Ms. Tran Thi Quy is a 42-year-old unskilled worker. She has been participating in social insurance since 2006, with a relatively low salary used as the basis for her social insurance contributions.

During the period 2006-2010, she paid social insurance contributions based on a base salary of 890,000 VND. From 2011-2020, Ms. Quy paid based on a base salary of 3,200,000 VND. It wasn't until 2021-2022 that Ms. Quy paid social insurance contributions at a rate of 7 million VND per month. From 2023 to the present, she has paid at a rate of 8 million VND per month.

Ms. Tran Thi Quy shared: "When I retire, how much will my pension be? I'm worried because if the average pension is calculated, will it be enough to give me peace of mind in my old age?"

According to Vietnam Social Security, pensions are calculated based on the actual salary changes during which the employee's social insurance contributions were paid. Since Ms. Quy has not yet reached retirement age, there is no basis to determine the average salary used for social insurance contributions as the basis for calculating her pension.

However, the current pension calculation mechanism has been reviewed to ensure the fairest possible benefits for all workers. For workers whose salaries were regulated by the State in the past, and whose social insurance contribution rates were very low (calculated based on the base salary), a pension calculation mechanism will be in place to ensure that their pensions are not too low in old age.

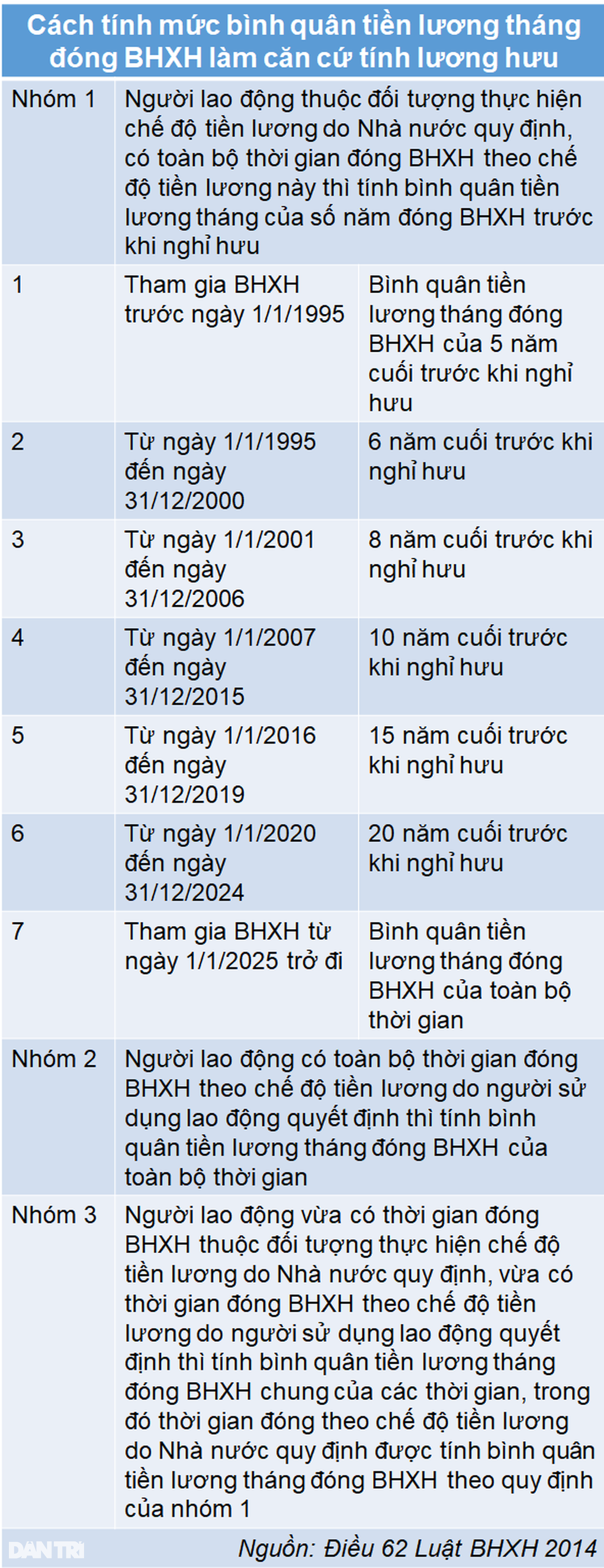

According to the Vietnam Social Security, the method for calculating the average monthly salary used as the basis for calculating pension benefits for employees is stipulated in Article 62 of the current Social Insurance Law No. 58/2014/QH13, enacted in 2014. Different calculation methods are used for three groups of employees with different periods of social insurance participation.

Furthermore, workers don't need to worry about their pensions being low compared to the cost of living at the time of retirement. This is because the law provides for pension adjustments based on the annual inflation index.

Specifically, Clause 2, Article 79 of the 2014 Social Insurance Law stipulates: "Monthly income on which social insurance contributions have been paid, used as the basis for calculating the average monthly income for social insurance contributions of employees, shall be adjusted based on the consumer price index of each period as prescribed by the Government ."

Source

![[Video] Hue and Quang Ninh mark strong tourism growth](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/12/12/1765555481742_dung00-22-16-02still007-jpg.webp)

Comment (0)