Innovation in tax inspection and examination: Many benefits for both the tax industry and businesses

According to Mr. Tran Van Khuong, Head of Business Support Management Department No. 1, Binh Dinh One-Stop Shop (Tax Department of Region XIII), instead of waiting for businesses to commit violations and then regularly organize tax inspections at the business headquarters, the tax sector has focused on developing skills and improving inspection skills by applying information technology to provide contents and items with potential violations corresponding to the suspected data and estimated incorrect tax amounts of each business. From there, information and warnings are provided for businesses to self-review, correct errors and adjust correct declarations; businesses that do the right thing and provide reasonable explanations will have their tax declarations fully supplemented. All stages are carried out in an electronic environment, helping businesses avoid unnecessary violations, and receiving and processing tax declarations of businesses is also more convenient and effective.

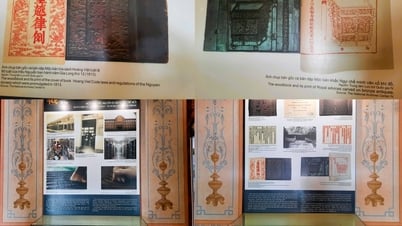

|

Tax officials check tax declarations in the electronic environment. Photo: T.SY |

Mr. Pham Dao Thanh, Head of Inspection and Examination Department No. 1, Binh Dinh One-Stop Department, said: The Tax Department only conducts inspections and examinations at the enterprise's headquarters when the tax declaration dossier has too many problems that the enterprise cannot prove or explain reasonably and the enterprise's dossier cannot be checked at the tax authority. Another case that needs to be inspected is when the enterprise applies for dissolution according to the Enterprise Law and pre-inspection of tax refunds for investment projects with first-time tax refunds, solving capital difficulties for enterprises according to the provisions of the Law on Tax Administration.

This innovation of the Tax sector is welcomed by enterprises. According to Ms. Dong Thi Anh - General Director of PISICO Binh Dinh Corporation, President of Binh Dinh Women Entrepreneurs Association, when the tax authority pays more attention to supporting enterprises and changing the tax inspection method to help enterprises avoid unnecessary violations, the pressure in coordinating tax inspection is also gone. From there, enterprises focus their time and resources on investing in production and business, voluntarily fulfilling tax obligations and making more contributions to society.

On the tax authority side, Mr. Nguyen Anh Tuan, Deputy Head of the Tax Department of Region XIII, said: Thanks to promoting the information technology ecosystem and changing the inspection method in the tax field, the tax authority has reduced time and effort, but still ensured the effectiveness of tax management and collection. Total domestic revenue up to March 25 in the province was more than 3,744 billion VND, reaching 23% of the year's estimate, up 41.8% over the same period.

MINH HANG

Source: https://baobinhdinh.vn/viewer.aspx?macm=5&macmp=5&mabb=343376

![[Photo] Prime Minister Pham Minh Chinh chairs conference on anti-smuggling, trade fraud, and counterfeit goods](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/14/6cd67667e99e4248b7d4f587fd21e37c)

Comment (0)