More than half of all businesses are in trouble.

Realizing the key role of sustainable development, many businesses in sectors such as food, textiles, mechanics, etc. are proactively transforming themselves towards greening. However, to realize these long-term strategies, they face a big problem of investment capital - an indispensable factor for the process of technological innovation, improving production processes and ensuring increasingly strict environmental standards.

Mr. Thomas Jacobs - Country Director of the International Finance Corporation (IFC) in charge of Vietnam, Cambodia and Laos - pointed out: "Vietnam needs about 368 billion USD to achieve the goal of net zero emissions by 2050. However, currently, green credit only accounts for less than 5% of the total outstanding debt of the whole market, while the climate bond market is still in the formation stage and has not really developed clearly."

According to a report by the State Bank of Vietnam, by the end of 2024, the total outstanding green credit balance will reach about VND520,000 billion, equivalent to more than USD20 billion, accounting for only 4.5% of the total outstanding credit balance of the entire system. Of which, the renewable energy sector (wind power, solar power) accounts for the largest proportion (about 47%), followed by waste treatment (14%) and cleaner production (10%).

However, in reality, many businesses – especially small and medium enterprises (SMEs) – still face many obstacles when accessing green credit sources, mainly due to lack of collateral, substandard technical documents, and lack of a complete environmental and social assessment process.

Mr. Dinh Hong Ky - Vice Chairman of the Ho Chi Minh City Business Association (HUBA) - commented: "Currently, the demand for green credit is very large as many businesses want to make the transition to a green production model. However, most of the businesses with the capacity to implement this are large corporations. Meanwhile, according to data from VCCI, about 98% of businesses in Vietnam are small and medium enterprises, but up to 65% of them have difficulty accessing green capital."

Some green credit packages currently being implemented in Vietnam include:

BIDV's green credit package: In cooperation with the Asian Development Bank (ADB), BIDV has launched a financial package worth 100 million USD for renewable energy and energy efficiency projects, with priority given to businesses in the solar, biomass and wind power sectors.

HSBC Vietnam's support package: For businesses with green projects or environmentally friendly process improvements, with a preferential interest rate of 0.5-1% compared to the regular loan package.

AFD (French Development Agency) E-Enhance Program: Cooperating with a number of domestic banks such as TPBank, supporting SMEs to invest in clean technology, energy saving, and sustainable production.

From a practical perspective, at the workshop “Green transformation journey and financial-technological solutions” on April 21, Ms. Nguyen Thi Thu Thao - representative of Gemadept Group - said that in order to access green credit, businesses must clearly define specific KPI indicators that can be measured, verified, and consistent with the green development strategy of the business itself. This is the basis for credit institutions to review and accompany the disbursement process.

Ms. Thao also said that although green credit interest rates and incentives are more attractive than conventional commercial loans, we should not expect interest rates to be too low.

Instead, the greatest value is that the business's reputation is affirmed through the selection of international financial institutions or domestic banks - as a form of "green certification" in the market.

This not only helps businesses enhance their brand, but also attracts investors with the same orientation towards sustainable development.

“In addition to financial benefits, being assessed by a third party (reputable financial institutions), along with the enhanced corporate reputation thanks to the green transition process, are values that cannot be measured in money,” Ms. Thao emphasized.

Banks find it difficult to lower interest rates

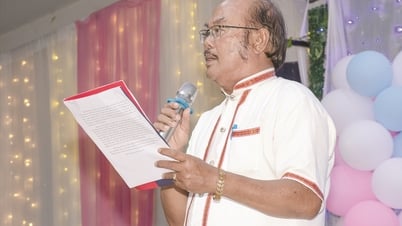

At the National Cooperative Forum 2025 with the theme “Transforming green production for sustainable development” organized by Business Magazine, Dr. Can Van Luc – Chief Economist of BIDV – frankly pointed out that most Vietnamese enterprises are still only in the initial stages of the green transformation process.

One of the biggest barriers to this process is that Vietnam has not yet built a complete legal framework and a synchronous and consistent policy system, especially in key areas of green growth.

The lack of clear regulations on green project classification and certification, specific green criteria and standards has made it difficult for credit institutions to appraise and evaluate projects. As a result, lending activities have become less transparent and potentially risky.

Dr. Can Van Luc also pointed out the challenges of coordination mechanisms and preferential policies for green activities. According to him, the connection between levels and sectors is still fragmented; meanwhile, support tools such as financial incentives, credit, taxes or policies to promote the green transformation ecosystem are not strong enough to create real change momentum.

From the perspective of the banking industry, Mr. Luc affirmed that it is impossible to expect too low lending interest rates for green projects. Because the nature of green transformation is a long-term investment process, input costs are high, while the level of risk is not small, with many businesses failing or not achieving the expected results. Therefore, the reasonable interest rate for green credit needs to be at an average level or higher. According to him, this further shows that the State's coordinating and leading role is extremely necessary.

In an effort to support businesses, BIDV has implemented many green credit programs, including products such as green loans, sustainable development bonds, green trade finance and ESG consulting services.

By the end of 2024, the bank had financed more than 1,600 customers, with nearly 2,000 green projects, with a total outstanding loan balance exceeding VND80,000 billion. In addition to preferential interest rates (usually 1-2% lower than normal), businesses also receive technical support during the process of deploying and implementing green transformation.

However, banks are also having difficulty finding green projects that are eligible for financing. Mr. Pham Hong Hai – General Director of OCB – said that the lack of a specific set of green standards makes the process of measuring the environmental performance of projects complicated.

Meanwhile, international financial institutions require detailed reporting on carbon emissions, energy consumption and many other environmental indicators – something that most domestic enterprises do not have the appropriate management systems to meet.

From this reality, Mr. Hai expressed his hope that the State Bank will soon issue guidelines on the green finance framework in 2025, in order to create a clear legal corridor and support businesses in the transformation process.

Ms. Do Thi Thanh Huyen - Director of BIDV's Wholesale Product Policy Department - commented: "Enterprises that build a clear green transformation strategy with a specific action roadmap will seize more market opportunities and easily attract domestic and foreign investment capital."

Source: https://baodaknong.vn/doanh-nghiep-khat-von-re-cho-lo-trinh-xanh-hoa-250212.html

![[Photo] Prime Minister Pham Minh Chinh receives delegation from the US-China Economic and Security Review Commission of the US Congress](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/7/ff6eff0ccbbd4b1796724cb05110feb0)

![[Photo] General Secretary attends the parade to celebrate the 80th anniversary of the victory over fascism in Kazakhstan](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/7/dff91c3c47f74a2da459e316831988ad)

![[Photo] Sparkling lanterns to celebrate Vesak 2025](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/7/a6c8ff3bef964a2f90c6fab80ae197c3)

Comment (0)