World silver price

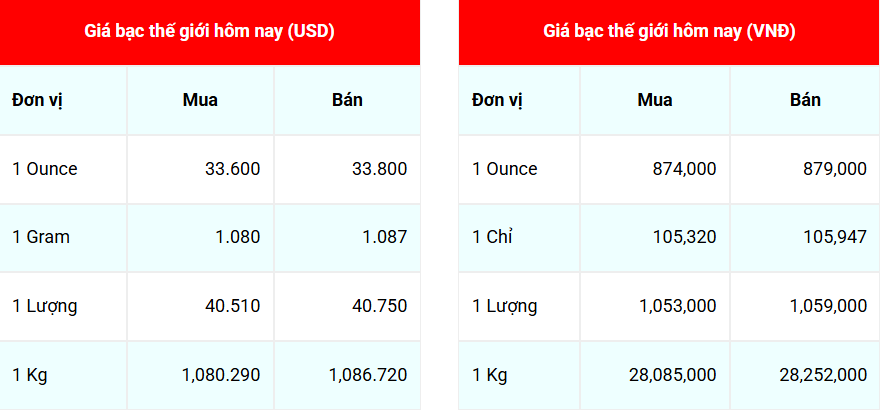

As recorded at 05:29 on April 24 (Vietnam time), the spot silver price on giabac.net stopped at 33,610 USD/ounce, a sharp increase of 1,064 USD/ounce compared to yesterday morning's session - the highest increase of the week. Previously, the Goldprice.org platform also recorded 32.76 USD/ounce, an increase of 0.15 USD/ounce compared to the previous session.

Converted at the current exchange rate, the international silver price is equivalent to 874,000 VND/ounce (buy) and 879,000 VND/ounce (sell) - an increase of 33,000 VND and 32,000 VND respectively compared to yesterday.

This development reflects investor sentiment leaning towards defensive assets in the face of geopolitical uncertainty and slowing global economic growth. At the same time, silver demand in the electronics, solar panels and electric cars sectors continues to be stable, creating a supportive foundation for silver prices in the medium term.

Domestic silver price

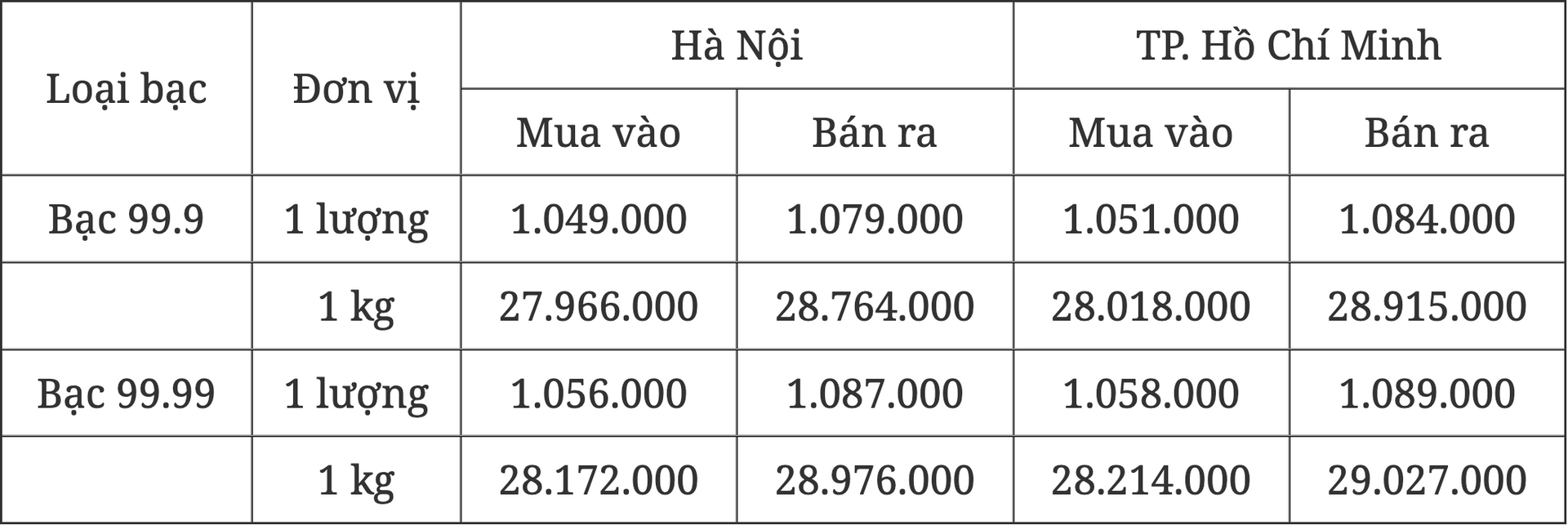

In the domestic market, silver prices on the morning of April 24 recorded a simultaneous increase in both Hanoi and Ho Chi Minh City, with notable adjustments in both large trading systems and free zones:

Phu Quy Jewelry Group (Hanoi) listed silver price at 1,265,000 VND/tael (buy) and 1,304,000 VND/tael (sell) - an increase of 15,000 VND/tael in both directions compared to yesterday morning.

At free trading points in Hanoi, silver prices also increased sharply to VND1,049,000/tael (buy) and VND1,079,000/tael (sell) - an increase of VND18,000/tael compared to the previous session.

In Ho Chi Minh City, silver prices continued to rise, currently reaching VND1,051,000/tael (buy) and VND1,084,000/tael (sell) – an increase of VND18,000/tael for buying and VND17,000/tael for selling.

In addition to the silver bar price, the silver price by type and standard unit is also adjusted up as follows:

Silver Market Outlook

According to many commodity experts, silver is gradually regaining its position in the precious metals group thanks to its dual role as a safe-haven asset and a strategic industrial raw material. A report from Metals Focus forecasts that silver demand in the electrical and electronics and renewable energy sectors will continue to increase slightly this year, partially offsetting the impact of the high interest rate environment.

However, analysts warn that for silver prices to break out of the current $33-$34/ounce range, the market needs more obvious catalysts such as geopolitical fluctuations, sudden growth in industrial consumption or strong adjustments in monetary policy in the US and Europe.

Source: https://baodaknong.vn/gia-bac-hom-nay-24-4-dong-loat-tang-manh-bam-sat-da-phuc-hoi-the-gioi-250431.html

![[Photo] Prime Minister Pham Minh Chinh receives Swedish Minister of International Development Cooperation and Foreign Trade](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/12/ae50d0bb57584fd1bbe1cd77d9ad6d97)

![[Photo] Prime Minister Pham Minh Chinh works with the Standing Committee of Thai Binh Provincial Party Committee](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/12/f514ab990c544e05a446f77bba59c7d1)

![[Photo] Prime Minister Pham Minh Chinh starts construction of vital highway through Thai Binh and Nam Dinh](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/12/52d98584ccea4c8dbf7c7f7484433af5)

Comment (0)