EVNFinance has a charter capital of more than 7,000 billion VND after many increases - Photo: EVF

Electricity Finance Joint Stock Company - EVNFinance (EVF) recently announced its audited semi-annual financial report for 2024.

What is noteworthy in EVNFinance's loan balance?

Non-interest income contributes a part of the revenue for this financial company, but mainly from services. The investment securities trading segment alone lost more than 14 billion VND, while in the same period it made a profit of more than 344 billion VND.

This period, EVNFinance's credit risk provisioning costs also increased sharply, from VND247 billion in the same period last year to more than VND495 billion in the first half of this year.

As a result, this finance company reported pre-tax profit of more than 310 billion VND, up 56% over the same period.

Basically, the audited business results are unchanged compared to the previous self-prepared report.

A significant difference after the audit, the report had to clarify more details of the customer loan items.

Specifically, EVNFinance's total outstanding customer loans at the end of June this year reached more than VND37,968 billion.

Notably, there are groups of customers with the same representative or the same office building with loans of more than VND 24,900 billion. This amount accounts for more than 65% of the company's total outstanding loans.

In addition, if divided by sector, EVNFinance's outstanding loans related to real estate are also quite large.

Specifically, this company has short-term loans of more than VND 11,369 billion to contribute capital to business cooperation contracts to implement long-term real estate projects with collateral being property rights and assets formed in the future.

How are transactions between EVNFinance and related parties?

In 2018, according to Government regulations, EVN divested capital from EVNFinance. By the end of 2020, EVN had completed the entire divestment process from this enterprise after selling the remaining 2.65 million shares.

Currently, EVNFinance's chairman is Mr. Pham Trung Kien. Charter capital increased from the initial level of VND 2,500 billion to more than VND 7,042 billion at the end of 2023.

Data: Audited financial statements

Regarding shareholder structure, as of December 31, 2023, domestic shareholders hold 99.55% of shares, foreign shareholders only own 0.45%.

Notably, EVNFinance's shareholder structure is significantly diluted when the number of institutional shareholders reaches 56 units but only holds 17.43%, the remaining individuals hold 82.57% with 55,774 shareholders.

EVNFinance's 2023 annual report does not mention details of institutional shareholders holding shares in the company.

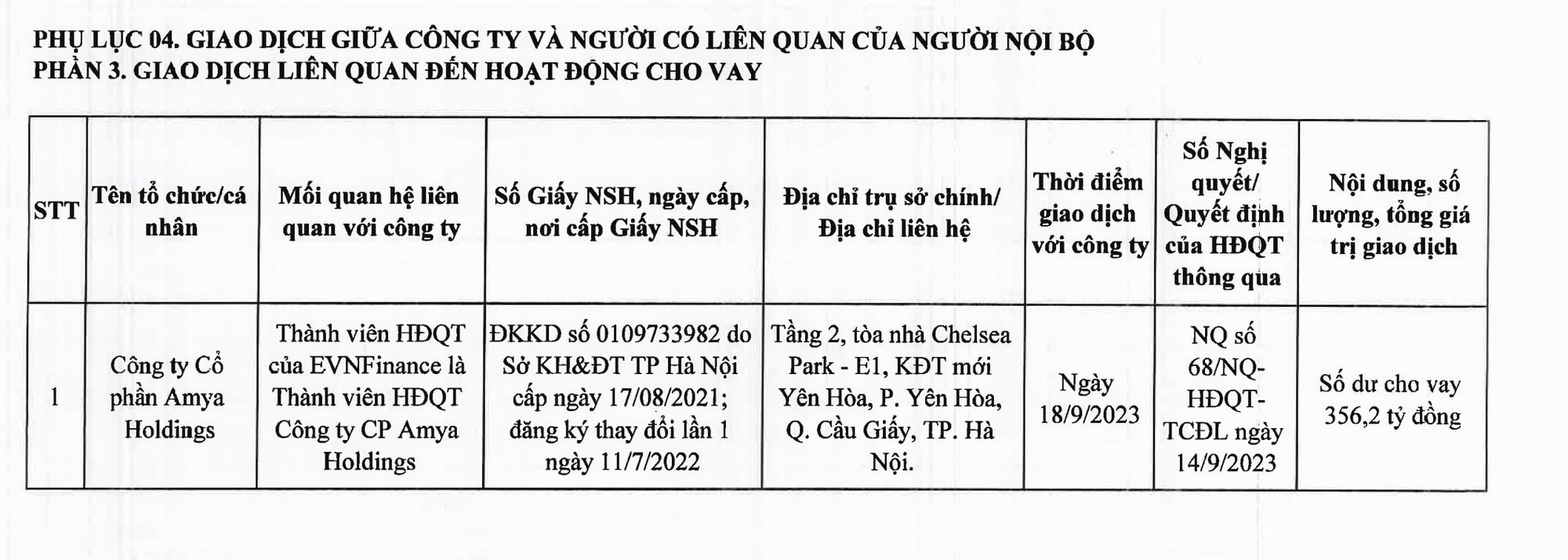

Meanwhile, in the management report for the first 6 months of this year, EVNFinance showed that there were transactions (deposit certificates or lending activities) with a number of related companies in the "ecosystem" Amber or Amya Holdings.

However, EVNFinance said that from April 4, 2024, Amber Fund Management Joint Stock Company is no longer related to them.

Similarly, Amber Fund Management Joint Stock Company and Amber Safe Bond Investment Fund also entered into transactions with EVNFinance. A member of the Board of Directors of EVNFinance is the operator of the Amber Safe Bond Investment Fund.

However, the management report for the first 6 months of 2024 also shows that Amber Safe Bond Investment Fund is no longer related to EVNFinance from April 5, 2024.

Transactions arising between the company and related parties of company insiders are shown in the periodic management report every 6 months, twice a year.

In addition, EVNFinance's management report also shows that there were transactions with Amya Holdings Joint Stock Company with a loan balance of more than VND 356 billion. EVNFinance's Board of Directors is a Board of Directors member of Amya Holdings.

Source: https://tuoitre.vn/evnfinance-rot-hon-11-369-ti-dong-vao-bat-dong-san-20240925105654566.htm

![[Photo] General Secretary To Lam works with the Standing Committees of the 14th Party Congress Subcommittees](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F09%2F1765253019536_a1-bnd-0983-4829-jpg.webp&w=3840&q=75)

![[Photo] Urgently help people soon have a place to live and stabilize their lives](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F09%2F1765248230297_c-jpg.webp&w=3840&q=75)

Comment (0)