Cash flow is vibrant, liquidity on the stock exchange exceeds 20,000 billion VND

Despite much supportive news, profit-taking pressure took back the gains of the VN-Index on the morning of September 20. However, the bright spot of the market was the liquidity figure, partly thanks to two foreign ETFs completing the portfolio restructuring in the third quarter of 2024.

|

| Trading value increased sharply, partly thanks to the portfolio restructuring activities of two foreign ETF funds. |

Before the new trading session, domestic investors welcomed positive developments in some world stock markets. In which, both Dow Jones and S&P 500 set new peaks.

Accordingly, the Dow Jones last night (Vietnam time) increased by 522.09 points (+1.26%) to 42,025 points, marking the first closing time above the 42,000 point threshold. The S&P 500 also increased by 1.7% to a record 5,713 points and the Nasdaq Composite increased by 2.51% to 18,013 points.

Positive investor sentiment from global developments has helped many stock groups increase sharply and helped pull the indices above the reference level. Trading in the market has also become more active.

However, what seemed like a breakout session for the general market today unexpectedly happened in the afternoon when the VN-Index “lost” many of its efforts to increase points in the morning session. Demand gradually weakened while profit-taking increased. This caused many pillar stocks to weaken, and the indices also significantly narrowed their growth momentum.

The 1,280-point mark is a strong psychological resistance for investors. The VN-Index surpassed the above mark at times but immediately encountered selling pressure. In addition, investors are somewhat more cautious as this is the session when foreign ETF funds complete their portfolio restructuring for the third quarter of 2024. The VN-Index closed still maintaining its green color.

At the end of the trading session, VN-Index increased by 0.77 points (0.06%) to 1,272.04 points. The entire floor had 224 stocks increasing, 185 stocks decreasing and 64 stocks remaining unchanged. HNX-Index increased by 0.53 points (0.23%) to 234.3 points. The entire floor had 86 stocks increasing, 87 stocks decreasing and 53 stocks remaining unchanged. UPCoM-Index moved sideways, meaning it still held the 93.63 point mark.

|

| Vietcombank shares turned around at the end of the session, causing great downward pressure on the VN-Index on September 20. |

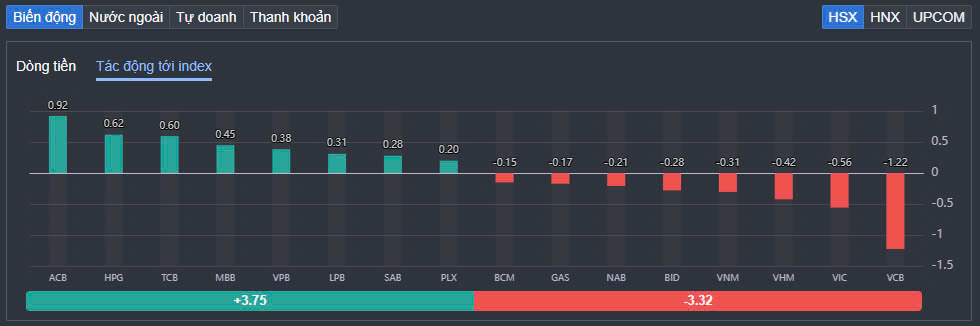

The focus of the market today is on the banking stocks group, which is also the group with the most important contribution to keeping the green color of the general market. In particular, ACB contributed 0.92 points to the VN-Index when it increased by more than 3.4%. According to recent information, on August 22, 2024, ACB was officially licensed to become a depository member of the Vietnam Securities Depository and Clearing Corporation. ACB is also one of the few domestic depository banks in Vietnam providing services to support investment activities of domestic and foreign investment institutions.

Banking stocks such as TCB, MBB, VPB and LPB also increased in price today. In addition, HPG also had a positive trading session when it increased by 1.6% and contributed 0.62 points to the VN-Index. SAB and PLX contributed greatly to the VN-Index in this session.

The oil and gas stocks attracted attention, of which, PVB increased by 5.7%, PVD increased by more than 5%, PVS increased by nearly 3%. Information supporting this industry group is that according to Petrotimes, Mr. Le Ngoc Son, General Director of Vietnam Oil and Gas Group (PVN) met and worked with Mr. Harada Hidenori, Chairman and General Director of Mitsui Oil and Gas (MOECO), and announced that the Block B - O Mon project officially started construction on September 18, 2024.

On the other hand, the divergence was strong when a series of large stocks reversed and put pressure on the general market. VCB fell nearly 1% and took 1.22 points off the VN-Index. VIC fell 1.4% and took 0.56 points off. VHM, VNM, BID, NAB… were the next stocks that had a big negative impact on the VN-Index.

In the group of small and medium-cap stocks, real estate codes did not fluctuate well, of which, NTL decreased by 1.4%, NLG decreased by 1.3%, DXG decreased by 1.3%, PDR decreased by 0.9%.

|

| Foreign investors returned to net selling, focusing on VHM shares. |

Trading on the market was quite active and liquidity increased sharply compared to the previous session. This was partly due to the fact that today was the last session for two foreign ETF funds to complete their investment portfolio restructuring for the third quarter of 2024. The total trading volume on the HoSE floor reached more than VND 898 billion, worth VND 21,820 billion, of which negotiated transactions accounted for only VND 1,761 billion. The trading value on the HNX and UPCoM reached VND 1,417 billion and VND 677 billion, respectively.

Today's session recorded 3 stocks with trading value exceeding 1,000 billion VND: HPG (1,150 billion VND), VHM (1.1 billion VND) and SSI (1.06 billion VND).

Foreign investors returned to net selling on the HoSE after 4 consecutive net buying sessions with a value of over 300 billion VND. Of which, this capital flow net sold the most VHM code with 268 billion VND. VIX and VNM were net sold 192 billion VND and 178 billion VND respectively. In the opposite direction, SSI was net bought the most with 194 billion VND. TCB and VND were net bought 125 billion VND and 68 billion VND respectively.

Source: https://baodautu.vn/dong-tien-soi-dong-thanh-khoan-tren-san-chung-khoan-vuot-20000-ty-dong-d225466.html

![[Photo] National Assembly Chairman Tran Thanh Man chairs the meeting of the Subcommittee on Documents of the First National Assembly Party Congress](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/72b19a73d94a4affab411fd8c87f4f8d)

![[Photo] Prime Minister Pham Minh Chinh meets with the Policy Advisory Council on Private Economic Development](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/387da60b85cc489ab2aed8442fc3b14a)

![[Photo] President Luong Cuong presents the decision to appoint Deputy Head of the Office of the President](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/501f8ee192f3476ab9f7579c57b423ad)

![[Photo] General Secretary concludes visit to Azerbaijan, departs for visit to Russian Federation](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/7a135ad280314b66917ad278ce0e26fa)

![[Photo] Prime Minister Pham Minh Chinh talks on the phone with Singaporean Prime Minister Lawrence Wong](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/5/8/e2eab082d9bc4fc4a360b28fa0ab94de)

Comment (0)