Foreign exchange rates, USD/VND exchange rate today, September 24, recorded a slight increase in the USD in the last trading session, while the EUR decreased.

Foreign exchange rate update table - Vietcombank USD exchange rate today

| 1. VCB - Updated: 09/24/2024 08:57 - Time of website supply source | ||||

| Foreign currency | Buy | Sell | ||

| Name | Code | Cash | Transfer | |

| AUSTRALIAN DOLLAR | AUD | 16,390.39 | 16,555.95 | 17,087.91 |

| CANADIAN DOLLAR | CAD | 17,748.41 | 17,927.68 | 18,503.72 |

| SWISS FRANC | CHF | 28,344.66 | 28,630.97 | 29,550.91 |

| YUAN RENMINBI | CNY | 3,422.66 | 3,457.23 | 3,568.85 |

| DANISH KRONE | DKK | - | 3,601.16 | 3,739.24 |

| EURO | EUR | 26,661.10 | 26,930.40 | 28,124.32 |

| Sterling Pound | GBP | 32,031.73 | 32,355.28 | 33,394.89 |

| HONGKONG DOLLAR | HKD | 3,084.08 | 3,115.24 | 3,215.33 |

| INDIAN RUPEE | INR | - | 294.13 | 305.90 |

| YEN | JPY | 165.47 | 167.14 | 175.10 |

| KOREAN WON | KRW | 15.95 | 17.72 | 19.23 |

| KUWAITIAN DINAR | KWD | - | 80,560.19 | 83,784.93 |

| MALAYSIAN RINGGIT | MYR | - | 5,808.01 | 5,934.98 |

| NORWEGIAN KRONER | NOK | - | 2,299.99 | 2,397.76 |

| RUSSIAN RUBLE | RUB | - | 256.34 | 283.78 |

| SAUDI RIAL | SAR | - | 6,548.74 | 6,810.88 |

| SWEDISH KRONA | SEK | - | 2,367.23 | 2,467.86 |

| SINGAPORE DOLLAR | SGD | 18,595.01 | 18,782.84 | 19,386.35 |

| THAILAND | THB | 660.58 | 733.98 | 762.12 |

| US DOLLAR | USD | 24,440.00 | 24,470.00 | 24,810.00 |

Exchange rate developments in the domestic market

In the domestic market, according to TG&VN at 7:00 a.m. on September 24, the State Bank announced the central exchange rate of the Vietnamese Dong to the USD at 24,126, down 22 VND.

The reference USD exchange rate at the State Bank of Vietnam is listed at: 23,400 VND - 25,282 VND.

USD exchange rates at commercial banks are as follows:

Vietcombank: 24,430 VND - 24,800 VND.

Vietinbank: 24,300 VND - 24,800 VND.

|

| Foreign exchange rates, USD/VND exchange rate today, September 24: EUR 'falls dramatically', USD gradually increases. (Source: 24 News) |

Exchange rate developments in the world market

The US Dollar Index (DXY) measures the greenback's movements against six major currencies (EUR, JPY, GBP, CAD, SEK, CHF) at 100.91, up 0.91%.

The US dollar edged up slightly in the last trading session, while the euro fell against the US dollar as disappointing Eurozone economic reports hit the market.

The dismal eurozone data has bolstered expectations that the European Central Bank will cut interest rates further this year. Markets are now pricing in a roughly 77% chance of a cut of at least 25 basis points (bps) at the central bank’s October meeting.

Business activity in the eurozone contracted sharply this month, a survey by S&P Global showed, with the downturn being widespread, notably in Germany. Meanwhile, the French economy returned to the doldrums after being boosted in August by the Olympic Games.

In contrast, US business activity stabilized in September, but average prices of goods and services rose at the fastest pace in six months, which could lead to rising inflation in the coming months.

The data comes after the US Federal Reserve (Fed) cut interest rates by 50 basis points last week, with some Fed officials commenting on September 23 that the move was aimed at maintaining balance in the economy.

The US Composite PMI Output Index, which tracks manufacturing and services sectors, was little changed at 54.4 this month, compared with a final reading of 54.6 in August, S&P Global said.

The DXY index rose to 101.23 at one point in the last trading session. The EUR fell 0.39% to $1.112 and was on track for its biggest one-day drop since September 9.

The US dollar suffered its third consecutive weekly decline last week, after the Fed cut interest rates and several Fed officials are scheduled to speak this week, including Fed Chairman Jerome Powell, as well as Governors Michelle Bowman, Lisa Cook and Adriana Kugler.

The pound rose 0.2 percent to $1.3345 after rising to $1.33595, its highest since March 3, after a similar survey showed British businesses reported slowing growth this month.

The Bank of England kept interest rates on hold at its policy meeting last week, saying the central bank needed to be careful not to cut rates too quickly or too much.

The dollar weakened 0.37% to 143.38 yen after a holiday in Japan. The greenback hit a two-week high of 144.50 yen last week after the Bank of Japan (BOJ) kept interest rates unchanged and signaled it would not rush to raise them again.

Meanwhile, the Swiss National Bank will make a policy announcement later this week, expected to cut by 25 basis points.

Source: https://baoquocte.vn/ty-gia-ngoai-te-ty-gia-usdvnd-hom-nay-249-eur-rot-tham-usd-tang-dan-287284.html

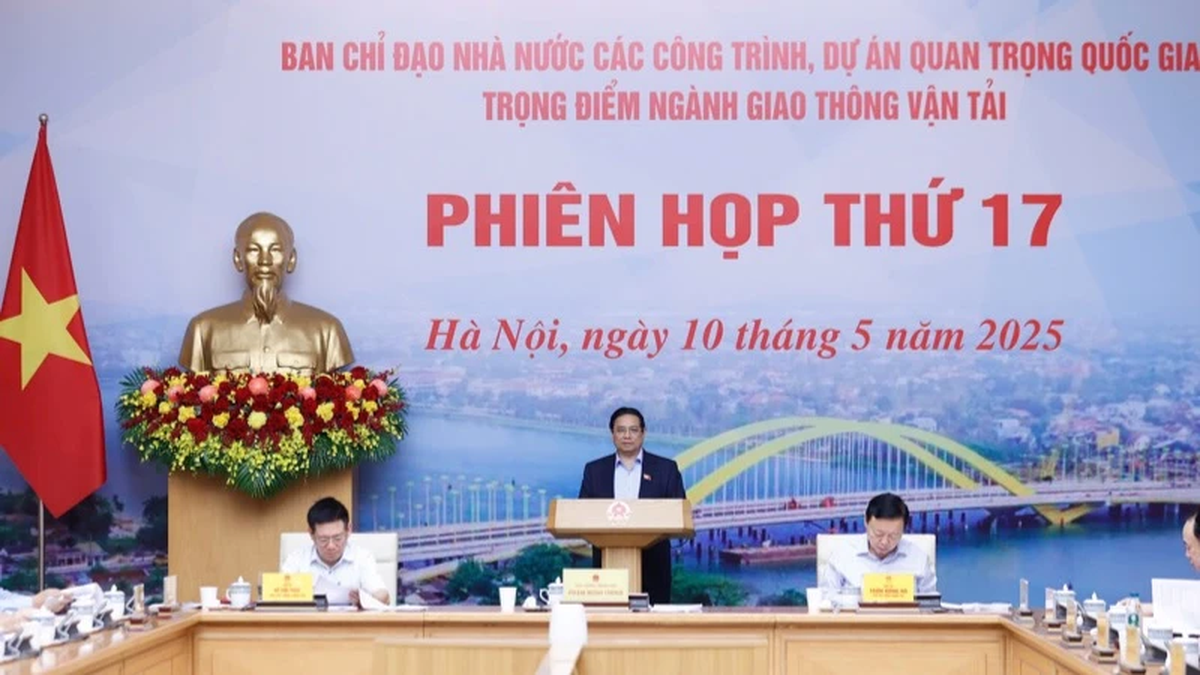

![[Photo] Prime Minister Pham Minh Chinh chairs a meeting of the Steering Committee for key projects in the transport sector.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/10/0f4a774f29ce4699b015316413a1d09e)

![[Photo] General Secretary To Lam holds a brief meeting with Russian President Vladimir Putin](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/10/bfaa3ffbc920467893367c80b68984c6)

Comment (0)