Commodity market today, November 29, 2024: Robusta coffee prices rose slightly by 0.6%, remaining pegged at historical highs amidst Arabica coffee trading suspension.

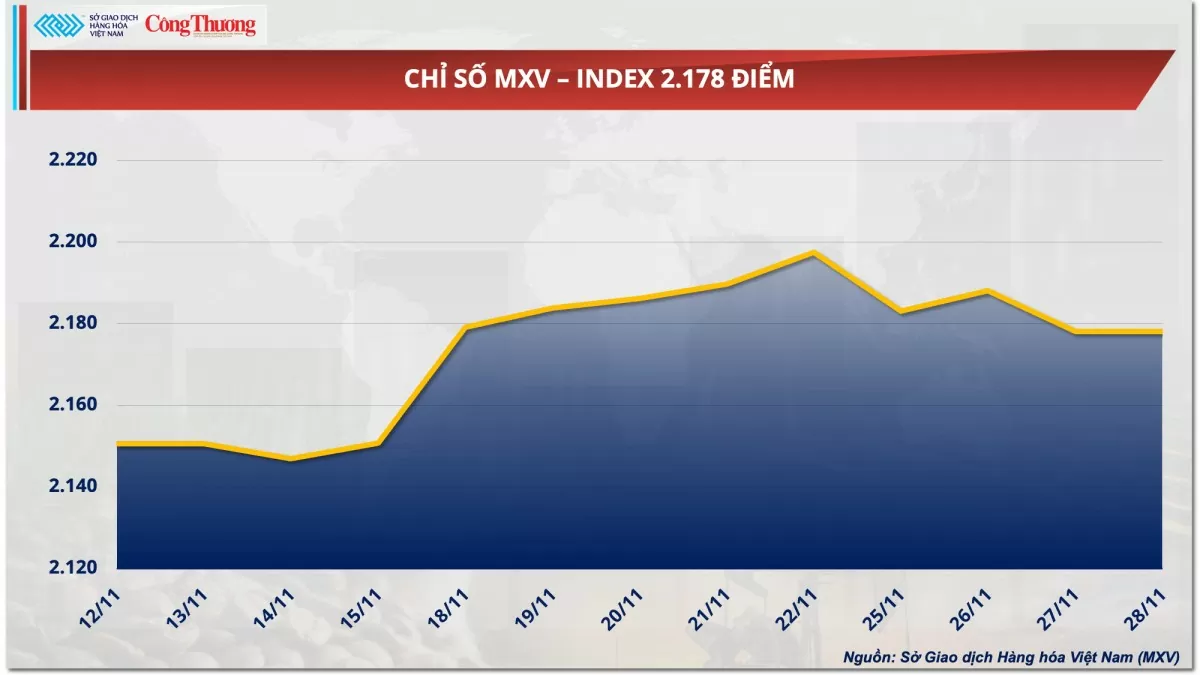

The Vietnam Commodity Exchange (MXV) reported that the global raw materials market was relatively quiet due to the suspension of trading for most commodities on Thanksgiving Day in the US. Industrial raw materials continued to attract market attention, with prices rising for four out of five traded items. Additionally, the prices of silver and platinum also increased slightly. At closing, the MXV-Index remained unchanged at 2,178 points.

|

| MXV-Index |

Robusta coffee prices remain at historical highs.

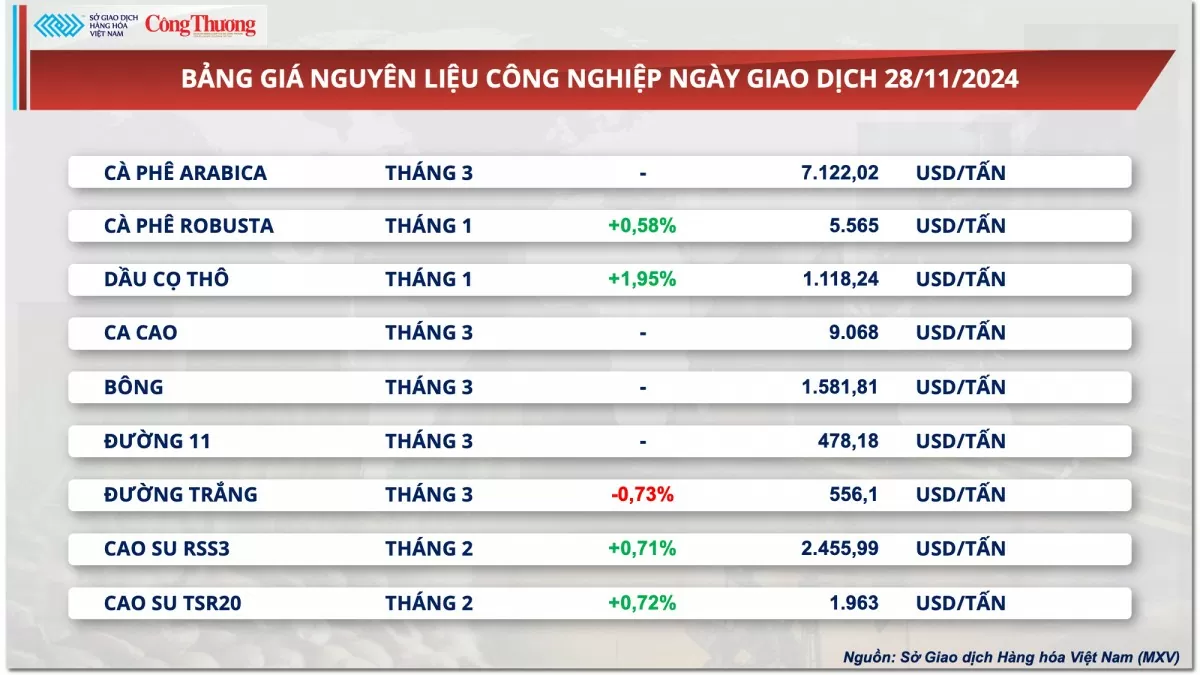

At the close of yesterday's trading session, the price list for industrial raw materials continued to be dominated by green, with 4 out of 5 commodities increasing in price. Yesterday, the Intercontinental Exchange of New York (ICE US) was closed for Thanksgiving, so most commodities in the group were not trading.

|

| Industrial Raw Material Price List |

Robusta coffee prices edged up 0.6%, remaining pegged at historical highs amid Arabica trading suspensions. With no new market information, coffee prices remain high due to concerns about supply in major producing countries and intermarket capital flows.

In the domestic market, coffee prices in the Central Highlands and Southeast regions this morning (November 29) were recorded at 128,000 - 128,800 VND/kg, an increase of 1,700 VND/kg compared to yesterday. However, compared to the same period last year, the price has doubled.

In other news, white sugar prices fell 0.7% compared to the benchmark, despite shrinking sugar production in Brazil. The Brazilian government 's Crop Supply Agency said the country's sugar production for the 2024-2025 season is expected to reach 44 million tons, down 2 million tons from the previous season.

Previously, the US Department of Agriculture (USDA) lowered its forecast for Brazil's 2024-2025 sugar production to 43 million tons, a decrease of 1 million tons from the initial forecast and 2.5 million tons lower than the 2023-2024 crop year. Extreme weather conditions, including record droughts and large wildfires, have damaged the current crop.

In addition, according to an S&P Global survey, sugar production in the region is expected to reach 979,000 tons in the first half of November, a 55.5% decrease compared to the same period last year. Currently, the market is still awaiting official figures from the Brazilian Sugar Industry Association (UNICA).

Metals saw quiet trading on a day with thin margins.

According to MXV, the metals market was relatively quiet with thin liquidity as the US observed Thanksgiving Day. Due to the market closing early on the holiday, prices will be calculated up to 2:30 AM Vietnam time today. For precious metals, silver prices rose approximately 0.41% to $30.7 per ounce, and platinum prices also increased 0.58% to $937 per ounce.

|

| Metal Price List |

Precious metals continue to benefit amid escalating geopolitical conflict risks. While a ceasefire between Israel and Hezbollah has eased tensions in the Middle East, tensions between Russia and Ukraine show no signs of abating. Precious metals, considered a safe haven investment during economic downturns, continue to flow into this sector to secure profits, especially as a weakening US dollar makes investment costs cheaper. The Dollar Index has fallen from its two-year peak as demand for the greenback, fueled by the "Trump trade," is gradually cooling down.

Furthermore, President-elect Donald Trump's announcement of tariffs on several countries has increased market instability, thereby boosting precious metal prices. Specifically, Donald Trump recently announced a 25% tariff on all goods imported from Canada and Mexico into the US. He also announced an additional 10% tariff, higher than any other additional tariff, on imports from China.

For base metals, COMEX copper prices fell by approximately 0.14% to $9,102 per ton after experiencing a relatively volatile session.

On the one hand, copper prices are being supported as the market shows signs of increasing supply risks. Recently in Peru, the world's third-largest copper producer, thousands of miners blocked highways, disrupting mining and copper transportation. Prior to this, the International Copper Study Group (ICSG) warned that the global refined copper market had a deficit of 131,000 tonnes in September, marking the first time in seven months that the global copper market faced a supply shortage.

On the other hand, weak consumption prospects due to the prolonged real estate crisis in China continue to put pressure on prices. Furthermore, the latest economic data shows that the economy remains sluggish, despite recent large-scale stimulus packages from the government. As a barometer of economic health, the outlook for copper prices has also become less optimistic.

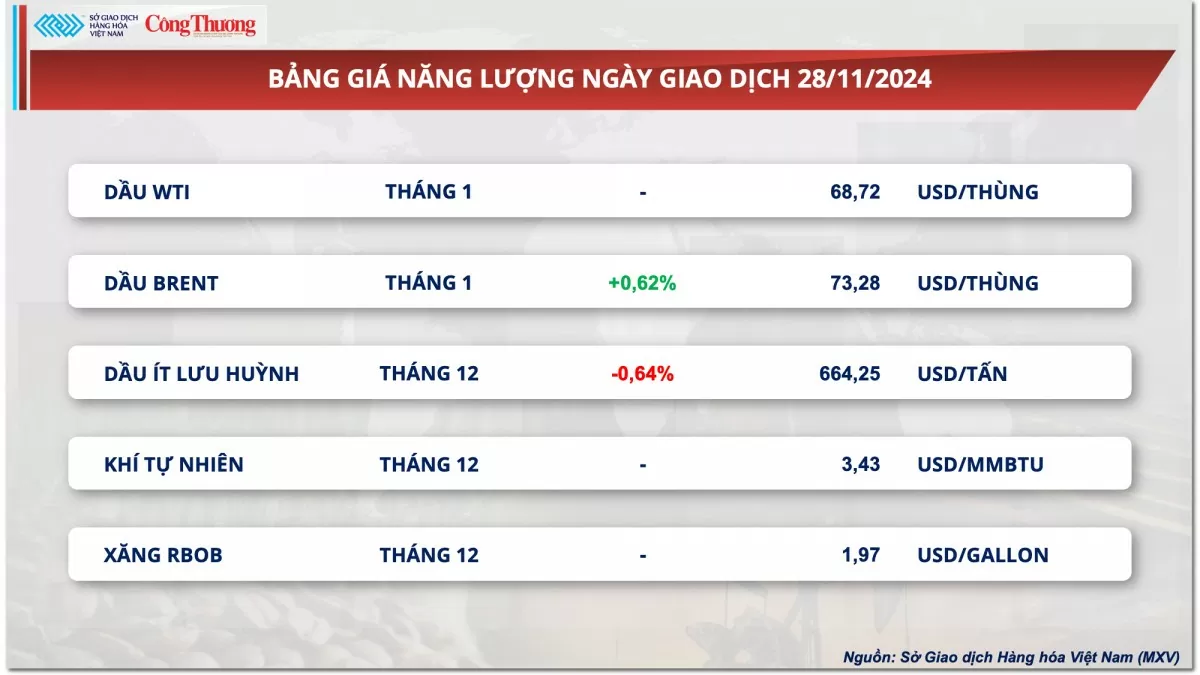

Prices of some other goods

|

| Energy price list |

Source: https://congthuong.vn/thi-truong-hang-hoa-hom-nay-2911-gia-ca-phe-robusta-neo-dinh-lich-su-361500.html

![OCOP during Tet season: [Part 1] Ba Den custard apples in their 'golden season'](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F402x226%2Fvietnam%2Fresource%2FIMAGE%2F2026%2F01%2F26%2F1769417540049_03-174213_554-154843.jpeg&w=3840&q=75)

Comment (0)