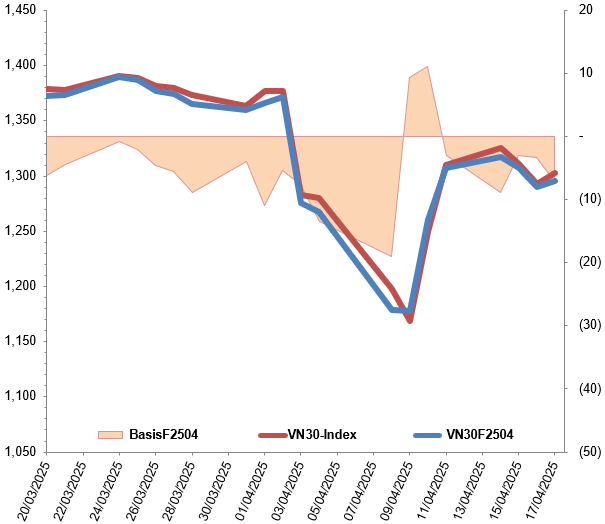

The derivatives trading session on April 17 saw a rise as all futures contracts increased in points. The VN30F2505 contract increased sharply by 1.16% to 1,303.4 points, while the VN30F2504 contract increased by 0.47% and maintained green at the end of the session thanks to overwhelming demand in the second half of the afternoon.

However, it is worth noting that the trading volume of the entire derivatives market decreased slightly , in which the F2504 contract decreased by more than 14%, reflecting the hesitant and cautious sentiment of investors. Foreign investors returned to net buying with a modest scale - 583 contracts, but this is still a positive signal in the context of volatile trading.

The difference (basis) between the VN30F2504 contract price and the underlying VN30-Index widened to -7.03 points, showing that investors' short-term expectations are still leaning towards caution.

Technically, the VN30-Index is in the process of retesting the strong resistance zone of 1,280–1,300 points , which coincides with the Fibonacci Projection 38.2% level. The MACD indicator is still below the signal line but has gradually narrowed the gap. If the buy signal reappears, the short-term trend will become more positive, creating positive momentum for futures contracts.

In the short term, the sideways trend is likely to continue in the session of April 18, especially in the 1,300-1,305 point range for VN30F2505. This will be a strategic area for investors to consider opening a buying position if the market does not correct deeply. On the contrary, profit-taking pressure may increase if the 1,310 point threshold is exceeded without confirmation of liquidity.

For government bond futures , GB05F2506, GB05F2509 and GB05F2512 are currently priced attractively relative to their fair valuations. This could be a notable medium-term investment opportunity amid stable interest rates.

Overall, the session on April 18 is likely to continue to be a session of differentiation and accumulation in the derivatives market, with the opportunity to open short-term positions at the support zone of 1,296-1,300 points, but it is necessary to closely follow technical signals and cash flow developments before taking action.

Source: https://baonghean.vn/du-doan-chung-khoan-phai-sinh-ngay-18-4-giang-co-keo-dai-cho-xac-nhan-tu-dong-tien-va-ky-thuat-10295355.html

![[Photo] Prime Minister Pham Minh Chinh and Prime Minister of the Kingdom of Thailand Paetongtarn Shinawatra attend the Vietnam-Thailand Business Forum 2025](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/16/1cdfce54d25c48a68ae6fb9204f2171a)

![[Photo] President Luong Cuong receives Prime Minister of the Kingdom of Thailand Paetongtarn Shinawatra](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/16/52c73b27198a4e12bd6a903d1c218846)

Comment (0)