Circular 68 coming into effect will bring opportunities for securities companies to have a solid capital buffer and large market share, and will increase competition among securities companies, especially in terms of capital.

Circular 68 coming into effect will bring opportunities for securities companies to have a solid capital buffer and large market share, and will increase competition among securities companies, especially in terms of capital.

Opportunity with securities company strong in capital and market share

From November 2, 2024, Circular No. 68/2024/TT-BTC dated September 18, 2024 amending and supplementing a number of articles of the Circulars regulating securities transactions on the securities trading system; clearing and settlement of securities transactions; activities of securities companies and information disclosure on the securities market officially takes effect.

The Circular amends and supplements the requirement that investors must have sufficient money when placing an order to buy securities, except in the following cases: Investors trading on margin as prescribed; Organizations established under foreign law participating in investment in the Vietnamese securities market buying shares are not required to have sufficient money when placing an order as prescribed.

Thus, from the beginning of November, foreign institutional investors participating in investment in the Vietnamese stock market can buy stocks without requiring sufficient funds when placing orders according to regulations. This will open up new business opportunities for securities companies, however, not all companies have the advantage to perform this service well, the key is that securities companies will be responsible for paying transactions for foreign investors when investors do not have enough money to pay for the transactions they have made.

In the early stages, the advantage will lie with securities companies with solid capital buffers and large market shares, especially in the institutional client group.

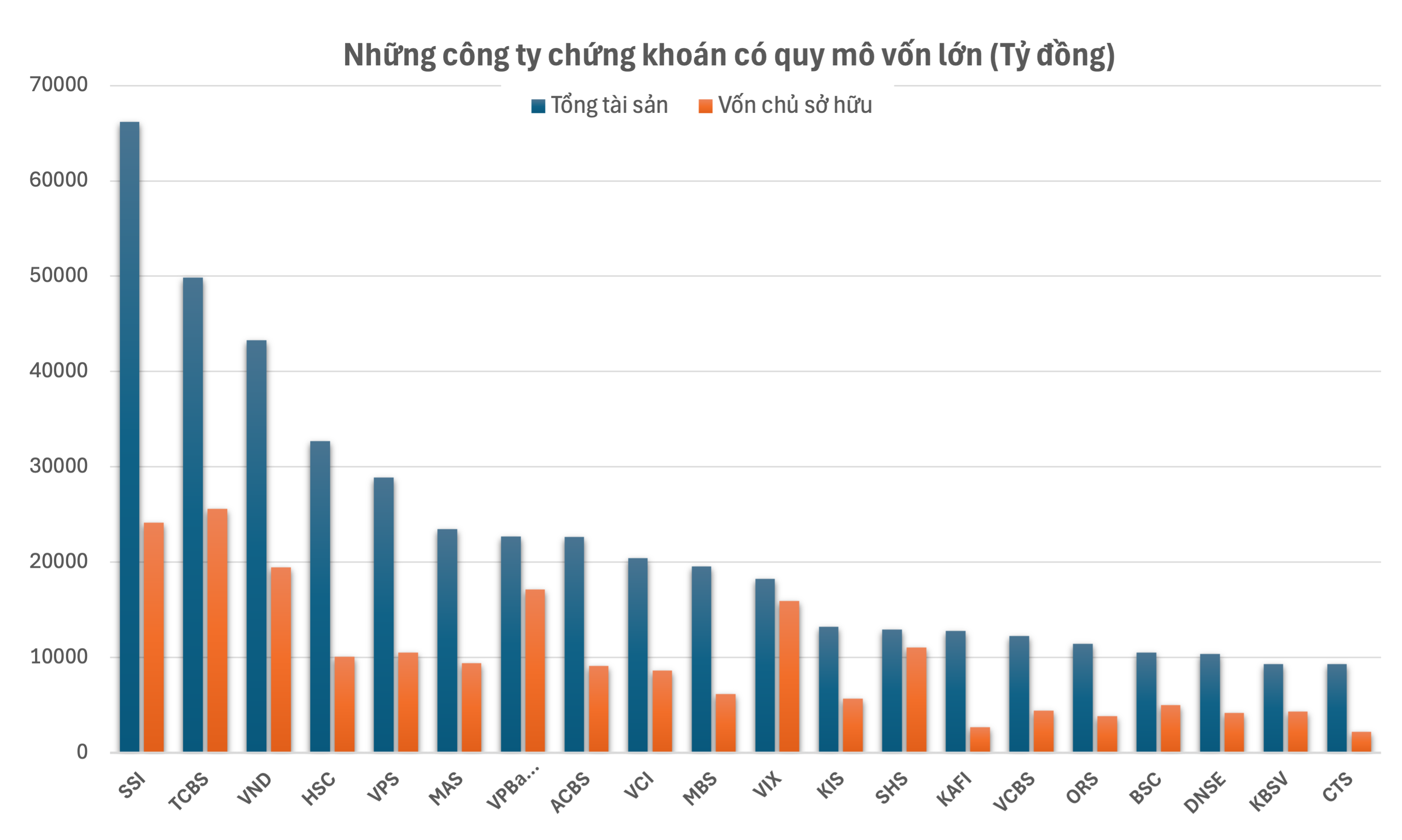

Statistics from Dau Tu Online Newspaper on 27 large-scale securities companies show that most of the companies increased their assets in the first 9 months of the year. Of which, 5 securities companies increased their total assets by more than 50% compared to the beginning of the year such as VIX (+100.5%), KAFI (+96%), ACBS (+92.2%), HSC (+82.7%) and ORS (+64.5%).

|

However, the securities companies with the highest total assets are still familiar names, holding the main market share. Currently, SSI is the company with the highest total assets with 66,181 billion VND as of the end of the third quarter of 2024. Next are TCBS and VND with total assets of over 40,000 billion.

The number of securities companies with total assets of over VND10,000 billion has also increased significantly compared to the beginning of this year. The list of capital sources over VND10,000 billion has seen the appearance of some new names such as VIX, KIS, KAFI, ORS, BSC and DNSE.

In terms of equity, TCBS is currently the company with the largest equity with VND 25,589 billion at the end of the third quarter of 2024. There are only 8 companies with equity over VND 10,000 billion, ranked after TCBS in turn are SSI, VND, VPBS, VIX, SHS, VPS and HSC. Of which, VIX stands out with its equity increasing by 80% compared to the beginning of the year after successfully offering shares to existing shareholders in September 2024.

Competitive pressure will increase

However, not all securities companies with high capital will have an advantage.

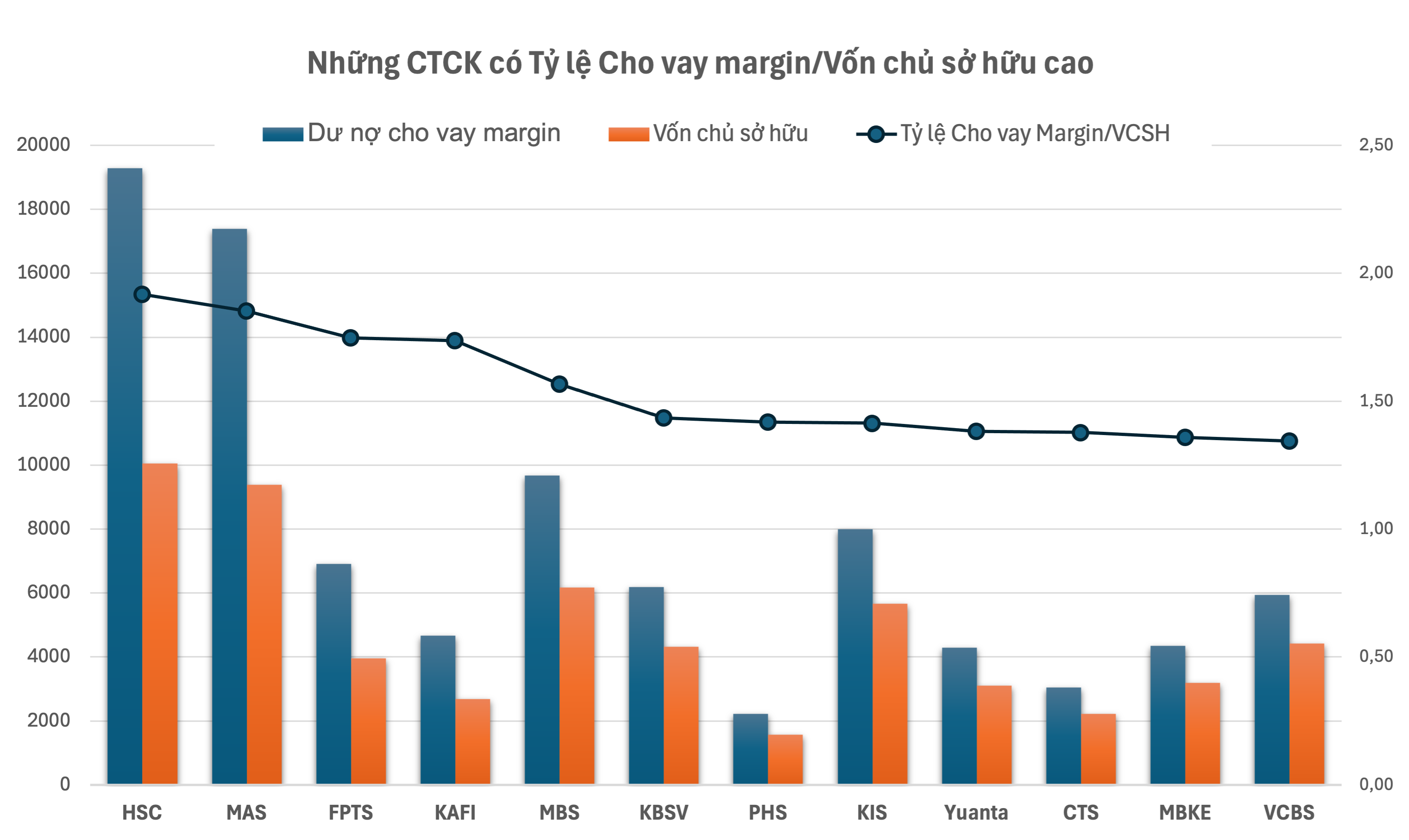

Circular 68 stipulates that the limit for accepting stock purchase orders is equal to the total amount that can be converted into cash but does not exceed the difference between 2 times the equity of the securities company and the outstanding loan balance for margin trading securities. This means that the higher the ratio of Margin Loan/Equity of the securities company, the lower the limit for accepting stock purchase orders.

According to regulations, securities companies are not allowed to lend more than twice their equity on margin. Up to now, after a period of hot margin growth, some securities companies have almost reached the limit, and there is not much room left for margin lending.

Statistics on 27 securities companies show that 5 securities companies have almost reached this threshold. In particular, the highest Margin Lending/Equity ratio is happening at HSC. HSC's margin lending balance at the end of the third quarter of 2024 was VND 19,286 billion, an increase of nearly 60% compared to the beginning of the year and 1.92 times higher than equity, equivalent to HSC's margin lending space of only over VND 800 billion.

|

At Mirae Asset, margin lending has also increased continuously. At the end of the third quarter, this figure was VND17,385 billion, up 30% compared to the beginning of the year. MAS's margin lending is currently at 1.85 times equity. Securities companies also have a high margin lending/equity ratio of over 1.5 times, including FPTS, KAFI and MBS.

With the tight ratio, securities companies will have to increase capital, not only to serve non-prefunding activities but also to meet margin lending rates - a segment that is gradually becoming the main contributor to revenue.

VNDirect’s analysis suggests that the securities industry will benefit from serving more foreign institutional investors thanks to increased brokerage income as liquidity increases. In addition to the benefits, there are potential risks such as payment risks due to foreign institutional funds paying late after T+2 after purchase. Therefore, securities companies need to strengthen risk management related to customers, margin ratios, market conditions and appropriate lending ratios.

To attract foreign institutional investors, securities companies will compete based on: 1) transaction fees; 2) pre-funding ratio (equity/total purchase value); 3) total value of pre-funded capital; and 4) service quality (information and reporting).

For the first factor, although securities firms can provide capital to foreign institutional clients, foreign institutional clients will still only be charged transaction fees. For the second factor, the ability to provide lower pre-funding rates will provide a competitive advantage. The third factor will depend on the equity of the firm, as securities firms with a larger equity structure will provide a distinct advantage.

VNDirect believes that the third factor will increase the pressure on securities companies to increase equity capital, due to the regulation limiting the debt-to-equity ratio to no more than five times. In short, large-scale securities companies with low transaction fees and competitive pre-funding ratios will benefit from attracting foreign institutional investors.

Source: https://baodautu.vn/don-non-prefunding-cong-ty-chung-khoan-nao-co-loi-the-d229089.html

![[Photo] Prime Minister Pham Minh Chinh chairs conference on anti-smuggling, trade fraud, and counterfeit goods](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/14/6cd67667e99e4248b7d4f587fd21e37c)

Comment (0)