entered the final months of the crop year, with monthly Robusta exports remaining at 500-600 thousand bags, a record export volume compared to the same period in previous crops.

|

| Robusta production of Brazil and Indonesia |

Besides Brazil, in April, Indonesia, the world's third largest Robusta exporter, also entered a new coffee crop.

In contrast to the upturn in Brazil, El Nino continues to haunt Indonesia's main coffee-producing regions, keeping Robusta output forecast to remain low in 2024.

With limited output and low supplies from previous crops, Indonesia’s coffee exports are unlikely to improve significantly in the near future. In 2023, the Southeast Asian country will only export about 2.5 million bags of beans, down about half compared to the same period last year.

|

| Mr. Nguyen Ngoc Quynh, Deputy General Director of Vietnam Commodity Exchange |

Commenting on the new supply addition from Brazil and Indonesia, Mr. Nguyen Ngoc Quynh, Deputy General Director of MXV said: “ In the context of concerns about supply shortages, the addition of newly harvested coffee from Brazil and Indonesia is expected to temporarily overwhelm the monopoly from Vietnam. This is expected to be a positive factor, helping to improve the world coffee supply, especially in major import markets that are in a state of depleted inventories such as the US and Europe.”

Coffee prices may cool down but are unlikely to fall sharply

The addition of coffee from Brazil and Indonesia is one of the most important information for the global coffee market. In particular, the ability of these two countries to offset the new supply from export activities compared to the shortage from Vietnam will be the leading factor determining the price movement of coffee in the second quarter.

In the Vietnamese market, the amount of coffee in the hands of farmers has almost been exhausted, the buying and selling situation has become gloomy since the beginning of 2024. This comes earlier than every year, making concerns about coffee shortages in the coming months more serious. In the first 5 and a half months of the 23/24 crop, our country has exported nearly 1 million tons of coffee, an increase of 15-20% compared to previous years. Meanwhile, VICOFA expects Vietnam's coffee exports in 2024 to decrease sharply by 20% compared to the previous year, down to about 1.3 million tons.

|

| Vietnam's coffee output and export volume |

In this context, coffee exports from Brazil and Indonesia may increase when new crop supplies are available, but it will be difficult to fully offset the shortage in Vietnam. In 2023, Brazil and Indonesia will only export about 8 million bags of Robusta, less than half of the amount of coffee exported from Vietnam. Moreover, Indonesia’s ability to boost coffee exports is uncertain when the new crop output is low and the old crop inventory is almost zero. Currently, this country is still actively buying coffee from Vietnam.

Commenting on coffee prices in the context of additional supplies from Brazil and Indonesia, Mr. Nguyen Ngoc Quynh emphasized: Coffee prices are likely to cool down from the middle of the second quarter but are unlikely to decrease sharply. Market sentiment may be more stable when there is additional supply from Brazil and Indonesia, but the volume of goods from these two countries is not enough to compensate for Vietnam. In my opinion, the world Robusta price is expected to continue to move up to the record level of 4,000 USD/ton, then there will be a downward adjustment. In the domestic market, the price of green coffee beans will continue to move towards levels above 100,000 VND/kg and then cool down following world prices.

Source

![[Photo] Award ceremony for works on studying and following President Ho Chi Minh](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/20/a08ce9374fa544c292cca22d4424e6c0)

![[Photo] Vietnamese shipbuilding with the aspiration to reach out to the ocean](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/20/24ecf0ba837b4c2a8b73853b45e40aa7)

![[VIDEO] - Enhancing the value of Quang Nam OCOP products through trade connections](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/5/17/5be5b5fff1f14914986fad159097a677)

Comment (0)