Is it unusual that Garena Vietnam's profit margin is 9 times lower than the average statistics of world game companies?

During the Covid-19 pandemic, many economic sectors were severely damaged due to the social distancing policies of governments in many countries to fight the epidemic. However, according to information from Ernst & Young Switzerland, the gaming industry witnessed an unprecedented boom during this period. Although now, when life returns to normal, the boom period has passed, the profit margin of the gaming industry is still at a respectable level.

EY Parthenon statistics show that the average profit margin of the world's top 26 gaming companies in 2020 was 24.9%. This figure dropped to only 23.5% in 2021 and in 2022 it was only recorded at 18.1%.

In Vietnam, statistics on the profit margin of game companies are only about 2-5%, not to mention loss-making projects. Compared to the average profit margin of the top 26 game companies in the world above, this number is strangely low.

Garena Vietnam's profit margin in 2022 is 9 times lower than the average of the world's 26 largest game companies (Photo TL)

In fact, game companies in Vietnam mainly publish foreign games. In which, businesses will have to buy game copyrights to publish and have to pay a relatively high publishing fee. The costs for items such as copyrights, intermediary payment gateways, and marketing costs are given by publishers as the reason why almost all of the game industry's revenue is eroded.

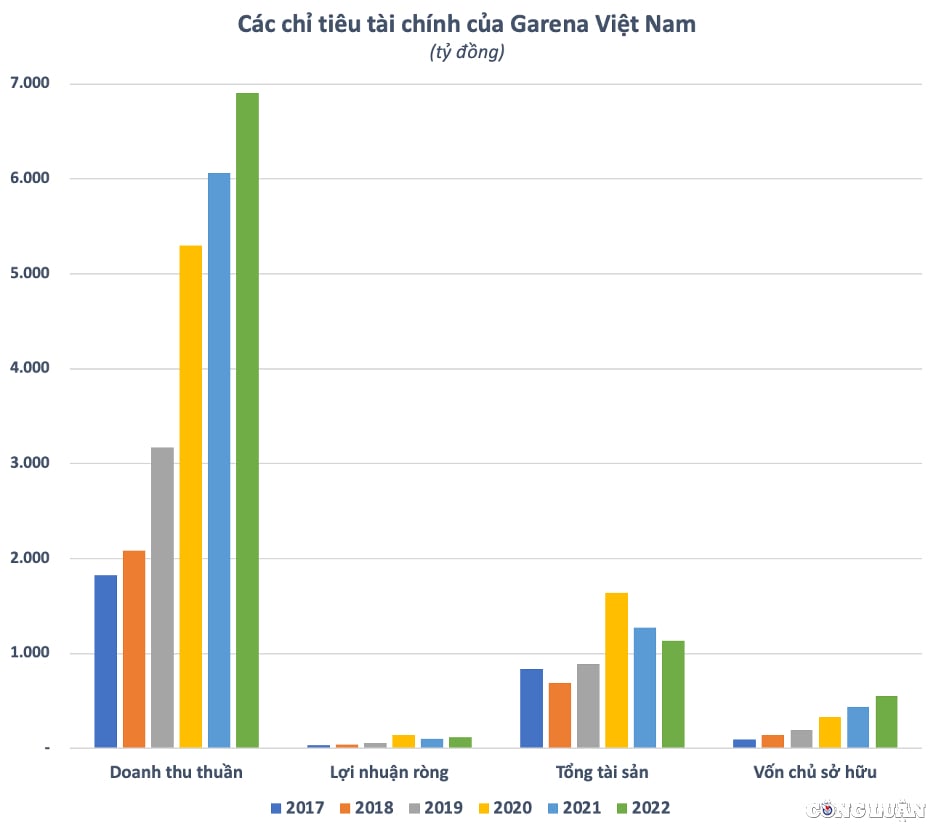

For the most practical example, Garena Vietnam, a game publisher that owns a series of popular games such as: Lien Quan Mobile, Free Fire, FIFA online... achieved a record revenue of 6,900 billion VND in 2022, an increase of 14% over the same period last year.

Compared to the previous year's revenue in 2017, Garena's revenue has increased 4 times. However, the profits of this unit have fluctuated erratically.

After-tax profit reached a record of VND143 billion in 2020 but then decreased by 27% in 2021 before increasing again to VND115 billion in 2022. The profit level in 2022 is equivalent to a net profit margin of only 2%. Compared to the average profit margin of the group of large gaming companies in the world as given by EY Parthenon, it is only 1/9.

Is this profit margin suitable for a major game publisher in a game market that is considered to have great potential like Vietnam? According to data from the Vietnam Game Producers and Publishers Alliance, the revenue of the Vietnamese game industry in 2022 reached more than 600 million USD, with an average growth rate of 9%/year. The number of gamers in Vietnam by the end of 2022 also reached 54.6 million people.

Where did the money go when Garena Vietnam's revenue was in the thousands of billions but it only paid taxes equivalent to 2 days' revenue?

One thing worth noting is that Garena Vietnam's charter capital is relatively "thin". The company only recorded a charter capital of 9 billion VND, the current equity is 553 billion VND, mainly recorded from undistributed profits accumulated over the past few years.

Despite the small amount of capital, Garena's revenue continues to grow every year, reaching 6,900 billion VND in 2022.

However, as mentioned above, although revenue scale is continuously growing, Garena's profit margin is extremely low, only at 2% in 2022. This means that every 100 VND of revenue only brings in 2 VND of profit.

Such a low profit level means that Garena Vietnam only has to pay less than 26 billion VND in taxes in 2022 for the revenue of 6,900 billion VND. The amount of tax to be paid is only equivalent to the amount of money that Garena Vietnam earns in 2 days.

Who is benefiting from Garena Vietnam's trillion-dollar revenue?

Garena Vietnam's shareholders include: Mr. Mai Minh Huy owns 69.5%, foreign shareholders own 30% and Mr. Le Minh Tri owns 0.5%. The General Director and legal representative of the company is currently Mr. Vu Chi Cong (born in 1984). Garena Vietnam's foreign shareholder is Garena Vietnam Private Limited, a subsidiary of Sea Limited Group (Singapore).

The games associated with Garena's name are also being released in many countries around the world and bringing in huge revenue from these markets. For example, Lien Quan Mobile, the game is released in Taiwan, Thailand, Korea, Laos, the European Union, the US, India, Japan... under many different names such as Arena of Valor, Penta Storm, Realm of Valor.

According to statistics from Sensor Tower, the world's leading market data provider, the estimated revenue of Arena of Valor under the international name Arena of Valor was up to 140 million USD in 2018, equivalent to more than 3,400 billion VND. The above revenue level does not include revenue in the billion-people Chinese market. It should be noted that this is only the revenue level before the Covid-19 pandemic. During the pandemic, social distancing regulations in many countries have indirectly helped the gaming industry's revenue explode and Arena of Valor is no exception.

Or the game Garena Free Fire, which was released in 2017, also brought in a huge amount of revenue from markets outside of Vietnam such as India, Indonesia, Brazil, and Latin America. Sensor Tower's statistics also show that the revenue of this game in the Southeast Asian market alone in 2022 reached 7.9 million USD, equivalent to 192.3 billion VND.

Recently, many businesses with foreign-related factors have been continuously expanding their scale and doing business smoothly, but... continuously reporting losses or thin profits.

Even many businesses that are said to benefit from the Covid-19 pandemic still... reported heavy losses. For example, according to the Ministry of Finance, Airpay and Shopee companies had high revenue in 2020, expanded in scale, but still... reported losses. This limited their contribution to the state budget, with these two businesses only paying tens of billions to the state budget.

The "scenario" of expanding scale, increasing revenue but "continuous losses" that has attracted the most public attention is Coca-Cola Vietnam. Although operating in Vietnam for a long time and continuously growing, Coca-Cola Vietnam regularly reports losses. According to the tax authority, the "secret" for this company to continuously declare losses lies in the cost of raw materials, which are mainly imported directly from the parent company at very high prices.

"Transfer pricing" by buying raw materials at high prices and paying royalties from the parent company has also caused a number of other famous businesses to be mentioned a lot in transfer pricing and tax evasion scandals such as Adidas, Pepsico or most recently Grab.

The issue of transfer pricing and tax evasion has once again been mentioned in the gaming industry and game publishers in Vietnam, with similar "tricks" such as "high game copyright purchase prices" from the parent company.

Journalist & Public Opinion Newspaper will continue to inform about this issue in the next issue.

Source

![[Photo] Spreading passion for science and technology in educational environment](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/27/059521b98e3847368f5ff4120460a500)

![[Photo] Magnificent rehearsal of the parade to celebrate the 50th anniversary of national reunification](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/27/9d03de12cfee4bd6850582f1393a2a0f)

![[Photo] Ho Chi Minh City residents stay up all night waiting to watch the parade rehearsal](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/27/0c555ae2078749f3825231e5b56b0a75)

Comment (0)