(NLDO)- This enterprise reported a loss after tax of nearly 47 billion VND, while in the same period last year it made a profit of nearly 30 billion VND, a decrease of more than 250%.

Danh Khoi Group Corporation (stock code: NRC) has just announced its consolidated business results for the fourth quarter of 2024, recording revenue of only VND 1.1 billion, down more than 31% compared to the fourth quarter of 2023.

Meanwhile, financial expenses increased by 26%, to VND25 billion, and business management expenses also increased sharply, to more than VND25 billion. After deducting expenses, Danh Khoi reported a loss after tax of nearly VND47 billion, while in the same period last year, it made a profit of nearly VND30 billion, a decrease of more than 250%.

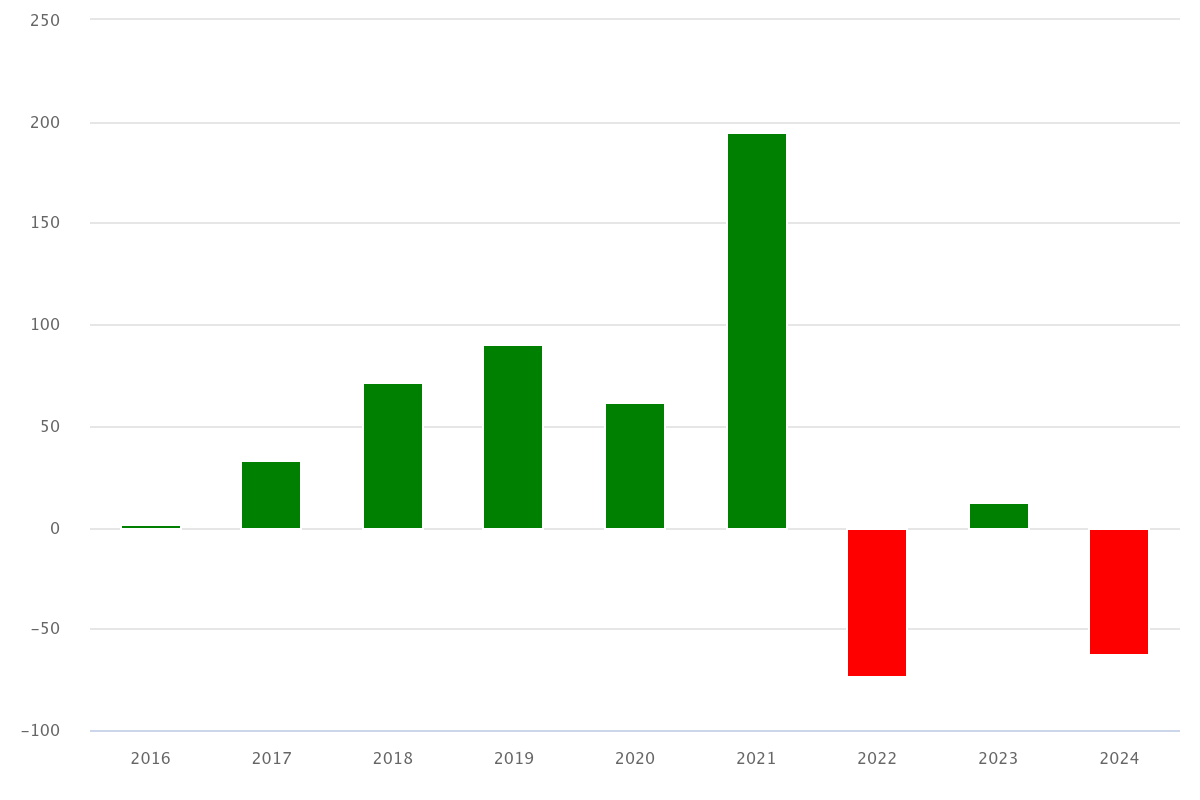

Accumulated in 2024, Danh Khoi recorded net revenue of 4.5 billion VND, a slight increase over the same period, but after-tax profit was negative 63.1 billion VND (same period profit was nearly 12 billion VND) due to the main pressure coming from interest and bad debts.

According to Danh Khoi, the reason for the sharp decrease in after-tax profit compared to the same period last year was because the company's business situation at the end of the year had not improved because the real estate market was still not vibrant, sales did not meet expectations, leading to the company not being eligible to record revenue from investment cooperation contracts.

Danh Khoi's after-tax profit plummeted in 2024

"The company is in the process of restructuring its human resources and continuing to implement cost-saving policies," said Danh Khoi representative.

As of December 31, 2024, Danh Khoi's asset size reached VND 2,006 billion, a slight decrease compared to the beginning of the year. However, the value of the cash and cash equivalents portfolio decreased by nearly half compared to the beginning of the year, from VND 897 million to VND 470 million, mainly due to a sharp decrease in cash.

Previously, at the 2024 Annual General Meeting of Shareholders, Danh Khoi approved a plan to issue 100 million shares for private offering, at a price of VND10,000/share, to raise VND1,000 billion.

In the capital usage plan, the company wants to spend 375 billion to buy back legal land products in planned residential projects with completed infrastructure.

Of which, this enterprise wants to spend 195 billion VND to buy part of the Dai Nam residential area project in Minh Hung commune, Chon Thanh district, Binh Phuoc province, expected to be implemented in the fourth quarter of 2024 and 2025.

This is a project by Tan Khai LLC - a member of Dai Nam Joint Stock Company, chaired by Mr. Huynh Uy Dung (also known as Dung "Lime Kiln").

Dai Nam residential area is nearly 100 hectares wide, deployed since mid-2018, including nearly 2,460 townhouses, villas, 5 kindergartens and land for social housing.

On the stock market, at the close of trading on February 6, NRC shares were priced at VND 4,300/share, up slightly by 2% compared to the previous session, but compared to the beginning of 2025, this stock decreased by 14%.

Source: https://nld.com.vn/doanh-nghiep-muon-mua-du-an-cua-ong-dung-lo-voi-lo-nang-196250206175614339.htm

![[Photo] Prime Minister Pham Minh Chinh chairs a meeting of the Steering Committee for key projects in the transport sector.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/10/0f4a774f29ce4699b015316413a1d09e)

Comment (0)