Danh Khoi Group - the company that announced it wanted to buy back part of Mr. Dung 'Lo Voi''s project - has just reported a loss of nearly 6 billion VND in the third quarter of this year. On the balance sheet, cash and cash equivalents were 678 million VND.

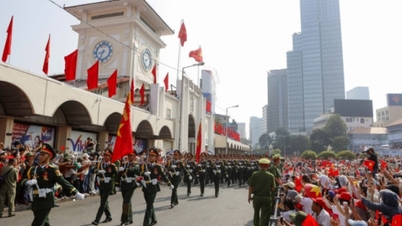

Dai Nam residential area in Chon Thanh, Binh Phuoc province - Photo: A LOC

Danh Khoi Group Joint Stock Company (NRC) has just announced its financial report for the third quarter of this year with revenue of only 1.29 billion VND, a slight increase compared to the same period last year.

Although many expenses have been reduced, NRC no longer recorded "other income" in the third quarter of this year as last year. As a result, NRC reported a loss of nearly VND 6 billion in the third quarter of 2024, while in the same period last year it made a profit of nearly VND 18 billion.

Explaining the reason, the leader of Danh Khoi Group said that "the real estate market has not improved", sales did not meet expectations, leading to insufficient conditions to record revenue from investment cooperation contracts.

In the first 9 months of this year, this real estate company recorded revenue of 3.8 billion VND, and after-tax profit was negative 16.2 billion VND, slightly down from the loss of 17.7 billion VND in the same period last year.

On the consolidated balance sheet, Danh Khoi's cash and cash equivalents were only over VND678 million at the end of September this year.

According to the financial statement, NRC's cash is only over 1.2 million VND, the remaining 676 million is deposited in the bank without a term. NRC also did not record any short-term financial investments.

As of the end of September 2024, the total assets of this real estate enterprise were 2,064 billion VND, a slight decrease compared to the beginning of the year.

Of which, inventory is only nearly 12 billion VND, the rest is mostly short-term and long-term receivables, accounting for more than 1,700 billion VND.

On the other side of the balance sheet, NRC's liabilities reached VND787 billion, unchanged from the beginning of the year. Of which, short-term debt accounted for VND566 billion.

Due to loss-making operations, NRC's management income has decreased compared to last year.

According to the report, Mr. Le Thong Nhat - Chairman of NRC, received an income of more than 287 million VND in the third quarter of 2024, a decrease of 36% over the same period.

In the first 9 months of this year, Mr. Nhat received 872 million VND, a decrease of 1.4 billion VND compared to the same period last year. Mr. Tran Vi Thoai - member of the Board of Directors, received 225 million VND in the third quarter, also a decrease compared to 362 million VND in the same period last year...

Danh Khoi issues shares to buy back part of Mr. Dung 'lime kiln' project

At the 2024 shareholders' meeting resolution, Danh Khoi approved the plan to issue private shares to increase charter capital.

Accordingly, NRC will offer 100 million shares with a par value of VND10,000 to professional securities investors, raising VND1,000 billion.

The purpose of issuing the above shares is to supplement working capital, pay off debts, buy back part of the Dai Nam residential area project (Mr. Dung 'lime kiln' project) and part of the project in the Ham Thang - Ham Liem residential area.

Before approval, shareholders questioned the feasibility of this private offering. Because the expected issuance price is twice as high as the market price of shares. Currently, NRC's price is at VND4,400/share.

Responding to shareholders, Mr. Le Thong Nhat - Chairman of Danh Khoi, said that this private issuance was planned 12 months in advance and was carefully prepared.

The leader of this real estate company affirmed that he is "very confident" about the issuance and so far the preliminary results of discussions with some partners are about 40% of the issuance plan.

Source: https://tuoitre.vn/doanh-nghiep-muon-mua-du-an-ong-dung-lo-voi-vua-bao-lo-tien-mat-con-vai-tram-trieu-20241105114134123.htm

![[Photo] National Assembly Chairman Tran Thanh Man attends the Party Congress of the Committee for Culture and Social Affairs](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/f5ed02beb9404bca998a08b34ef255a6)

![[Photo] National Assembly Chairman works with leaders of Can Tho city, Hau Giang and Soc Trang provinces](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/c40b0aead4bd43c8ba1f48d2de40720e)

![[Photo] Discover the beautiful scenery of Wulingyuan in Zhangjiajie, China](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/1207318fb0b0467fb0f5ea4869da5517)

Comment (0)