On October 25, Vietnam Investment Credit Rating Joint Stock Company (VIS Rating) announced its long-term issuer credit rating of GELEX at A with a stable outlook.

VIS Rating has rated GELEX Group Joint Stock Company (stock code GEX – HoSE) A in the context of the world economy and Vietnam still facing many challenges in the future. This is the first time VIS Rating has rated GELEX.

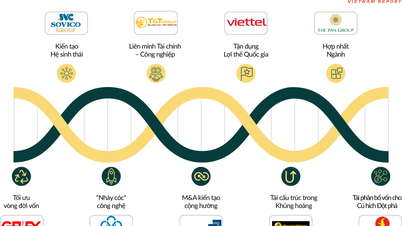

The VIS Rating report shows that the competitive position and business diversification score at 'Strong' level is mainly contributed by the 'Strong' score of the Industrial Park Real Estate and Electrical Equipment Manufacturing segments. Most of the Group's member units are industry leaders in terms of market share and business coverage.

Currently, GELEX is the leading electrical equipment manufacturer in Vietnam, with diverse product lines, accounting for 20 - 35% market share of each product type.

Through its subsidiary GELEX Electricity (stock code GEE), the Company is holding many nationally famous brands of electrical equipment such as Vietnam Electric Cable Joint Stock Company, EMIC Electrical Measuring Equipment Joint Stock Company, Electrical Equipment Joint Stock Company (THIBIDI), Hanoi Electromechanical Manufacturing Joint Stock Company (HEM), Vietnam Copper Wire Company CFT.

In the field of industrial park real estate, GELEX's member unit, Viglacera Corporation - JSC (stock code VGC), has the highest leasing area in 2023 in industrial parks among listed companies. Viglacera has developed 15 industrial parks with more than 4,000 hectares of area and 1,000 hectares available for lease, ranking among the top 5 listed companies in the industrial park real estate sector. Viglacera is also a leading enterprise in the Construction Materials sector with 42% market share of construction glass and 30% market share of ceramic tiles.

Song Da Clean Water Investment Joint Stock Company – Viwasupco (VCW) specializes in the field of clean water production with a capacity of 300 thousand cubic meters of clean water per day and night, serving about ¼ of Hanoi's clean water needs. The company is currently investing in expanding the water supply chain system to double its capacity with an expected completion time in 2025 – 2026.

GELEX Group is among the 30 largest listed companies on the Stock Exchange in terms of consolidated revenue over the past 5 years. VIS Rating stated in its ranking: Our 'Very Strong' assessment of GEX's Scale reflects its deep and solid market presence in core business areas, its product diversity to serve market needs and its ability to maintain good relationships with suppliers and financial institutions.

VIS Rating said: “We appreciate the business diversification aspect as GELEX Group has business and investment activities spread across Vietnam and in many different industries. The company also has a history of implementing business plans well and often exceeding annual profit targets.”

The organization also expects GEX to maintain its annual revenue at 'Very Strong' in the long term, thanks to its solid market share in the Electrical Equipment Manufacturing group and its investment portfolio in the Industrial Park Real Estate group. GEX also has long-term plans to expand its scale, including projects to increase clean water capacity, export electrical equipment products and the Tran Nguyen Han Real Estate Complex Project.

The Group’s EBITDA (Earnings before interest, taxes, depreciation and amortization) margin on consolidated revenue is 19-23%, higher than the average of Vietnamese companies in the past 5 years. The high margin is mainly contributed by the Industrial Park Real Estate, Electricity and Water Groups.

Meanwhile, GELEX's total debt is relatively low compared to the average leverage ratio of Vietnamese enterprises. GELEX's main subsidiaries account for 55% of the group's total debt, with low Debt/EBITDA ratios, namely VGC (1.0x) and GEE (2.5x).

GELEX was established in 1990 and is currently a holding company, investing mainly in two core areas: Electrical Equipment Manufacturing and Infrastructure. The company maintains its growth rate thanks to an effective investment strategy, with flexible solutions in the context of the general market. Recently, GELEX has focused on human resource development, risk management and promoting social responsibility.

VIS Rating was granted a credit rating agency license by the Ministry of Finance of Vietnam in September 2023. The unit was established based on a cooperative relationship with Moody's (the world's most prestigious credit rating organization) and a number of other organizations, initiated by the Vietnam Bond Market Association (VBMA). VIS Rating provides independent credit rating services to domestic corporate issuers in Vietnam.

Source: CafeF

Source: https://gelex.vn/tin-tuc/gelex-duoc-vis-rating-danh-gia-xep-hang-o-muc-a-ve-do-tin-nhiem.html

![[Photo] Opening of the 14th Conference of the 13th Party Central Committee](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/11/05/1762310995216_a5-bnd-5742-5255-jpg.webp)

![[Photo] Panorama of the Patriotic Emulation Congress of Nhan Dan Newspaper for the period 2025-2030](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/11/04/1762252775462_ndo_br_dhthiduayeuncbaond-6125-jpg.webp)

Comment (0)