(NLDO) - The market is struggling, foreign investors are net sellers and cash flow is strongly divergent, focusing on stocks with prospects of increasing profits at the end of the year.

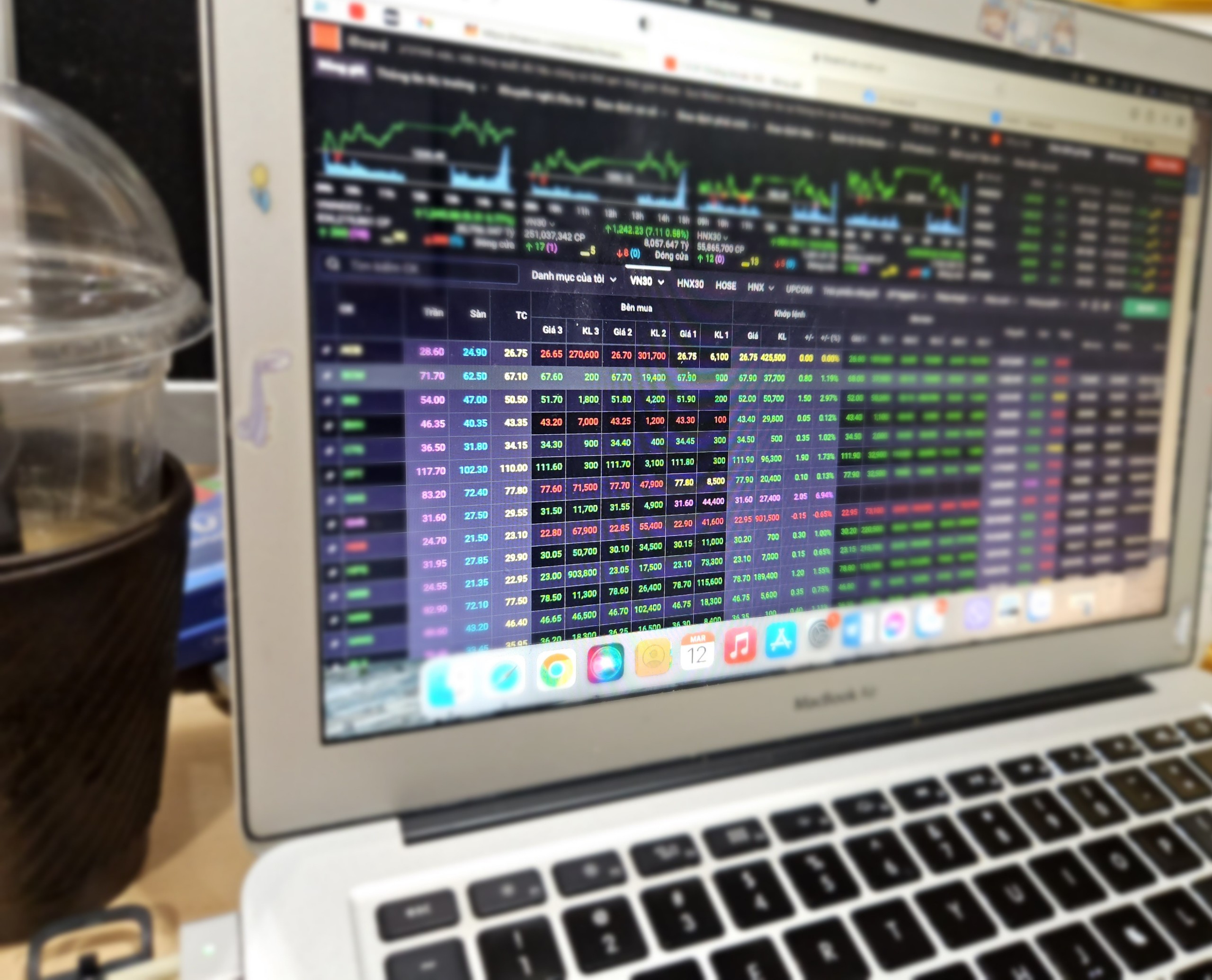

In the trading session on December 10, although the market opened in green, selling pressure increased somewhat, making it impossible for the VN-Index to maintain its green color. Profit-taking selling pressure caused the index to continue to fluctuate.

VN-Index closed at 1,272.07 points, down 1.77 points; HNX-Index increased 0.03 points, closing at 229.24 points. The entire market had 223 stocks decreasing in price, 170 stocks increasing in price. Foreign investors continued to net sell for the second consecutive session with a net selling value of over 132 billion VND.

Stocks contributing to the increase include FPT, HDB, HPG, HVN, SAB; stocks contributing to the decline include VCB, VIC, VHM, GVR…

The total value of matched transactions of VN-Index reached over 14,400 billion VND, down 9.9% compared to the previous session. According to securities companies, the market cash flow shows signs of differentiation and focuses on stocks of enterprises expected to have positive business results in the last quarter of the year.

The stock market continues to struggle and shows signs of correction after several positive sessions.

Mr. Vo Kim Phung, Head of Analysis, BETA Securities Company, commented that cash flow is cautious when the index approaches the old resistance zone around 1,270 points. Foreign investors continue to net sell, affecting the psychology of domestic investors. Although the short-term trend of VN-Index remains positive, it needs time to accumulate and wait for information on US interest rate policy.

"Cash flow is differentiated, actively looking for profit opportunities in the market. Investors can consider accumulating stocks of businesses with good foundations and positive growth potential in the last quarter of 2024 and 2025 during fluctuations and adjustments. Avoid the psychology of chasing stocks that show signs of overheating, are far from the accumulation base and have unattractive valuations," said Mr. Phung.

Vietnam Construction Securities Company (CSI) also believes that profit-taking pressure has increased after the last 3 sessions of VN-Index's increase. However, the decrease is not large and liquidity has decreased, so the market is still positive. Investors need to be patient and adjust to the support level to increase the proportion of stocks and add new stock buying positions.

According to experts from Phu Hung Securities Company, cash flow tends to go to small and medium-cap stocks in industries such as minerals, shipping, real estate, media, pork, steel, etc. The VN-Index may correct downwards in a few sessions. The general strategy is that investors can gradually re-enter with an average proportion, prioritizing groups such as banking, textiles, seafood, fertilizers, shipping, and technology.

Source: https://nld.com.vn/chung-khoan-ngay-11-12-dong-tien-chay-vao-co-phieu-nao-196241210174736687.htm

![[Photo] General Secretary concludes visit to Azerbaijan, departs for visit to Russian Federation](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/7a135ad280314b66917ad278ce0e26fa)

![[Photo] Prime Minister Pham Minh Chinh meets with the Policy Advisory Council on Private Economic Development](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/387da60b85cc489ab2aed8442fc3b14a)

![[Photo] President Luong Cuong presents the decision to appoint Deputy Head of the Office of the President](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/501f8ee192f3476ab9f7579c57b423ad)

![[Photo] General Secretary To Lam begins official visit to Russia and attends the 80th Anniversary of Victory over Fascism](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/5d2566d7f67d4a1e9b88bc677831ec9d)

![[Photo] National Assembly Chairman Tran Thanh Man chairs the meeting of the Subcommittee on Documents of the First National Assembly Party Congress](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/72b19a73d94a4affab411fd8c87f4f8d)

![[Photo] Prime Minister Pham Minh Chinh talks on the phone with Singaporean Prime Minister Lawrence Wong](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/5/8/e2eab082d9bc4fc4a360b28fa0ab94de)

Comment (0)