Red covered the market, especially the VN30 group. This continued to cause the VN-Index to decrease in the session of January 22.

Red covered the market, especially the VN30 group. This continued to cause the VN-Index to decrease in the session of January 22.

VN-Index ended at 1,246.09 points, down 0.28%, trading volume increased by about 6.3% and was only 70% of the average. Entering the session on January 22, the market opened with a slight increase. But then, selling pressure began to spread, pushing VN-Index down slightly after more than 1 hour of trading. The VN30 group of stocks was also not very positive, when the number of codes with price reductions was outstanding. VN-Index then fluctuated with continuous ups and downs. The market lacked the motivation to buy to push up prices. Liquidity of the whole market remained at a very low level, reflecting the cautious trading psychology of investors when the demand to reduce portfolio proportions was still higher in the final period of the lunar year.

After the lunch break, the market still fluctuated narrowly around the reference level with continuous increases and decreases. However, in the second half of the afternoon trading session, with the overwhelming red color on the electronic board, the VN-Index only fluctuated below the reference level. Both the VN-Index and VN30-Index even closed at the lowest level of the session. However, overall, the decrease of the VN-Index was not too strong as there were still many supporting pillars.

At the end of the session, VN-Index decreased by 3.56 points (-0.29%) to 1,242.53 points. HNX-Index decreased by 1.01 points (-0.46%) to 220.67 points. Meanwhile, UPCoM-Index increased by 0.24 points (0.26%) to 93.08 points.

|

| LPB is a rare bright spot in the market. |

The entire market recorded only 286 stocks increasing, while 422 stocks decreased and 870 stocks remained unchanged/no trading. Despite the negative market fluctuations, 23 stocks still hit the ceiling, while 12 stocks hit the floor.

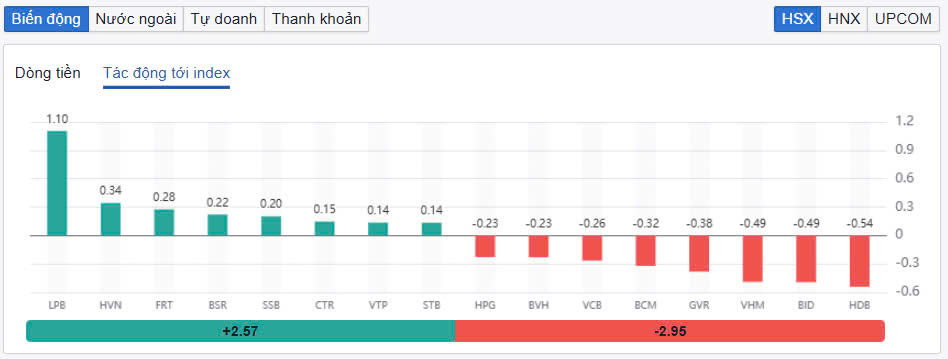

A series of large-cap stocks were sold off heavily today and negatively impacted the general market, in which HDB, BVH, BCM, VRE, PLX and GVR all had quite strong declines. HDB decreased by 2.87% to VND22,000/share. This was also the code that had the most negative impact on the VN-Index, taking away 0.54 points from the index.

Besides, stocks such as BID, VHM, VCB… were also in red. BID decreased by 0.75% and took away 0.49 points from VN-Index.

On the contrary, in the top 8 stocks with the most positive impact on the VN-Index, only SSB and STB were in the VN30. Meanwhile, LPB was the stock with the most positive impact with 1.1 points. At the end of the session, LPB increased by 4.87% to VND33,400/share. HVN also increased by 2.47% to VND27,000/share and also contributed 0.34 points. Stocks such as FRT, BSR ... also increased well.

Viettel stocks continued to be the focus when they all increased in price. It is worth noting that this group of stocks often fluctuates positively when the general market is facing difficulties. At the end of the session, VTP increased by 2.8%, VGI increased by 3.5%, CTR increased by 4.2%, and VTK increased by 7%.

On the other hand, NVL continued to give investors a headache when it fell 3.98% to a historic low of only VND8,680/share. Other real estate stocks such as HDG, DPG, CEO, DXG… were also in the red.

In the securities group, VDS and HCM are two of the few codes that have green color, while VND, BSI, CTS, MBS, AGR... are all in red.

|

| Foreign investors extend net selling streak. |

Total trading volume on HoSE reached 509 million shares, equivalent to a trading value of VND12,032 billion, up 5% compared to the previous session, of which negotiated transactions accounted for VND2,707 billion. Trading values on HNX and UPCoM reached VND1,227 billion and VND593 billion, respectively. HDB was the most traded stock in the market with a value of VND426 billion. FPT and CTR traded VND417 billion and VND373 billion, respectively.

Foreign investors continued to net sell about 280 billion VND in the whole market, in which, this capital flow net sold the most GMD code with 48 billion VND. FRT and FPT were net sold 47 billion VND and 43 billion VND respectively. In the opposite direction, LPB was net bought the most with 85 billion VND. HDB was also net bought 30 billion VND.

Source: https://baodautu.vn/dong-tien-yeu-nhom-vn30-chim-trong-sac-do-d242102.html

![[Photo] Special flag-raising ceremony to celebrate the 135th birthday of President Ho Chi Minh](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/19/1c5ec80249cc4ef3a5226e366e7e58f1)

![[Photo] Party and State leaders visit President Ho Chi Minh's Mausoleum](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/19/d7e02f242af84752902b22a7208674ac)

![[Photo] Party and State leaders attend the special art program "You are Ho Chi Minh"](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/18/6895913f94fd4c51aa4564ab14c3f250)

Comment (0)