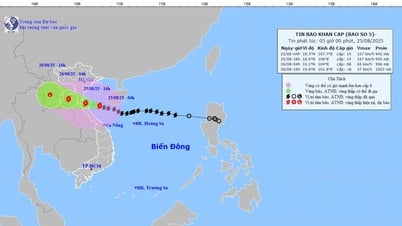

The General Department of Taxation has just sent a dispatch to 26 localities with specific instructions on solutions to support organizations, individuals, and businesses suffering losses due to storm No. 3 and post-storm floods.

The document was sent to 26 tax departments of provinces and cities including: Quang Ninh, Hai Phong, Thai Binh, Nam Dinh, Hoa Binh, Lao Cai, Yen Bai , Son La, Lai Chau, Dien Bien, Ha Giang, Cao Bang, Bac Kan, Thai Nguyen, Tuyen Quang, Phu Tho, Vinh Phuc, Lang Son, Bac Giang, Bac Ninh, Hai Duong, Hanoi, Hung Yen, Ha Nam, Ninh Binh, Thanh Hoa.

Things to do for households and individual businesses

If facing difficulties due to natural disasters, business households and individuals will receive reductions in personal income tax (PIT), special consumption tax (SCT), and resource tax.

The personal income tax rate is reduced corresponding to the level of damage but not exceeding the amount of tax payable.

The amount of special consumption tax reduction is determined based on actual losses caused by natural disasters, but not exceeding 30% of the tax payable in the year of damage and not exceeding the value of damaged assets after compensation (if any).

The resource tax rate is reduced corresponding to the amount of lost resources; in case tax has been paid, the tax paid will be refunded or deducted from the resource tax payable in the following period.

Households and individuals engaged in production and business activities are granted an extension to pay value-added tax (VAT) and personal income tax until December 30, 2024 at the latest.

Business households and individuals only need to submit an extension request, no later than September 30, 2024, to receive a tax payment extension.

The tax authority shall not charge late payment fees for the tax and land rent amounts that are extended during the extended payment period.

In case the tax authority has calculated late payment fees (if any) for tax records that are eligible for extension, the tax authority shall make adjustments and not calculate late payment fees.

Business households that suffer material damage due to natural disasters that directly affect production and business are granted an extension to pay taxes for no more than 2 years from the tax payment deadline. Taxpayers are not subject to penalties and do not have to pay late payment fees calculated on the tax debt during the tax payment extension period.

The amount of tax that is subject to an extended tax payment deadline is the amount of tax owed up to the time the taxpayer encounters a natural disaster, but does not exceed the value of material damage after deducting compensation and insurance amounts as prescribed (if any).

What businesses need to do

There are 3 business expenses that are deductible when determining taxable income for corporate income tax (CIT).

One is the value of loss caused by natural disasters that is not compensated (determined by the total value of loss minus the value that the insurance company or other organization or individual must compensate according to the provisions of law).

Documents for assets and goods lost due to natural disasters that are included in deductible expenses include: Minutes of inventory of the value of assets and goods lost by the enterprise (must clearly identify the value of assets and goods lost, the cause of loss, the responsibility of organizations and individuals for the losses; types, quantities, and values of assets and goods that can be recovered (if any); inventory list of lost goods with confirmation signed and responsible by the legal representative of the enterprise; damage compensation records accepted for compensation by the insurance agency (if any); records specifying the responsibility of organizations and individuals that must pay compensation (if any).

Second is funding for education , health, scientific research, and disaster relief.

Documents determining the funding for overcoming the consequences of natural disasters, including: Minutes confirming the funding with the signature of the representative of the sponsoring enterprise, the representative of the organization damaged by natural disasters (or the agency or organization with the function of mobilizing funding) as the funding recipient (according to form No. 05/TNDN issued with Circular No. 78/2014/TT-BTC); invoices, documents for purchasing goods (if funding in kind) or documents for payment (if funding in cash).

Third, welfare expenses paid directly to employees , such as expenses to support employees' families affected by natural disasters. The total amount of welfare expenses must not exceed 1 month of the average actual salary paid in the tax year of the enterprise.

The determination of 1 month's average actual salary in the tax year of an enterprise is determined by dividing the actual salary fund in the year by 12 months. In case the enterprise operates for less than 12 months, the determination of 1 month's average actual salary in the tax year is determined by dividing the actual salary fund in the year by the actual number of months of operation in the year.

The implemented salary fund is the total actual salary paid in the settlement year up to the deadline for submitting the settlement dossier as prescribed (not including the amount of salary reserve fund deductions of the previous year spent in the tax settlement year).

Tax payment extension is considered based on the request of taxpayers who suffered material damage due to natural disasters, directly affecting production and business. The head of the tax authority directly managing the tax payment extension shall decide on the amount of tax to be extended and the tax payment extension period based on the tax payment extension dossier. Taxpayers must prepare and submit tax payment extension dossiers to the tax authority directly in charge. Tax payment extension dossiers include: A written request for tax payment extension, stating the reason, tax amount, and payment deadline; Documents proving the reason for tax payment extension. Tax authorities receive tax payment extension applications from taxpayers in the following forms: Receive directly at the tax authorities; Receive by post; Receive electronic applications via the tax authorities' electronic transaction portal. In case the dossier is legal, complete, and in accordance with the prescribed form, the tax authority shall notify the taxpayer in writing of the tax payment extension within 10 working days from the date of receipt of the complete dossier; in case the dossier is incomplete according to the regulations, the taxpayer shall be notified in writing within 3 working days from the date of receipt of the dossier. |

Source: https://vietnamnet.vn/dn-muon-mien-giam-gia-han-thue-sau-bao-lu-viec-gi-can-lam-ngay-2322876.html

![[Photo] Closing ceremony of the 18th Congress of Hanoi Party Committee](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/17/1760704850107_ndo_br_1-jpg.webp)

![[Photo] Nhan Dan Newspaper launches “Fatherland in the Heart: The Concert Film”](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/16/1760622132545_thiet-ke-chua-co-ten-36-png.webp)

Comment (0)