Many business owners have to pay a lot of money to handle illegal invoices used in the accounting process. There are accountants who get into trouble with the law when handling invoices for businesses.

“ My boss buys invoices to pay for outside expenses. Is there any risk?

My company has a sales team that goes to buy supplies or business expenses... specializing in buying invoices to fill out payment records.

Many times sales buy invoices to fill in payment documents, accountants are helpless. Tax officials have to spray glue to explain.

The previous check was ok because the invoice supplier was still operating, but a few years later they left the address, now the tax finalization requires the invoice to be removed and fined, explaining to the tax officer is very difficult .

A series of opinions from businesses participating in the seminar on financial and accounting risks held on the afternoon of November 19 showed that many businesses are still not fully aware of the potential risks of buying and selling invoices.

With 15 years of experience in the field of accounting and tax, Ms. Dinh Thi Huyen, Director of Savitax Tax Consulting JSC, has witnessed many unfortunate cases.

“Recently, a company operating in the field of elevator installation discovered a large number of risky invoices when the tax authority inspected it. The director said that the company in Ho Chi Minh City, during the 2020-2021 period, was working on a project in Hanoi and was forced to hire a group of individuals in Hanoi to perform some small tasks. This group did not have a legal entity, so they could not issue invoices. They had to send invoices from another company for payment. Currently, the director cannot contact those collaborators and does not know which company actually issued the invoices. While it is true that the actual costs incurred at the company,” Ms. Huyen said.

Another common case, according to Ms. Huyen, is that the sales team goes to work outside, buys cheap goods without invoices and documents, then buys invoices from other units and brings them back to the accounting department for payment. Without invoice control tools, it is difficult for accountants to know whether this invoice is from the invoice trading network or not.

It should be noted that in the context of a large number of enterprises and a small number of tax officers, many enterprises have to wait 5-7 years to be called up for tax settlement. Recently, a business has received a notice from the tax authority requesting it to prepare documents from 2019 to 2023.

Only when the tax authorities intervened did many businesses "fall backwards" when they realized they were using illegal invoices, causing many consequences. In addition to not being able to deduct value added tax due to invalid invoices, businesses were also fined and had to pay compensation for expenses related to these invalid invoices.

“From the end of 2023 until now, the tax authority has issued a series of documents on companies using illegal invoices, many business accountants have had to explain. Many business owners have had to pay a lot of money to handle illegal invoices used in the accounting process. It is heartbreaking when an accountant gets into trouble with the law when handling invoices for businesses,” Ms. Huyen shared.

While there are still many businesses that make a living by buying and selling invoices, which may only operate for a short time, to reduce the risk of tax settlement later, Ms. Huyen recommends that businesses carefully control input invoices.

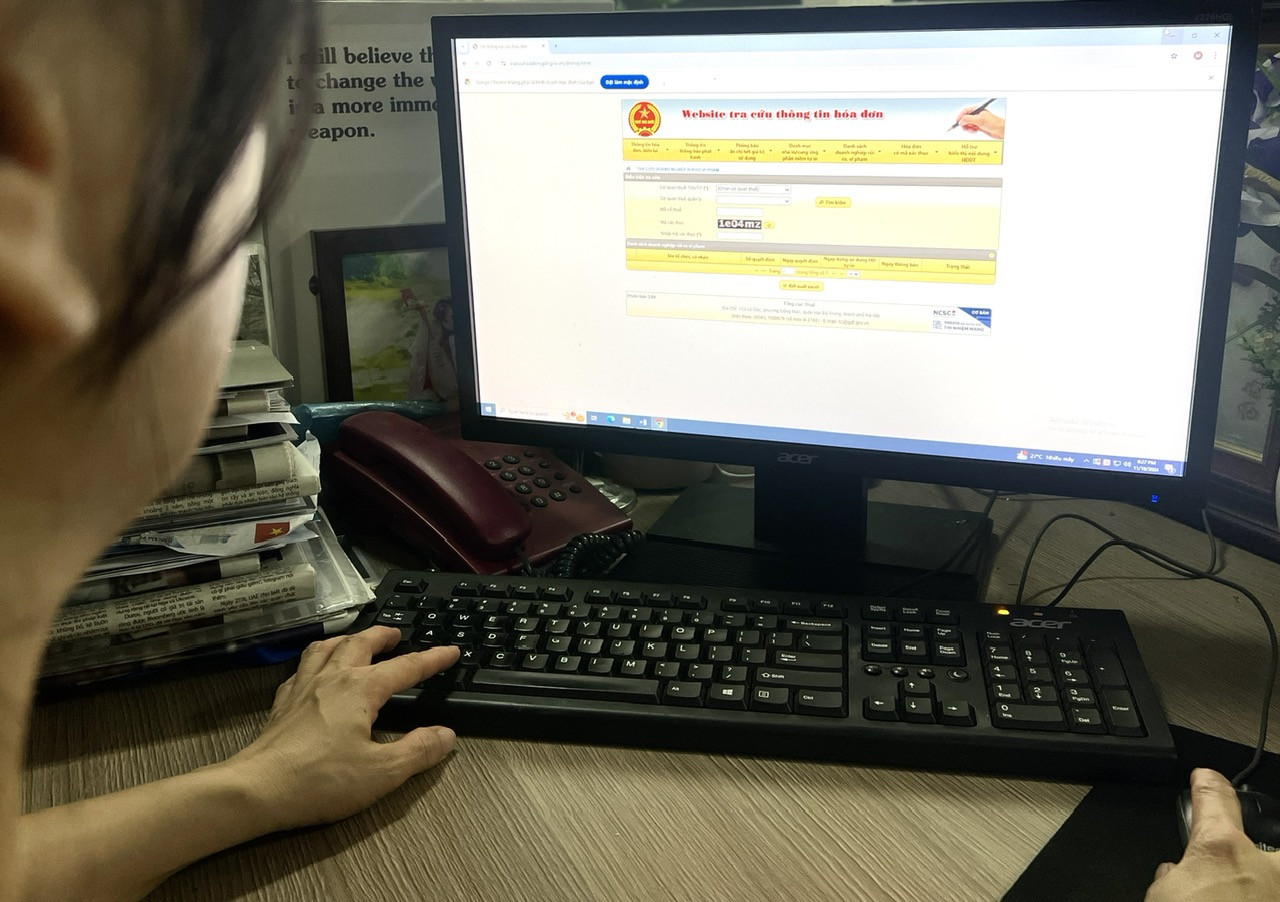

Enterprises can check the legality of invoices by looking up the tax authority's website, comparing the list of enterprises with invoice risks announced by the General Department of Taxation; or using input invoice processing software with invoice risk warning features.

| According to current regulations, invalid invoices and documents include: Erased or altered to lose authenticity; Not in accordance with prescribed form, without signature or stamp of the seller; Insufficient information of buyer, seller, item, quantity, unit price, etc.; Fake invoices, without actual transactions. |

Source: https://vietnamnet.vn/doanh-nghiep-van-chua-biet-so-khi-mua-hoa-don-khong-2343627.html

![[Photo] General Secretary To Lam and National Assembly Chairman Tran Thanh Man attend the 80th Anniversary of the Traditional Day of the Vietnamese Inspection Sector](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/11/17/1763356362984_a2-bnd-7940-3561-jpg.webp)

Comment (0)