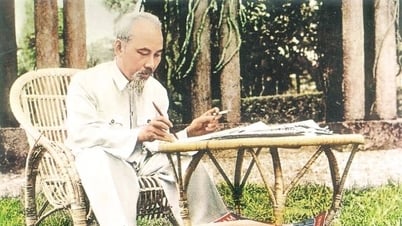

Recently, many companies on the stock exchange have encountered problems with auditing, some units were even rejected by 30 auditing companies - Photo: QUANG DINH

In a document recently sent to the State Securities Commission, Nghe An Tea Corporation (CNA) said that it has approved the selection of the 2024 financial statement auditing unit, Vietnam Auditing and Valuation Company Limited, from the 2024 general meeting of shareholders.

However, on November 29, this tea company received a document from Vietnam Auditing and Valuation Company Limited announcing the termination of cooperation due to many objective reasons.

The leader of Nghe An Tea Corporation said that it is impossible to select and sign an audit contract with another audit unit to audit the 2024 financial statements within the prescribed time of November 30, 2024.

Currently, the Board of Directors of Nghe An Tea Corporation has met and conducted procedures to obtain shareholders' written opinions to change the selection of another auditing unit for the 2024 financial statements.

In the document sent to the management agency, Nghe An Tea Corporation did not specify the reason why the auditing unit refused to provide the service.

However, in the 2023 financial report, Nhan Tam Viet Auditing Company Limited gave a series of exceptions and emphasized issues to Nghe An Tea Corporation.

Accordingly, Nhan Tam Viet Auditing said that it has not yet collected full confirmation letters with the entire balance of short-term receivables from customers, short-term prepayments to sellers, other short-term receivables, short-term payables to sellers, and short-term prepayments from buyers at the end of 2022 and 2023.

The auditor also noted to the reader the difference in interest payable between the company's data and the number reported by the Joint Stock Commercial Bank for Investment and Development of Vietnam - Nghe An branch.

This made the auditor doubt the company's ability to have these debts cleared from the Vietnam Development Bank - Nghe An branch.

In addition, at the date of issuance of the audit report, Nghe An Tea Corporation has not yet approved the financial settlement, settlement of proceeds from equitization, settlement of equitization costs, settlement of support funds for redundant employees, etc.

Explaining the audit opinion, Mr. Nguyen Duc Thang - Chairman of Nghe An Tea Corporation, said that due to the prolonged equitization process, the company is still in the process of stabilizing the organization and rearranging the production activities of its affiliated branches.

However, the enterprise still guarantees that the figures in the financial statements honestly and reasonably reflect, in all material aspects, the company's financial situation as of December 31, 2023.

Also according to the financial report, the total assets of Nghe An Tea Corporation were nearly 50 billion VND at the end of 2023. Ineffective business caused the company to have an accumulated loss of 3.8 billion VND, and equity decreased to more than 30 billion VND.

Auditor has the right to refuse

Recently, there have been a series of audit-related issues. A large company on the stock exchange recently changed a “Big 4” auditor for the reason that “it did not meet the requirements”.

Meanwhile, speaking to Tuoi Tre Online, Mr. Dang Van Thanh - former chairman of the Vietnam Association of Accountants and Auditors, admitted that recently there have been more lawsuits due to concerns about occupational risks. He sympathized and said that "auditing or any profession has risks and pressure at work".

Mr. Thanh emphasized that all auditors' opinions must be based on legal, reliable and evaluated evidence. Auditors are allowed to give one of three types of opinions: fully acceptable audit opinion; partially acceptable audit opinion with exceptions; and audit opinion refusing to give an opinion.

“Auditors have every right not to give an opinion if they do not have enough evidence, or if the evidence is not sufficient, not reliable enough, or if they feel it is risky. If they give an opinion that is not consistent with the evidence that has been collected and evaluated, either due to professional competence or impure motives, it is a violation,” Mr. Thanh emphasized.

Independent Audit Scandal After Scandal

Independent Audit Scandal After Scandal

![[Photo] Party and State leaders attend the special art program "You are Ho Chi Minh"](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/18/6895913f94fd4c51aa4564ab14c3f250)

![[Photo] Ready for the top competitions of Vietnamese table tennis](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/18/9c547c497c5a4ade8f98c8e7d44f5a41)

![[Photo] Many young people patiently lined up under the hot sun to receive a special supplement from Nhan Dan Newspaper.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/18/6f19d322f9364f0ebb6fbfe9377842d3)

Comment (0)