According to the report of the Ministry of Finance , in July 2024, the individual corporate bond market had 56 successful issuances with a volume of about 45,000 billion VND, down 15% compared to June 2024, but up 57% compared to the same period in 2023.

Of which, the group of credit institutions (CIs) issuing VND35,100 billion (accounting for 78% of the issuance volume), real estate enterprises issuing VND5,500 billion (12.1%); enterprises remaining in the fields issued about VND4,400 billion (9.9%).

Real estate businesses issue VND38,700 billion in bonds. (Photo: ST)

Classified by secured bonds: 6,300 billion VND of bonds issued with secured terms (14% of issued volume). Of which, bonds of real estate enterprises with secured terms account for 86.5%; bonds of credit institutions without secured terms.

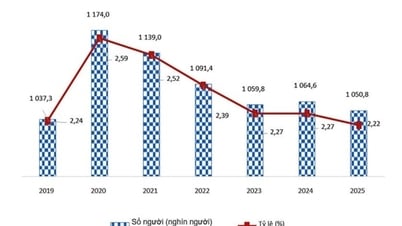

In the first 7 months of 2024, there were 174 successful private corporate bond issuances with a volume of VND 161,500 billion, 2.6 times higher than the same period in 2023.

Of which, credit institutions issued more than VND109,000 billion, accounting for 67.5% of the issuance volume, real estate enterprises issued nearly VND38,700 billion (24%); enterprises remaining in the fields issued VND13,800 billion (8.5%).

By secured bonds, there are 24,000 billion VND of bonds issued with secured clauses (14.9% of issued volume). Of which, bonds of real estate enterprises with secured clauses account for 84.4%; bonds of credit institutions without secured clauses.

The volume of early repurchases was VND 88,800 billion, down 36% compared to the same period in 2023.

Regarding the secondary market situation, information from the Hanoi Stock Exchange shows that in the first 7 months of 2024, the total transaction value reached VND 566,857 billion, the average transaction value per session reached about VND 4,049 billion/session.

Source: https://www.congluan.vn/doanh-nghiep-bat-dong-san-phat-hanh-38700ty-dong-trai-phieu-post306392.html

Comment (0)