On the morning of April 22, 2025, in Ho Chi Minh City, Orient Commercial Joint Stock Bank (OCB - Stock code: OCB) held the 2025 Annual General Meeting of Shareholders (AGM) to report on 2024 business results, 2025 business plan orientation and some other important contents.

Core business growth is good

Speaking at the opening of the Congress, Mr. Trinh Van Tuan - Chairman of the Board of Directors of OCB said that in 2024, the world situation continues to be complicated and unpredictable with many risky and uncertain factors. However, the world economy is gradually stabilizing as global trade improves again, inflationary pressures are less tense, and financial conditions continue to be loosened.

|

| Mr. Trinh Van Tuan - Chairman of OCB Board of Directors speaking at the General Meeting of Shareholders |

In that context, OCB quickly made strong changes towards sustainable development. The bank has implemented a series of preferential credit programs with a total limit of more than VND 65,000 billion, helping 15,000 corporate and individual customers to support groups of individual customers and small and medium enterprises (SMEs) to access capital at reasonable costs and competitive interest rates.

In addition, the bank also implemented a strong digital transformation to help shorten transaction times for customers. These activities have helped OCB maintain a credit growth rate of nearly 20% in market 1, higher than the industry average (15.08%), in which outstanding credit of individual customers increased by 11.4%, SME increased by 51.7% compared to the beginning of the year. Thanks to that, OCB's total assets improved significantly, reaching VND 280,712 billion, up 17% compared to 2023.

Market 1 mobilization reached VND 192,413 billion, up 14.5% compared to 2023, completing 98% of the plan for scale in 2024. Of which, deposit growth from residential customers and economic organizations reached 13.1%, higher than the average of <10% of the whole industry. Deposits from individual customers continued to grow steadily at a rate of approximately 16%, contributing 65% of the total customer deposit scale. In 2024, although the market showed signs of increasing interest rates, OCB continued to maintain low mobilization interest rates to support credit. Since then, lending interest rates have also been significantly reduced, contributing to promoting sustainable growth of credit products in line with the Government's orientation.

In particular, OCB has been effectively implementing capital mobilization activities in the "green revolution", demonstrating its pioneering role as one of the leading banks in sustainable development strategy. As of December 31, 2024, green credit at OCB increased by 30% compared to 2023, which is considered a high credit growth rate compared to banks in the whole system.

OCB's total net revenue reached VND 10,069 billion, up 12.7% year-on-year thanks to the core business's continuous strong growth, especially net interest income reaching VND 8,607 billion, up 27.2% compared to 2023, thanks to credit growth of nearly 20% and NIM improving to 3.5% by the end of 2024.

Notably, with flexibility in operations, restructuring the business portfolio towards diversifying revenue sources, improving asset quality, promoting the effectiveness of debt management, debt collection and settlement... in the fourth quarter of 2024, the bank's business situation has had positive changes when pre-tax profit increased by 230% compared to the previous quarter. As a result, OCB's pre-tax profit in 2024 reached VND 4,006 billion.

Strictly adhering to the limits and safety ratios in banking operations, OCB has maintained safe and effective operations and well controlled risks throughout 2024. In addition, OCB also conducted an internal assessment of liquidity adequacy (ILAAP) combined with liquidity stress testing according to scenarios. Thereby, it affirmed that there are enough highly liquid assets to fulfill financial obligations to customers and partners in possible situations.

|

| List of elected members of the Board of Directors for the 2025 - 2030 term |

2025 profit plan to grow 33%

In 2025, OCB targets total assets of VND 316,779 billion, up 13%, total mobilization of market 1 of VND 218,842 billion, up 14%. In particular, with a solid foundation from 2024, through a strong structural shift to customers with good growth potential, OCB expects total outstanding loans of market 1 to increase by 16%, reaching VND 208,472 billion. Pre-tax profit increases by 33% compared to 2024, reaching VND 5,338 billion.

With the set strategic goals, in 2025, OCB has built an operational orientation towards governance and operational optimization, specifically: Striving to bring OCB into the Top 5 leading private commercial banks in Vietnam in terms of ESG efficiency, ensuring sustainable development; Optimizing governance and operational models in a modern direction, restructuring the organizational model; Building a clear customer segmentation strategy, orienting products and services according to the needs of each segment; Strengthening the risk management and compliance platform, ensuring sustainable growth; Promoting digital transformation and applying technology to operations; Building a high-quality human resource team, creating sustainable competitive advantages.

In particular, complete and promote comprehensive ESG implementation in banking operations, aiming to bring the proportion of green credit outstanding to total outstanding TT1 debt in 2025 to over 11%.

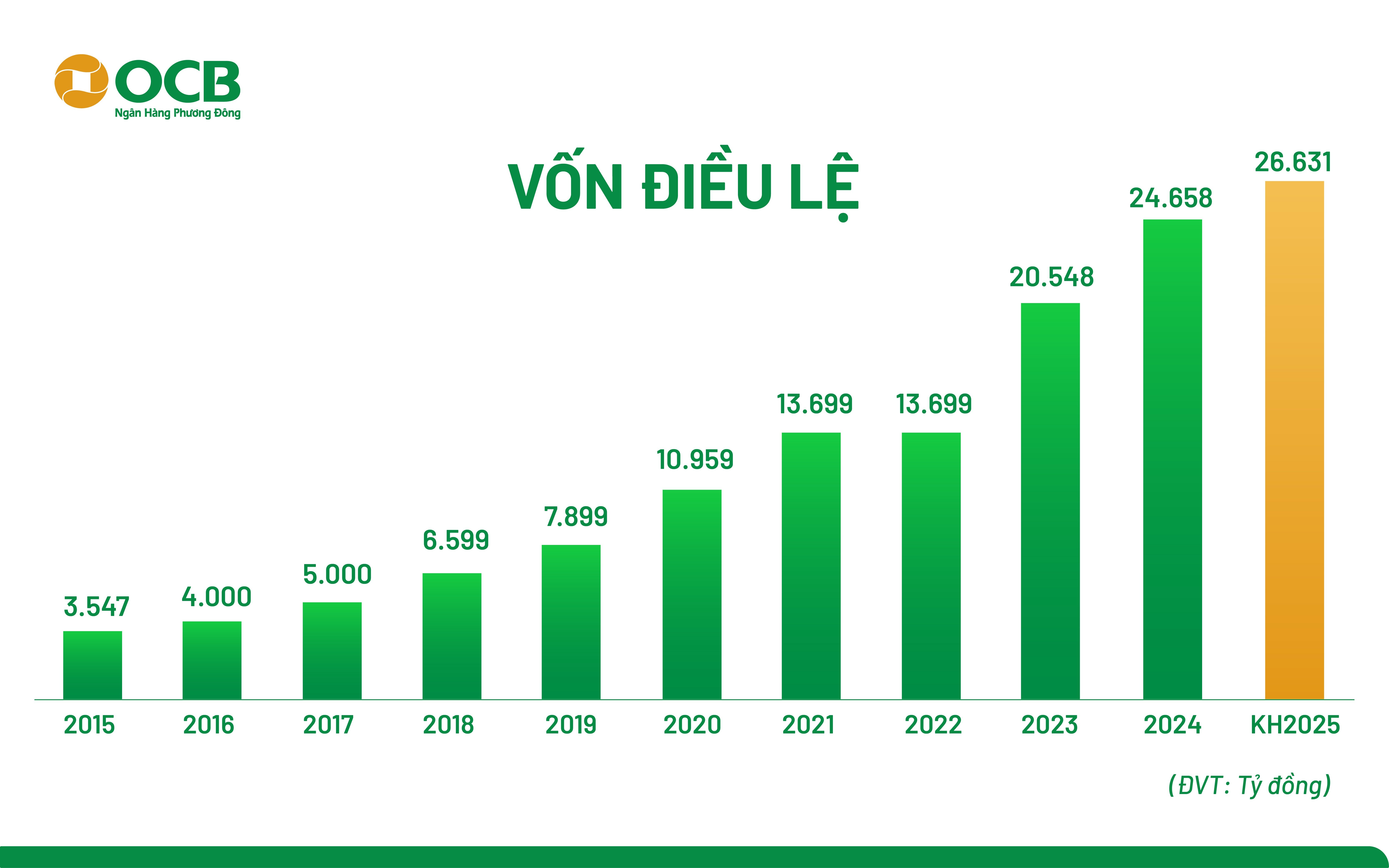

Cash dividend payment, increase charter capital to VND 26,631 billion

In 2025, the total expected benefit to shareholders is 15% through the cash dividend policy at a rate of 7% of charter capital, equivalent to VND 1,726 billion and continuing to increase charter capital to VND 26,631 billion by issuing shares to increase capital from equity at a rate of 8%.

This is the first year OCB has paid cash dividends since its listing on the stock exchange. Previously, the bank mainly paid dividends in shares or issued shares to increase its equity capital.

The bank will use the proceeds from the capital increase to supplement its business capital, invest, lend, and purchase and build facilities. In fact, with the plan to continuously increase business scale every year, increasing charter capital is necessary to help the bank improve its financial capacity, increase room for credit expansion, and strengthen the capital adequacy ratio (CAR).

The timing of capital increases will be decided by the Board of Directors after receiving approval from the competent authorities. It is expected that after the capital increase, Aozora Bank, Ltd. will remain the sole major shareholder of OCB with a 15% ownership ratio, unchanged from previous years.

|

| OCB's expected capital increase |

Source: https://thoibaonganhang.vn/dhdcd-ocb-tang-von-dieu-le-len-26631-ty-dong-thuc-hien-chia-co-tuc-tien-mat-163151.html

![[Photo] General Secretary To Lam meets and expresses gratitude to Vietnam's Belarusian friends](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/c515ee2054c54a87aa8a7cb520f2fa6e)

![[Photo] General Secretary To Lam arrives in Minsk, begins state visit to Belarus](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/76602f587468437f8b5b7104495f444d)

![[Photo] General Secretary To Lam concludes visit to Russia, departs for Belarus](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/0acf1081a95e4b1d9886c67fdafd95ed)

Comment (0)