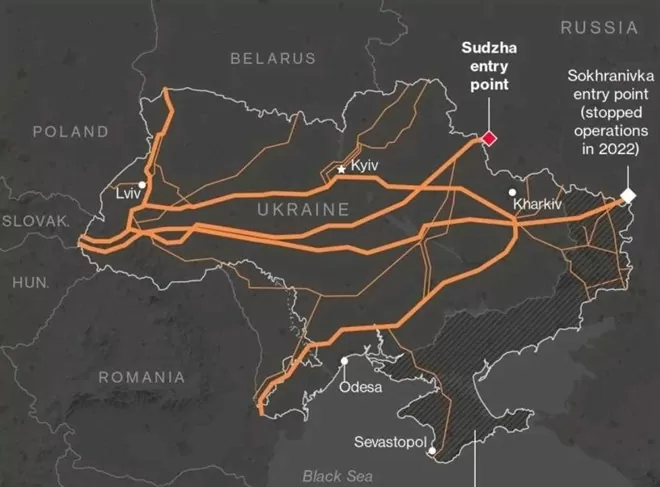

With more than 22,000 km of natural gas pipelines, Ukraine has played a key role in ensuring Europe’s energy security for decades. But Russian gas flows to the continent are unlikely to stop this winter if the transit agreement between Moscow and Kiev is not renewed in December.

This would cut off the flow of Russian fuel to EU member states at a crucial time.

Mr. James Hill, CEO of MCF Energy (UK) commented: " Ukrainian President Zelensky has finally cut off dependence on Russia by blocking the gas pipeline ."

|

| Russian gas pipeline network through Ukraine. Photo: Oxford Energy Institute |

“ While this is a strong and right move by Mr Zelensky, it also raises a major challenge for Europe ahead of the December contract expiration ,” Mr Hill said, adding that Europe’s gas supplies could be at risk.

According to estimates by Mykhailo Svyshcho, an analyst at Kiev-based consultancy ExPro Consulting, the amount of gas flowing through Ukraine accounts for less than 5% of the continent’s supply, but not renewing the agreement would not only damage Ukraine’s position as a reliable gas pipeline but also risk losing $800 million a year in transit fees.

Ukrainian Energy Minister German Galushchenko said the country had held transit talks with Azerbaijan, which supplies gas to eight European countries, but there were no concrete proposals from traders yet.

Deals with Azerbaijan and other suppliers in Central Asia are also possible, but time is running out before the year ends.

According to him, Ukraine and Europe need to take a strong approach before and after the contract expires to ensure energy security and stability, and protect themselves from retaliation by the Moscow government if it is not renewed.

|

| The current gas transit agreement between Ukraine's state energy company Naftogaz and Russia's state oil company Gazprom was signed in 2019 and is set to expire at the end of this year. Photo: RIA |

In a market with supply and demand in balance, the loss of the Russian gas route through Ukraine almost certainly risks causing volatility in energy prices in Europe.

Disruptions to supplies from other energy suppliers to Europe, such as Norway, or problems with liquefied natural gas (LNG) shipments could combine with a cold snap to send gas prices soaring.

“ Europe could be in a supply shortage this winter. The reality is that we are not yet tested because the last two winters have been quite mild, ” warned Frank van Doorn, head of trading at Vattenfall Energy Trading GmbH.

Since the outbreak of the Russia-Ukraine war, Europe has sought solutions to "wean" itself off Russian gas, including switching suppliers to Norway and increasing imports of LNG from the US.

European imports of Russian gas have fallen by more than 90%, and Moscow has lost its most lucrative market. Gazprom, which includes oil and power companies, posted a net loss of $7 billion in 2023, its first in a quarter of a century.

Last year, Russia shipped 14.6 billion cubic meters of gas via Ukraine, down nearly two-thirds from the 41.6 billion cubic meters transited in 2021.

According to Bloomberg estimates, the amount of Russian gas shipped through Ukraine to Europe brings Moscow $6.5 billion at current prices.

Gazprom has been in financial trouble since the EU, its historic customer, significantly reduced its imports of Russian gas, even declaring that it wanted to abandon Russian gas altogether by 2027.

For its part, Ukraine would lose about 720 million euros in annual revenue (almost 0.5% of its GDP), even though this money would mainly cover the costs of operating the gas network.

Source: https://congthuong.vn/dong-chay-nang-luong-bi-chan-o-ukraine-kinh-te-nga-lieu-co-dong-bang-346312.html

![[Photo] General Secretary concludes visit to Azerbaijan, departs for visit to Russian Federation](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/7a135ad280314b66917ad278ce0e26fa)

![[Photo] President Luong Cuong presents the decision to appoint Deputy Head of the Office of the President](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/501f8ee192f3476ab9f7579c57b423ad)

![[Photo] National Assembly Chairman Tran Thanh Man chairs the meeting of the Subcommittee on Documents of the First National Assembly Party Congress](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/72b19a73d94a4affab411fd8c87f4f8d)

![[Photo] General Secretary To Lam receives leaders of typical Azerbaijani businesses](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/998af6f177a044b4be0bfbc4858c7fd9)

![[Photo] Prime Minister Pham Minh Chinh talks on the phone with Singaporean Prime Minister Lawrence Wong](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/5/8/e2eab082d9bc4fc4a360b28fa0ab94de)

Comment (0)