(NLDO) – There have been unexpected developments in the corporate bond market, in a positive direction.

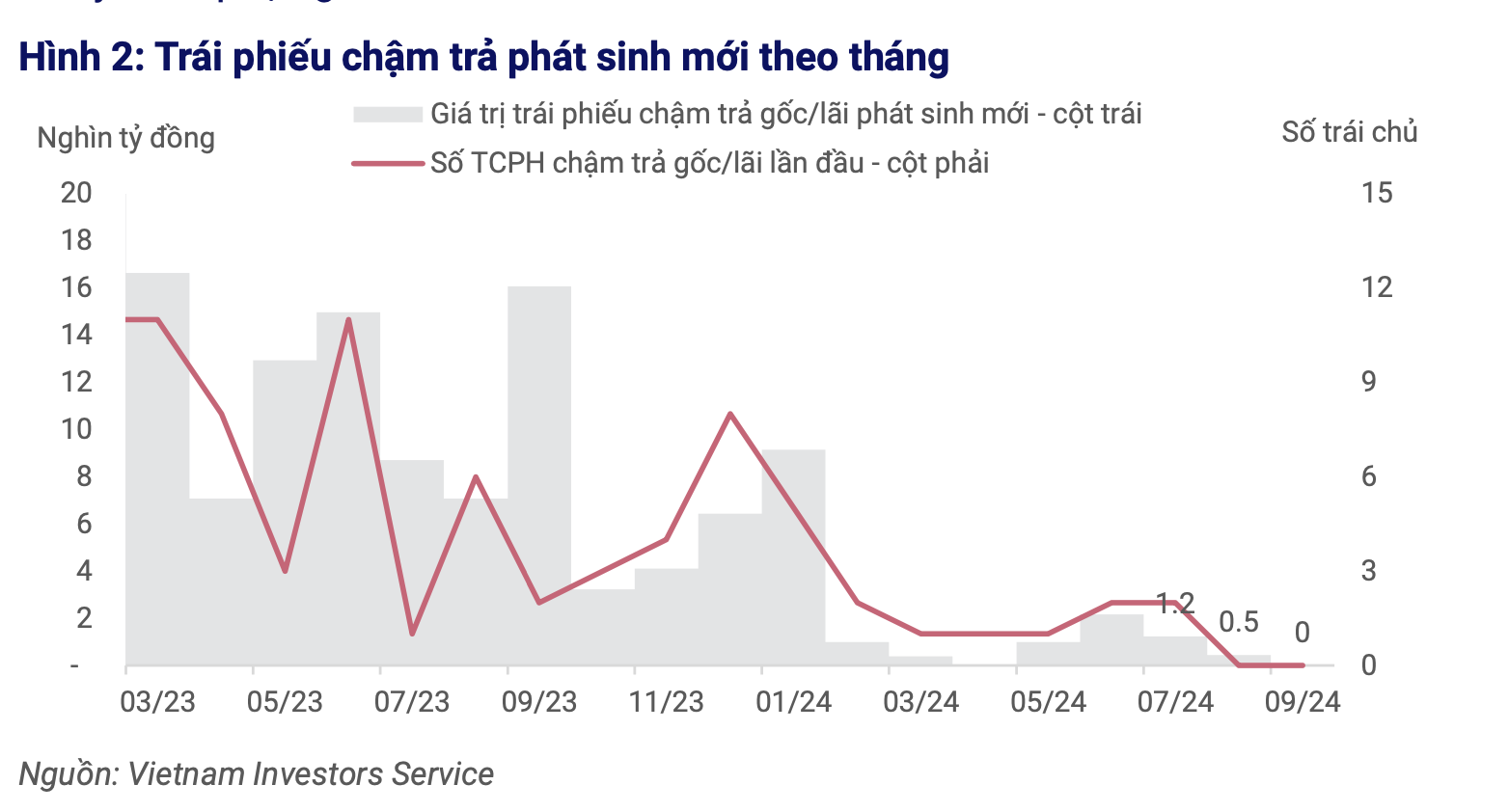

VIS Rating's recently released corporate bond market update report shows that September 2024 is the first month since October 2021 without any new cases of late payment.

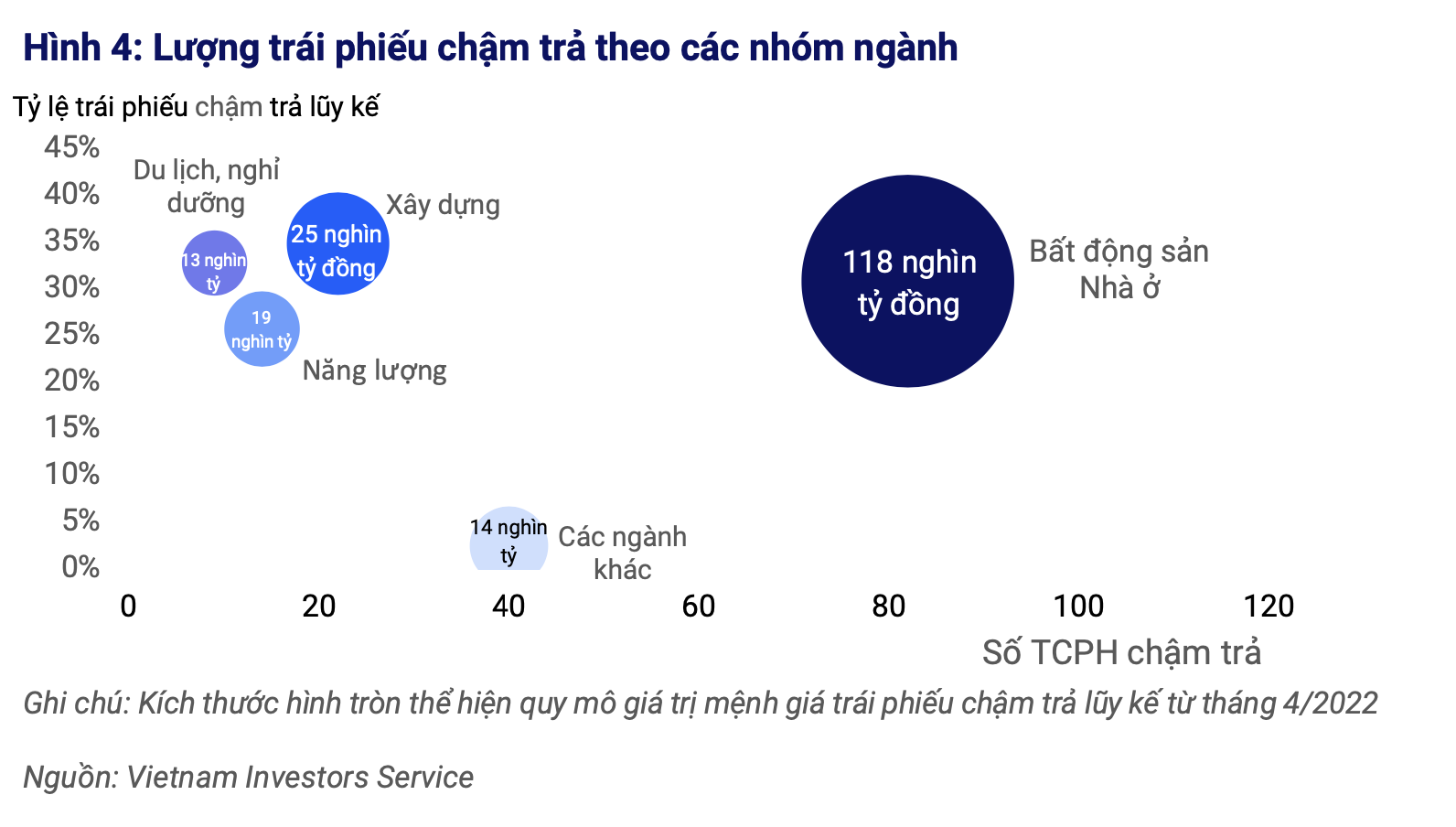

The cumulative rate of overdue bonds continues to decrease from the first quarter of 2024. As of September 30, the rate of overdue bonds is at 14.8% of the total value of outstanding corporate bonds.

New corporate bonds issued in September 2024 reached VND55,900 billion, bringing the total value since the beginning of the year to VND334,000 billion. The banking sector accounted for 72% of the total newly issued bonds.

Monthly delinquency rate of bonds decreased sharply

Another noteworthy information is that in September 2024, the outstanding principal debt of about VND 781 billion was paid to bondholders, raising the rate of late payment recovery to 21.2% thanks to improvements in the residential real estate and construction sectors.

This development is also consistent with the assessment of some experts about the recovery momentum of the real estate market.

According to Dr. Can Van Luc and the group of authors from BIDV Training and Research Institute, the corporate bond market and the real estate market are gradually recovering - although slower than expected. Partly thanks to the push from new laws taking effect such as the Land Law, Housing Law, and Real Estate Business Law, which took effect from August 1.

Regarding the banking industry, analysts from MB Securities Company (MBS) stated that banking is the industry group with the highest issuance value at about VND245,400 billion, up 188% over the same period. The average bond interest rate is about 5.6%/year, the average term is 5.3 years.

Residential real estate is still the sector with a high proportion of overdue corporate bonds.

Among them, the names leading in bond issuance volume since the beginning of the year include ACB with VND29,800 billion, Techcombank with VND26,700 billion, and OCB with VND24,700 billion. According to MBS, banks will continue to promote bond issuance to supplement capital to meet lending needs.

From the beginning of the year to the end of the third quarter, credit growth was about 9%, higher than the 6.24% in the same period last year. Credit is forecast to accelerate in the last months of the year following the strong recovery of production, exports and services.

Source: https://nld.com.vn/dien-bien-bat-ngo-tren-thi-truong-trai-phieu-doanh-nghiep-196241020153501369.htm

![[Photo] Panorama of the Opening Ceremony of the 43rd Nhan Dan Newspaper National Table Tennis Championship](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/19/5e22950340b941309280448198bcf1d9)

![[Photo] President Luong Cuong presents the 40-year Party membership badge to Chief of the Office of the President Le Khanh Hai](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/19/a22bc55dd7bf4a2ab7e3958d32282c15)

![[Photo] Close-up of Tang Long Bridge, Thu Duc City after repairing rutting](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/19/086736d9d11f43198f5bd8d78df9bd41)

![[Photo] General Secretary To Lam attends the conference to review 10 years of implementing Directive No. 05 of the Politburo and evaluate the results of implementing Regulation No. 09 of the Central Public Security Party Committee.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/19/2f44458c655a4403acd7929dbbfa5039)

![[Photo] Prime Minister Pham Minh Chinh inspects the progress of the National Exhibition and Fair Center project](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/19/35189ac8807140d897ad2b7d2583fbae)

![[VIDEO] - Enhancing the value of Quang Nam OCOP products through trade connections](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/5/17/5be5b5fff1f14914986fad159097a677)

Comment (0)