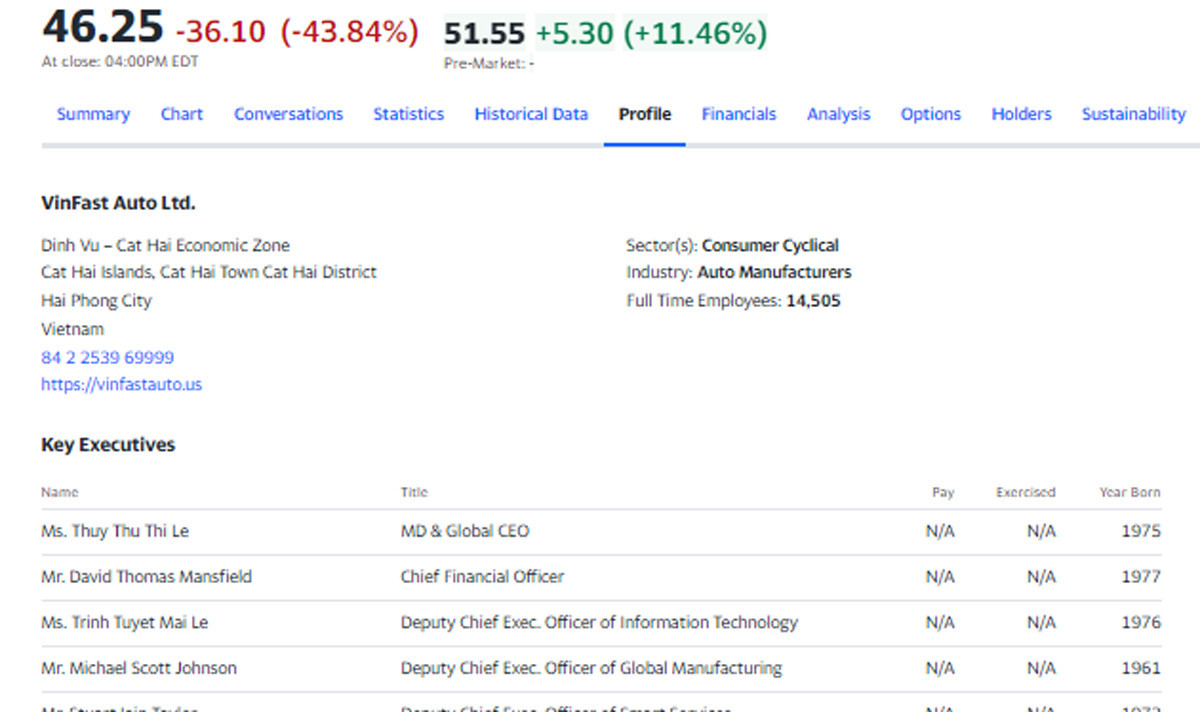

The consecutive price increases of VFS ( VinFast ) code are showing the attractiveness of the Vietnamese electric car company as well as the confidence of international investors in VinFast's potential. The scale of billionaire Pham Nhat Vuong's assets calculated by stock price has also continuously risen on Forbes's world billionaires ranking.

However, it is worth noting that recently, Forbes has unexpectedly changed the way VinFast is valued, in the direction of calculating the price/revenue coefficient and referring to the average price of other electric vehicle companies such as Lucid, Neo or Tesla instead of following the actual developments on the stock exchange.

The new calculation method immediately attracted public attention when the value of VinFast was only about 2 billion USD, and at the same time, Mr. Pham Nhat Vuong's assets were updated to 6.9 billion USD (at 10:00 p.m. on August 30, 2023).

This calculation method is controversial. For a long time, Forbes has agreed to calculate based on listed stock prices. Increases and deductions, if any, are only in some cases, according to a certain percentage but still based on the above method.

It can be seen that applying different reference systems to calculate in the same playground is quite inconsistent. When VinFast was listed on Nasdaq, the shares were publicly traded, and investors bought and sold according to market regulations.

Even the figure of more than 2 billion USD is unrealistic because only counting the assets such as production complex systems, machinery and equipment... to large costs such as R&D, the value of VinFast is many times higher than Forbes' calculation.

VinFast is a very new phenomenon, while Forbes may not have conducted an in-depth assessment, so its calculations are not close to reality.

Historically, there has been some information about SPACs in the electric vehicle sector being “inflated”, causing rating agencies to tighten up, and the valuation with VinFast may be the same.

A few years ago, there was indeed an “electric car storm” in the capital raising market. However, the context at that time was very different.

Names like Lordstown Motors, Nikola or Lucid were once valued and even raised billions of dollars but in reality only delivered a few hundred cars when they went public. There are companies like Lordstown Motors that after many years produced only… 19 cars and then filed for bankruptcy.

But that was a time when investors were investing in trends, and electric vehicle startups benefited greatly despite having no real solid foundation or potential.

However, over time, investors are now extremely cautious and strict when evaluating electric vehicle startups. Moreover, VinFast is also in a completely different position compared to other electric vehicle companies. Before officially listing on Nasdaq, the Vietnamese car company already had a modern factory system, electric vehicle products in all segments and especially tens of thousands of products that have reached users.

VinFast's influence has even gone beyond Vietnam, with a presence in the US, Europe, electric vehicles reaching consumers around the world , especially the multi-billion dollar factory that has just started construction in North Carolina.

All of these differences make it unsatisfactory that VinFast was scrutinized as a SPAC in the electric vehicle sector many years ago.

The VinFast "phenomenon" is still attracting special attention from investors and has a strong fluctuation range.

However, over time, VFS will gradually enter a stable orbit and with good user reception, the actual price of VFS will be decided by the market itself.

Nguyen Thanh Nhan

Expert in mining and analyzing economic data

Source

![[Photo] Prime Minister Pham Minh Chinh chairs a meeting on the implementation of the Lao Cai-Hanoi-Hai Phong railway project.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/20/0fa4c9864f63456ebc0eb504c09c7e26)

Comment (0)