Foreign exchange rates, USD/VND exchange rate today, June 5, the USD increased slightly compared to the Euro, the British Pound and the Swiss Franc, as investors consolidated profits in other currencies.

Foreign exchange rate update table - Vietcombank USD exchange rate today

| 1. VCB - Updated: June 23, 2024 15:25 - Time of website supply source | ||||

| Foreign currency | Buy | Sell | ||

| Name | Code | Cash | Transfer | |

| AUSTRALIAN DOLLAR | AUD | 16,505.59 | 16,672.31 | 17,205.77 |

| CANADIAN DOLLAR | CAD | 18,123.37 | 18,306.44 | 18,892.18 |

| SWISS FRANC | CHF | 27,825.49 | 28,106.56 | 29,005.88 |

| YUAN RENMINBI | CNY | 3,433.20 | 3,467.88 | 3,579.38 |

| DANISH KRONE | DKK | - | 3,585.83 | 3,722.84 |

| EURO | EUR | 26,546.33 | 26,814.47 | 27,999.61 |

| Sterling Pound | GBP | 31,379.47 | 31,696.44 | 32,710.62 |

| HONGKONG DOLLAR | HKD | 3,178.20 | 3,210.31 | 3,313.02 |

| INDIAN RUPEE | INR | - | 303.61 | 315.72 |

| YEN | JPY | 155.28 | 156.85 | 164.33 |

| KOREAN WON | KRW | 15.84 | 17.60 | 19.19 |

| KUWAITIAN DINAR | KWD | - | 82,749.40 | 86,050.57 |

| MALAYSIAN RINGGIT | MYR | - | 5,340.02 | 5,456.05 |

| NORWEGIAN KRONER | NOK | - | 2,364.93 | 2,465.14 |

| RUSSIAN RUBLE | RUB | - | 277.20 | 306.84 |

| SAUDI RIAL | SAR | - | 6,765.27 | 7,035.16 |

| SWEDISH KRONA | SEK | - | 2,374.60 | 2,475.21 |

| SINGAPORE DOLLAR | SGD | 18,321.50 | 18,506.56 | 19,098.71 |

| THAILAND | THB | 612.10 | 680.11 | 706.09 |

| US DOLLAR | USD | 25,218.00 | 25,248.00 | 25,468.00 |

Exchange rate developments in the domestic market

In the domestic market, at 7:30 a.m. on June 5, the State Bank announced the central exchange rate of the Vietnamese Dong against the USD decreased by 15 VND, currently at 24,246 VND.

The reference exchange rate at the State Bank's transaction office remains unchanged, currently at: 23,400 VND - 25,450 VND.

USD exchange rates at commercial banks are as follows:

Vietcombank: 24,188 VND - 25,458 VND/USD.

Vietinbank: 25,218 VND - 25,458 VND/USD.

|

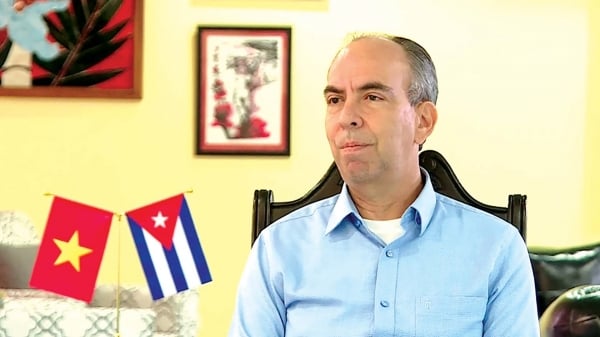

| The US dollar edged up against the euro, pound and Swiss franc as investors consolidated gains in other currencies. (Source: biz.crast.net) |

Exchange rate developments in the world market

The dollar edged up against the euro, sterling and Swiss franc, as investors consolidated gains in other currencies ahead of key non-farm payrolls data due later this week.

The greenback, however, extended losses against the Japanese yen, after US job creation fell more than expected in April, to its lowest level in more than three years.

The US jobs report, due on June 7, is expected to show 185,000 new jobs were created in May, up from 175,000 in April.

Manufacturing activity slowed for a second straight month and construction spending unexpectedly fell, according to the Job Openings and Labor Turnover Survey (JOLTS). Meanwhile, U.S. factory orders rose for a third straight month in April, boosted by demand for transportation equipment. Factory orders rose 0.7%, matching the revised pace in March.

In afternoon trading, the DXY index rose 0.1% to 104.12, after falling to its lowest since mid-April at 103.99.

In another development, the Euro fell 0.2% to $1.0879.

The European Central Bank (ECB) will hold a meeting tomorrow, June 6, and is widely expected to begin cutting interest rates.

The Bank of Canada (BOC) also meets today, June 5, and investors are betting about an 80% chance that the BOC will cut its benchmark interest rate for the first time since March 2020.

If the BOC and ECB cut rates simultaneously, the market will focus on the statements at the meeting to see if there is any difference with the US Federal Reserve (FED). These factors are actually more important than the rate cut.

The yen, on the other hand, rose to a three-week high against the greenback as Bank of Japan (BOJ) officials warned they were closely monitoring the currency, while Bloomberg reported that the central bank could soon discuss tapering its bond purchases.

The USD closed the trading session down 0.8% to 154.74 Yen.

BOJ Deputy Governor Ryozo Himino said on June 4 that the central bank must be “vigilant” about the impact of yen fluctuations on inflation in conducting monetary policy.

Bloomberg reported that the BOJ will address issues related to bond purchases at its two-day policy meeting next week. That could push yields higher in the coming weeks and could come before a rate hike in July.

Meanwhile, the British pound hit its highest since mid-March at $1.2818 before falling 0.3% to $1.2777.

Source: https://baoquocte.vn/ty-gia-ngoai-te-ty-gia-usdvnd-hom-nay-56-dong-usd-tang-nhe-so-voi-dong-euro-dong-bang-anh-va-dong-franc-thuy-sy-273819.html

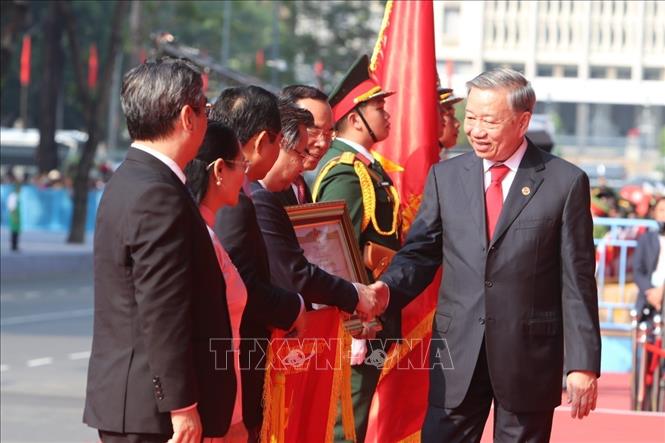

![[Photo] The parade took to the streets, walking among the arms of tens of thousands of people.](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/30/180ec64521094c87bdb5a983ff1a30a4)

![[Photo] Cultural, sports and media bloc at the 50th Anniversary of Southern Liberation and National Reunification Day](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/30/8a22f876e8d24890be2ae3d88c9b201c)

![[Photo] "King Cobra" Su-30MK2 completed its glorious mission on April 30](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/30/5724b5c99b7a40db81aa7c418523defe)

Comment (0)