When you don't need it, you have it, when it's hard, you don't.

On the afternoon of September 15, in Can Tho , the State Bank of Vietnam (SBV) held a conference to promote credit to support businesses in the rice and seafood sectors in the Mekong Delta. Hundreds of delegates, representatives of businesses, cooperatives, associations, seafood, shrimp, pangasius, rice, vegetables and fruits industries in the West attended the event...

Mr. Le Thanh Hao Nhien, Financial Director of Loc Troi Group ( An Giang ), commented that the capital limit for businesses to access is very limited compared to the constantly increasing demand. In particular, the maximum loan term for rice businesses is only 6 months, which is too short. For businesses participating in almost the entire rice production chain like Loc Troi, if including the seed production process and commercial rice, the capital flow takes at least 12 months or more. Loc Troi representative suggested that there should be policies to expand the limit for businesses to cooperate with farmers, creating conditions for businesses to support farmers in the consumption linkage.

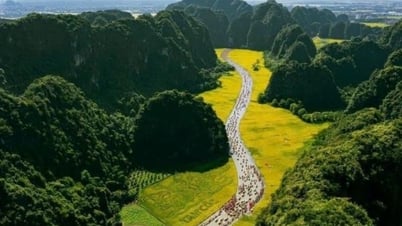

Outstanding debt of the fisheries sector reached nearly 129,000 billion VND, up 8.5% and accounting for nearly 59% of outstanding debt of the fisheries sector nationwide. Photo: DINH TUYEN

According to the conference report, the credit program for the forestry and fishery sector with a scale of about VND 15,000 billion has been instructed by the State Bank of Vietnam to be implemented by commercial banks since July 14. The program is implemented with self-mobilized capital from banks; the lending interest rate in VND is at least 1 - 2% lower per year than the average lending interest rate for the same term (short, medium, long term) of the lending bank itself... The implementation period is until June 30, 2024. To date, 13 commercial banks have registered to participate in the program and have implemented loans with a disbursement turnover of nearly VND 5,500 billion for nearly 2,000 loan customers.

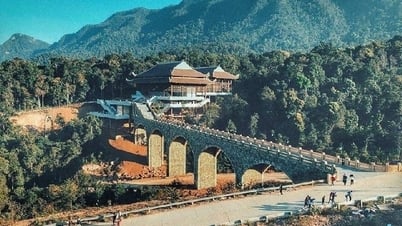

Rice enterprises still complain about difficulties in capital to expand production links with farmers, expand processing and export. Photo: DINH TUYEN

However, according to Mr. Ngo Minh Hien, Nam Can Seafood Company ( Ca Mau ), the implementation of the above credit package is still very hesitant, and businesses are not easily able to access it. The State Bank needs to have a policy to remove the loan limit of commercial banks, which needs to be more flexible. Mr. Hien gave an example: "In Ca Mau, the main extensive shrimp crop is from March to June, businesses buy shrimp seasonally. Many times, money is needed to consume and buy products from farmers, but the bank's management limit is rigid each year, making it very difficult. When money is needed to buy goods, there is none, when it is not needed, there is plenty. While farmers cannot sell to businesses, it often leads to a situation where the price of shrimp in the main crop is "as cheap as sweet potatoes".

Banks must compete with each other.

Deputy Governor of the State Bank of Vietnam Dao Minh Tu said that in order to remove difficulties for businesses, in recent times, the State Bank of Vietnam has had many mechanisms and policies to create more favorable conditions for commercial banks to provide credit products more conveniently, including using technology to reduce lending procedures, such as online lending... Strong growth in credit for rice and seafood in the Mekong Delta is a bright spot for the economy of this region in particular and the country's exports in general, not only having economic significance but also great social significance.

According to Mr. Tu, to solve the difficulties that businesses are facing, in terms of credit, in addition to general policies, it is impossible to lack capital, lack cash, lack services and create favorable conditions for production, purchasing, processing, temporary storage and especially export. Regarding rice, how to create conditions for businesses to make the most of the current favorable conditions for export. Similarly, it is necessary to solve the difficulties of seafood businesses in lacking capital, solving inventory problems, expanding markets, etc.

Many seafood processing enterprises say that the bank's management limit is rigid every year, making it very difficult. Photo: DINH TUYEN

"In fact, commercial banks have also actively lowered interest rates, but there will still be mechanisms forcing banks to compete with each other more on interest rates, thereby creating favorable conditions for businesses to benefit from low interest rate policies from commercial banks. "In particular, the policy allows businesses to borrow from banks with low interest rates to pay banks with outstanding debts and high interest rates. Thereby creating a more vibrant competitive market, more favorable for businesses," said Mr. Tu.

According to the State Bank of Vietnam's report, by the end of August 2023, the total outstanding debt of the Mekong Delta region reached over 1 million billion VND, an increase of 5.35% compared to the end of 2022. Notably, credit for the rice and aquaculture sectors, which are the strengths of the Mekong Delta, has had impressive growth. Outstanding debt of the aquaculture sector reached nearly 129,000 billion VND, an increase of 8.5% and accounted for nearly 59% of the total outstanding debt of the national aquaculture sector (of which, outstanding credit for pangasius increased by 10.5%, for shrimp increased by 8.8%). Outstanding debt of the rice sector reached nearly 103,000 billion VND, an increase of 9% compared to the end of 2022 and accounted for about 53% of the total outstanding debt of the national rice sector./.

According to thanhnien.vn

Source

![[Photo] National Assembly Chairman attends the seminar "Building and operating an international financial center and recommendations for Vietnam"](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/7/28/76393436936e457db31ec84433289f72)

Comment (0)