On April 22, Saigon - Hanoi Bank (SHB) successfully organized the 2025 Annual General Meeting of Shareholders (AGM) at Melia Hotel, Hanoi with the participation of thousands of shareholders and authorized representatives. In the process of strong and comprehensive transformation, SHB is constantly developing, enhancing its position, aiming to successfully implement strategic goals and business plans, thereby always ensuring the highest benefits and meeting the expectations of shareholders and investors.

Shareholders delighted with impressive business results

SHB's General Meeting of Shareholders always attracts great attention from shareholders and investors. SHB is currently among the banks with the largest number of shareholders in the market with more than 100,000 shareholders.

At this year’s congress, SHB shareholders expressed their joy and excitement when witnessing the bank’s continuous breakthroughs, achieving impressive achievements in all aspects: effective business, positive contributions to culture – sports and social security activities. These results continue to affirm SHB’s position, prestige and sustainable development throughout its 32-year journey with the country.

Speaking at the meeting, shareholder N.D.T emotionally shared: “I feel that investing in SHB is completely worth it. I have attended many meetings, but SHB is the happiest, because the Chairman and the Board of Directors always truly listen to shareholders. I would also like to congratulate SHB on completing and exceeding its targets, completing the payment of cash and stock dividends - a clear demonstration of its operational efficiency and concern for shareholders.”

This shareholder expressed strong confidence in SHB's long-term development potential and wished that the Board of Directors would always be steadfast and healthy to continue steering SHB further, bringing sustainable value to shareholders: "I hope that in the future I can pass on SHB shares to my children as a valuable asset."

In addition to business results, shareholders were also moved to mention the special milestones when SHB was the bank accompanying the Vietnamese football team at the ASEAN Cup 2024, organizing flights to bring fans and players' relatives to Thailand to cheer for the team - a humane and inspiring act, spreading the love of football and strong national spirit. Shareholders hope that SHB will continue to bring such meaningful journeys, so that shareholders will not only stick with it for profit, but also for pride.

In 2024, SHB has exceeded all targets according to the plan approved by the General Meeting of Shareholders. Specifically, SHB recorded pre-tax profit of VND 11,569 billion, up 25.2% over the previous year. Total assets reached VND 747,478 billion, up 18.6%; outstanding credit reached VND 533,984 billion; The ratio of operating expenses/total operating income (CIR) was 24.4% - the lowest group in the industry thanks to promoting digitalization of processes and application of technology to operations, services and products across the system.

The Bank always implements strict risk management policies. Capital adequacy ratios and risk management always comply better than the regulations of the State Bank. Capital adequacy ratio (CAR) is above 12% according to Basel II standards, liquidity risk ratio meets Basel III standards. Bad debt ratio is controlled at 2.4%, completing the bad debt control target according to the plan of the General Meeting of Shareholders.

SHB has completed paying 2023 dividends in cash at a rate of 5% and in shares at a rate of 11%, thereby increasing its charter capital to VND 40,658 billion, continuing to affirm its position as one of the Top 5 largest private banks in the system. The increase in charter capital is important to improve the bank's financial capacity, increase SHB's competitiveness in the process of international economic integration and especially meet the expected benefits of shareholders.

Throughout its development journey, SHB has always focused on and continuously increased the benefits of shareholders and investors. SHB's annual dividend payout ratio has reached 10-18% over the past many years. The bank is also one of the three credit institutions that listed shares the earliest on the Vietnamese stock market and is currently in the VN30 group - the group of stocks with the largest market capitalization.

2024 also marks a strong growth in the bank's international cooperation. SHB continues to complete capital transfer steps at SHBFinance, SHB Laos and Cambodia, while expanding cooperation with the world's leading prestigious organizations such as ADB, IFC, KfW, WB and Busan Bank (Korea)...

SHB continues to maintain and expand its relationships with many international financial organizations and institutions with a network of more than 600 correspondent banks worldwide, helping to affirm its position and enhance the bank's reputation. In particular, SHB has mobilized 3-year term capital from international financial institutions to finance green projects according to the provisions of SHB's green financing framework.

In addition to business development, SHB always focuses on actively participating in social security activities, especially programs to support people in difficult circumstances. Recently, accompanying the Ministry of Public Security, SHB and T&T Group joined hands to support the construction of 700 houses for poor and near-poor households in Bac Lieu province with a total amount of 42 billion VND. Previously, in 2024, SHB and T&T Group accompanied the Ministry of Public Security and local police to implement a program to build 150 houses and 1 school for people and children of ethnic minorities in mountainous areas of the northern provinces affected by storms, floods and natural disasters.

With the philosophy of "Business development associated with social responsibility"; at the same time, implementing the spirit of Chairman of the Board of Directors Do Quang Hien: "Contributing to society is part of the duty and honor of the enterprise", over the years, SHB has continuously spread profound human values, promoting the fine traditions of the nation. Through the Central Committee of the Vietnam Fatherland Front and the Fatherland Fronts of provinces and cities, SHB and the enterprises of businessman Do Quang Hien have donated thousands of billions of VND to support the poor and disadvantaged in society; support localities to overcome the consequences of natural disasters, storms and floods; Covid epidemic; build solidarity houses, eliminate temporary houses, dilapidated houses in many mountainous and border provinces, ... Typical is the program of donating 1,000 gratitude houses to the poor and meritorious people of Ha Giang province with a total cost of 60 billion VND; supporting 25 billion VND to eliminate temporary houses, build solidarity houses for poor households in Dien Bien province, ...

For many years, SHB has been in the TOP 5 banks with the largest budget contributions in Vietnam. The bank has also implemented financial support packages, interest rate reductions with a total amount of up to thousands of billions of VND (interest rate support loan program; housing support loan package for low-income people); at the same time, it supports customers in building business plans and providing comprehensive financial products and services on a modern technology platform, helping customers manage their finances effectively. SHB also actively connects businesses with reputable organizations, provides market information and support policies from the State, helping businesses stabilize and develop.

Recently, SHB cooperated with T&T Group to organize the 2025 Cultural Festival, creating a brilliant mark on the market. The event was organized to show gratitude, strengthen solidarity, increase love and pride in the organization of employees, and add motivation to prepare for a breakthrough phase together; while conveying the message about the mindset, aspirations and vision of T&T and SHB, ready to enter a new era - the era of national growth. In particular, the Cultural Festival is also a journey to honor traditional values, combined with the spirit of creativity and innovation towards a sustainable future of the organization and the country.

Target profit growth of 25%, continuously increasing shareholder benefits

Following the success of 2024, SHB sets a business plan for 2025 with total assets exceeding VND 832 trillion, charter capital reaching VND 45,942 billion, continuing to maintain its position in the TOP 5 largest private banks in Vietnam. Pre-tax profit reaches VND 14,500 billion, up 25% compared to 2024. Total outstanding credit growth is 16%. The bad debt ratio is tightly controlled below 2%.

As of March 31, SHB's total consolidated assets reached VND 790,742 billion, up 6% compared to the end of 2024, outstanding credit balance reached VND 575,777 billion, up 7%, focusing on investing in key production and business sectors and industries with growth potential associated with the sustainable development orientation of the economy, creating a foundation for stable and effective growth in the long term. Credit quality continues to be controlled within a safe threshold thanks to proactive, drastic and effective risk management and debt settlement solutions.

At the end of the first quarter of 2025, SHB's pre-tax profit reached nearly VND 4,400 billion, achieving 30% of the 2025 plan. This growth step shows SHB's solid internal capacity and a favorable foundation for breakthrough growth targets in 2025.

Notably, this year, the bank plans to pay dividends to shareholders at a higher rate than last year. The dividend payout ratio in 2024 is 18%, including 13% in shares and 5% in cash.

The bank continues to strengthen its risk management capacity and monitor compliance with modern, effective international standards. In addition, the bank identifies the prevention of corruption, waste and negativity as one of its core, regular, continuous and long-term tasks, demonstrating its commitment to maintaining a transparent, fair and effective working environment. The bank invests in building a data platform and smart analysis tools, helping to forecast risks in real time and support quick, accurate decision-making, adapting to market fluctuations. At the same time, SHB implements modern risk management standards such as Basel III, advanced capital calculation method (IRB), asset-liability management system (ALM), internal valuation (FTP) and international accounting standards IFRS 9.

The Bank continuously improves its management and administration capacity, focusing on perfecting a streamlined, strong, efficient, effective and efficient organizational structure associated with decentralization, delegation of authority, and promoting initiative at all levels.

Recently, Fitch Ratings announced the results of the first international credit rating for Saigon – Hanoi Commercial Joint Stock Bank (SHB). Accordingly, SHB was rated by Fitch with a long-term issuer default rating in local and foreign currencies (Long-Term Issuer Default Ratings – IDRs) at “BB–”, with a stable rating outlook, among the top groups in the banking industry.

Fitch is one of the three leading credit rating organizations in the world. Being rated at BB - affirms SHB's reputation and financial capacity in the international market, and reflects its solid financial foundation and stable profitability.

Take corporate culture as the core, technology as the driving force for breakthrough

In line with the Government's orientation in developing science, technology, innovation and digital transformation to bring the country to strong development in the new era, the Bank continues to invest in advanced technology solutions to optimize processes, bring superior experiences to customers and create modern, convenient and safe digital banking services.

At the same time, SHB promotes cooperation with leading international technology corporations and financial institutions, helping to enhance competitiveness in the present, creating development opportunities in the future, applying scientific solutions and digital transformation to make breakthroughs.

Recently, SHB signed a cooperation agreement with SAP Fioneer and Amazon Web Service (AWS), marking a special milestone in the strong and comprehensive implementation of the Transformation Strategy 2024-2028, which is the basis for realizing the Bank of Future (BOF) initiative. This initiative will comprehensively change SHB's competitiveness and customer service capacity and bring important results in 2025 and 2026 including: advanced digital services, digitizing customer journey, improving customer experience, increasing automation, increasing efficiency based on data technology, modernizing core banking, etc.

Bank of Future will be a model that fully integrates modern, leading technology platforms such as AI, Big Data, Machine Learning... into all processes, solutions, services, and products. SHB is the first bank in the ASEAN region to cooperate with SAP Fioneer to deploy Core Banking on the AWS cloud platform, once again affirming its pioneering steps, reaching regional and international levels.

In 2025, SHB's transformation focus is to provide added value to customers and improve sales efficiency through key solutions such as: deploying tools to improve sales processes and sales management, loan management in retail banking and corporate banking; transforming digital channels to bring a smoother and more intuitive online customer experience with world-class security.

The 2026–2027 period is a period of accelerated growth, integrating the financial – digital – customer ecosystem. SHB aims to become a bank with total assets of 1 million billion VND by 2026, marking an important step forward in its position in the domestic and regional financial markets.

By 2028, the Bank aims to make an effective breakthrough and develop sustainably. SHB aims to become the TOP 1 Bank in terms of efficiency, the most favorite digital bank, the best retail bank and the TOP Bank in providing capital, financial products and services to strategic private and state enterprises, with a supply chain, value chain, ecosystem, and green development. Vision to 2035, SHB will become a modern retail bank, a green bank, a digital bank in the TOP of the region.

At the same time, with a strong and comprehensive transformation based on 4 pillars: Reforming mechanisms, policies, regulations, and processes; People as the subject; Taking customers and markets as the center; Modernizing information technology and digital transformation, SHB continues to adhere to the 6 core cultural values of "Heart - Trust - Faith - Knowledge - Intelligence - Vision".

SHB's General Meeting of Shareholders also approved many important contents such as listing SHB bonds issued to the public and strengthening the Board of Directors to ensure resources to implement the strategy. The meeting unanimously elected Mr. Phan Dang Tuat as an independent member of the Board of Directors for the 2022-2027 term.

The 33rd General Meeting of Shareholders of SHB Bank took place successfully. Shareholders attending the meeting unanimously approved all contents with an almost absolute approval rate. Representative of SHB, Chairman of the Board of Directors Do Quang Hien pledged: Inheriting the 32-year tradition and strong financial foundation, the Board of Directors, Executive Board and all SHB staff will continue to promote corporate culture, solidarity, confidence, self-reliance, national pride, continuously learn, innovate in thinking, working methods, creativity, efficiency, determination to successfully implement the strategic goals and business plans approved by the General Meeting of Shareholders.

At the same time, SHB continues to proactively connect social resources, arouse the national spirit, all together with Unity - Brightness - Reaching Out, bringing prosperity to customers, partners, investors, shareholders, and the community; contributing to the strong development of the country, accompanying the country into a new era - the era of national growth!.

Source: https://baodaknong.vn/dhdcd-shb-but-pha-vuon-tam-trong-ky-nguyen-moi-ke-hoach-loi-nhuan-tang-25-co-dong-tin-tuong-dong-hanh-250301.html

![[Photo] People choose places to watch the parade from noon on April 29](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/29/3f7525d7a7154d839ff9154db2ecbb1b)

![[Photo] National Assembly Chairman Tran Thanh Man receives Vice Chairman of the Belarusian House of Representatives](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/29/fe0423b91f194dfaa208ccdba083f57c)

![[Photo] Students enthusiastically participate in the contest for the title of Champion and write beautifully](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/29/c4a774bd8a874b37bd782ad2b9fa0613)

![[Photo] Hanoi's gateway is crowded with people leaving the capital to return to their hometowns for the holidays](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/29/2dd3f569577d4491acc391239221adf9)

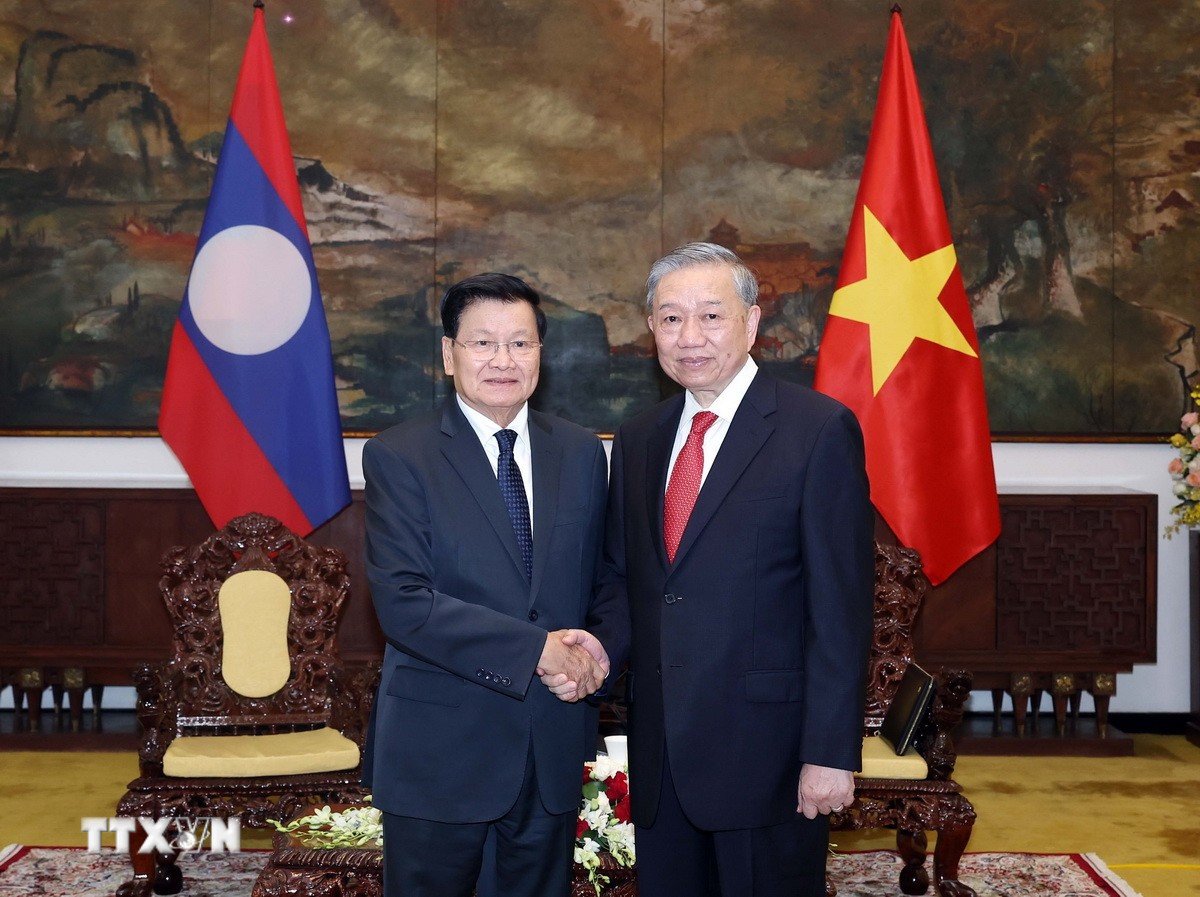

![[Photo] General Secretary To Lam receives General Secretary and President of Laos Thongloun Sisoulith](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/29/d64b36db7cbf4607870ba7d6ed6a5812)

Comment (0)