The banking sector is projected to experience slow growth.

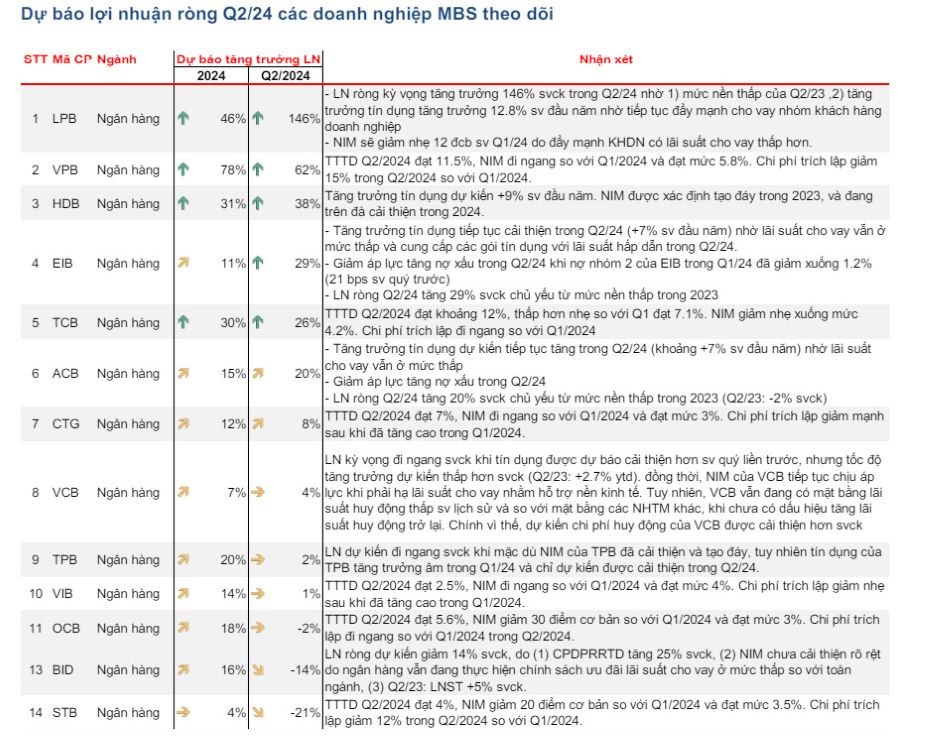

MBS Securities Company has just released an industry report, which includes a general forecast for the banking sector as well as profit forecasts for the second quarter of 2024 for 14 leading banks.

According to MBS analysis group, banking sector profits are projected to slow down to 12% year-on-year. Overall market profits could reach 9.5% year-on-year growth in Q2 2024, supported by a lower base year-on-year while production and consumption show a slight recovery.

The net interest margin (NIM) will continue to face downward pressure as lending rates are projected to fall further while deposit rates have slightly increased at most banks.

Credit growth in the second quarter is projected to be more favorable than in the first quarter, but still lower than the same period last year. Therefore, overall net interest income is unlikely to increase significantly. Non-interest income remains sluggish and has not yet recovered, relying mainly on fee collection and debt restructuring.

Furthermore, foreign exchange and securities trading is not expected to experience high growth as market conditions become increasingly difficult. Provisioning costs will continue to rise as non-performing loans show signs of increasing again in the second quarter. The increase in the non-performing loan (NPL) ratio and the decrease in the loan loss reserve (LLR) ratio are general trends across the industry.

Bank profits will not be high, and some banks will experience negative growth.

According to MBS's forecast, overall, the after-tax profits of banks will not experience high growth, with notable increases in some banks with good credit growth such as LPB, VPB, and HDB; some banks will record negative after-tax profit growth due to high after-tax profits in the same period last year, such as STB and BID.

The highest profit growth forecast belongs to LPBank (LPB) with a 146% increase year-on-year, due to a low base in Q2/2023. At the same time, credit growth is projected at 12.8% year-on-year thanks to continued strong lending to corporate clients.

The second largest projected increase belongs to VPBank (VPB), with a projected credit growth of 11.5% by the end of Q2 2024. Accordingly, Q2 2024 profits are expected to increase by 62% year-on-year. Full-year profits are projected to increase by 78% compared to 2023.

Several other banks are also projected to experience positive year-on-year growth, including HDBank (up 38%), Eximbank (up 29%), Techcombank (up 26%),ACB (up 20%), VietinBank (up 8%), Vietcombank (up 4%), TPBank (up 2%), and VIB (up 1%).

Conversely, some banks are projected to experience negative growth compared to the same period last year.

For example, BIDV's net profit in Q2/2024 is projected to decrease by 14% due to a 25% increase in risk provision costs, and its Net Interest Margin (NIM) has not improved significantly because the bank is still implementing a policy of offering low lending interest rates compared to the entire industry.

Similarly, MBS forecasts Sacombank's net profit for the second quarter of 2024 to decrease by 21% compared to the same period last year.

Source: https://laodong.vn/kinh-doanh/du-bao-loi-nhuan-cac-ngan-hang-trong-quy-ii2024-1357998.ldo

![[Photo] Prime Minister Pham Minh Chinh receives Lao Minister of Education and Sports Thongsalith Mangnormek](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F16%2F1765876834721_dsc-7519-jpg.webp&w=3840&q=75)

![[Image] Leaked images ahead of the 2025 Community Action Awards gala.](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F16%2F1765882828720_ndo_br_thiet-ke-chua-co-ten-45-png.webp&w=3840&q=75)

![[Live] 2025 Community Action Awards Gala](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F16%2F1765899631650_ndo_tr_z7334013144784-9f9fe10a6d63584c85aff40f2957c250-jpg.webp&w=3840&q=75)

![[Photo] Prime Minister Pham Minh Chinh receives the Governor of Tochigi Province (Japan)](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F16%2F1765892133176_dsc-8082-6425-jpg.webp&w=3840&q=75)

Comment (0)