Thai Binh's textile yarn export markets are mainly the US and European countries, so the new US tariff policy will adversely affect businesses exporting this item.

Reporter: Sir, the new US tariff policy is considered a "big barrier" to Vietnam's export goods. So, in your opinion, which industries will be most heavily affected?

Mr. Do Van Ve: The fact that US President Donald Trump signed an executive order imposing reciprocal tariffs on many countries, including Vietnam, at a high rate of up to 46%, may stem from measures to protect domestic production and the escalating global trade war.

This policy will certainly make Vietnamese goods exported to the US more expensive, making it difficult to compete with similar products from countries that are not subject to tariffs. The most affected industries are agriculture, textiles, footwear, wood products, and electronics - which are Thai Binh's export strengths. Unlike previous tax rounds that focused on a few products, this time the tax is applied comprehensively to many products, so the impact will be more profound and serious.

Reporter: How will the 46% tax rate specifically impact the province's export businesses, sir?

Mr. Do Van Ve: The impact is huge. First of all, it affects the psychology and confidence of businesses, causing concerns about legal risks and increased costs, forcing many businesses to adjust their production, investment and export market plans.

With a 46% tax rate, financial costs in exporting to the US will increase, leading to increased product prices and reduced competitiveness. Therefore, profits from orders to this market will decrease sharply. Many businesses may face cash flow difficulties, limiting the ability to reinvest or expand production, thereby affecting employment and local economic stability.

Leather shoes, a product that Thai Binh exports a lot to the US, will be greatly affected by this country's new tax policy.

Reporter: So what recommendations has the Provincial Business Association made to the province to remove difficulties for businesses in the current context?

Mr. Do Van Ve: First of all, we believe that the Government will soon negotiate with the US to bring the tax rate to a more reasonable threshold. On the province's side, the Association will propose implementing a number of practical support solutions. Specifically, it is necessary to promptly update policy information and advise businesses on response plans; at the same time, guide businesses to find alternative markets such as the EU, ASEAN or countries with free trade agreements with Vietnam. The province should also direct increased financial support, encourage banks to implement preferential loan packages with low interest rates for affected export businesses. It is possible to consider exempting and reducing appropriate taxes and fees so that businesses have more resources to overcome difficulties. In addition, it is necessary to organize conferences and forums to connect businesses, promote supply chain linkages in the province, thereby reducing dependence on export markets and limiting risks from external fluctuations.

We also emphasize supporting businesses in digital transformation, technological innovation, process improvement, and product quality improvement to increase competitiveness. The Provincial Business Association will coordinate with departments and branches to organize thematic dialogue conferences, survey severely affected businesses, and thereby have appropriate and accurate support policies.

Reporter: The 46% tax rate will officially take effect from April 9, 2025. So, in your opinion, from now until the tax is imposed, what preparations should export enterprises make? In the long term, what guidance do you have for enterprises in choosing export markets to avoid risks?

Mr. Do Van Ve: I think that, in the context of the 46% US tax rate officially taking effect from April 9, Thai Binh's export enterprises need to urgently review and re-evaluate all production and export activities to have appropriate adjustment plans. In the immediate future, enterprises must restructure the market, reduce dependence on the US market; at the same time, proactively seek alternative markets such as the EU, Japan, South Korea, Southeast Asian countries or countries that have signed free trade agreements (FTAs) with Vietnam. This is a necessary step to minimize risks and maintain export growth momentum.

In the long term, I orient businesses to focus on improving product quality, increasing added value, and meeting the strict standards of international markets. The application of science and technology, digital transformation, and innovation not only helps reduce product costs but also improves labor productivity and increases competitiveness. In addition, businesses also need to build a suitable and flexible supply chain in the face of global market fluctuations.

As the Provincial Business Association, we will continue to accompany businesses, make recommendations to authorities at all levels and coordinate with functional agencies and international organizations to propose practical solutions, protect business interests, and move towards sustainable development in the current difficult period.

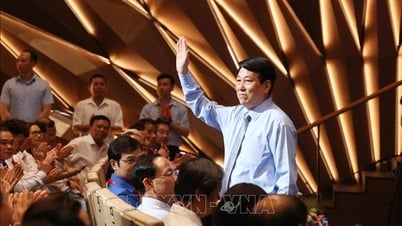

On the evening of April 4, General Secretary To Lam had a phone call with US President Donald J. Trump about Vietnam-US relations. The General Secretary affirmed that Vietnam is ready to negotiate to reduce import tariffs to 0% for goods from the US; at the same time, he proposed that the US apply similar tariffs to goods from Vietnam, continue to expand imports of goods that Vietnam needs, and create conditions for US businesses to increase investment in Vietnam. The two leaders agreed to soon discuss to sign a bilateral agreement to specify the commitments. On the same day, on the social network Truth Social, President Donald Trump said he had just had a “very productive phone call” with General Secretary To Lam. President Trump wrote: “He told me that Vietnam wants to reduce tariffs to ZERO if a deal can be reached with the United States. I thanked him on behalf of our country and said I look forward to meeting in person soon.” |

Reporter: Thank you very much!

Nguyen Hinh - Thu Ha

(perform)

Source: https://baothaibinh.com.vn/tin-tuc/4/221317/doanh-nghiep-thai-binh-ung-pho-the-nao-voi-chinh-sach-thue-quan-moi-cua-my

Comment (0)