Difficulties still surround real estate businesses

As Thanh Nien reported on the report on the "health" of the Vietnamese real estate market published by VARS, it is worth noting that only 30-40% of real estate brokers are working because developers and investors are facing many difficulties and the market is sluggish.

By mid-second quarter, although the Government, ministries and branches had mechanisms to extend and postpone debt payments, the solutions in the past were still not enough to thoroughly resolve the existing problems.

Real estate businesses are still facing difficulties despite support

VARS believes that debt deferral policies such as Decree 08 on bonds, Circular 02 of the State Bank, etc. have only helped businesses cope with difficulties; instead of "freezing", they prolong the state of being in a state of limbo.

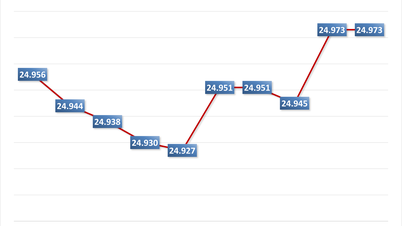

VARS's report stated that interest rates will remain high from the end of 2022, decrease slightly in early 2023 but remain at a high level for businesses to endure. Interest rate pressure will further weaken the "health" of real estate businesses.

At the same time, businesses themselves lack capital for production, investment and business. Meanwhile, revenue has decreased while businesses still have to shoulder many expenses. Credit mobilization remains difficult, most banks still tighten lending conditions, so most businesses, especially those with old debts, fall into the group of subjects for extension and deferment. Credit to real estate is still strictly controlled, capital mobilization channels through bonds are also tightly controlled.

Businesses need "special medicine"

In further discussion, Mr. Nguyen Van Dinh said, "Businesses now need specific medicine to treat diseases, which is a project that is approved early, and real money to restore production, investment, and business activities, not just transferring bad debts from one time to another. In the past, businesses were not given "medicine" but only given some "functional foods", so the nature of the disease could not be cured but only prolonged," Mr. Dinh likened.

Mr. Nguyen Van Dinh, Chairman of VARS, is concerned that if a way out is not found soon, investors, developers, and real estate brokers will have to leave the market.

According to the Chairman of VARS, the prolonged difficult situation not only affects the participants in the real estate market but also leads to stagnation in a series of other related industries. If there is no timely solution soon, the market will likely witness the departure of investors, investment enterprises, real estate brokers, etc.

Regarding the solution, Mr. Dinh said that it is necessary to review and classify each enterprise to have its own "specific medicine". Specifically, in the case of enterprises that are still strong and have signs of survival, it is necessary to urgently pilot approval, directly resolve problems, bring enterprises out of danger, continue production, business, and bring goods to the market. This plan needs to pay attention to large enterprises that have influence on the market.

In case of weak enterprises that have no capacity to implement the project but have completed the project legal procedures, it is necessary to organize investment promotion, with the aim of connecting with other investors to form joint ventures or mergers and acquisitions.

In cases where enterprises have projects with many problems but no longer have the capacity to implement the projects, the State needs to have support measures, buy back the projects and then auction them to select new investors after completing legal procedures.

"In parallel with classifying and handling the above cases, it is necessary to continue to have solutions to thoroughly remove common difficulties and obstacles of the market with practical, specific decrees and policies that meet the needs of the market, and continue to extend tax payment deadlines...", Mr. Dinh said.

On the business side, Mr. Dinh recommends that in difficult times, it is necessary to restructure and streamline the apparatus while still maintaining business capabilities, cutting costs, developing new sources of goods, new customers, and finding new sources of investment capital through joint ventures, mergers and acquisitions, etc.

Source link

Comment (0)