The Ministry of Finance proposes tax exemption for income from transfers related to emission reduction certificates, carbon credits, income from interest on green bonds...

The Ministry of Finance has just submitted to the Government a draft Law on Personal Income Tax (replacement). It mentions amending and supplementing regulations on tax issues with income from the transfer of emission reduction certificates, the first transfer of carbon credits after issuance by individuals who are granted emission reduction certificates, carbon credits; income from interest from green bonds and income from the first transfer of green bonds after issuance.

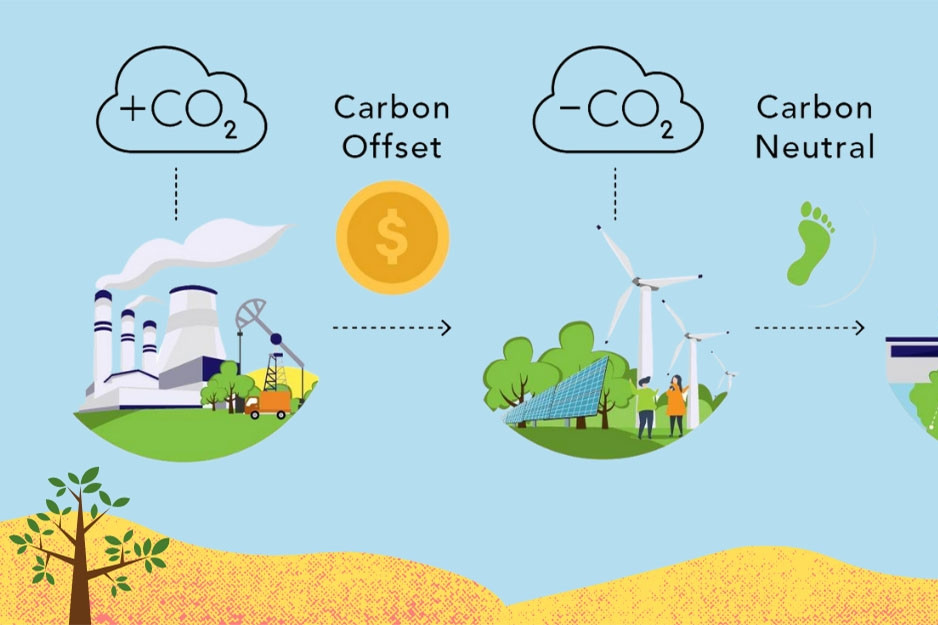

The Ministry of Finance believes that the international trend is encouraging the development of investment projects under the clean development mechanism (CDM). Because these are investment projects that produce new, advanced, environmentally friendly technology, resulting in reduced greenhouse gas emissions.

The International CDM Executive Board monitors, approves registrations and issues emission reduction certificates. Organizations and individuals have the right to transfer certificates to those in need and have additional capital to invest in clean production technology.

The Ministry of Finance emphasized that developing the carbon credit market is an important solution to achieve environmental protection goals. The Ministry also cited the Law on Environmental Protection passed by the National Assembly in 2020 (effective from January 1, 2022) which has regulations on carbon credits, carbon credit exchange and transfer mechanisms, as well as proposing that the State needs to have support mechanisms and policies to encourage development.

In addition, the Law on Environmental Protection also stipulates green bonds issued by the Government, local authorities, and enterprises to mobilize capital for environmental protection activities and investment projects that bring environmental benefits; issuers and investors purchasing green bonds enjoy incentives according to regulations and the Government shall specify details.

In fact, in recent years, many countries around the world have developed and implemented policies to promote the market for emission reduction certificates, carbon credits, and green bonds to encourage environmental protection through carbon emission reduction. Thereby, raising public awareness of greenhouse gas emission reduction, aiming for green growth and sustainable development.

Research on international experience shows that some countries such as Thailand, Malaysia, China... have regulations on tax exemption for income from transferring emission reduction certificates. Meanwhile, Mexico, India, and the US have applied many preferential policies on income tax to promote the green bond market.

In particular, in the US, income from green bonds issued by local governments is exempt from income tax. Or in Thailand and some countries, there are policies to exempt or reduce taxes on income from carbon credit transfers, the Ministry of Finance cited.

To further promote activities towards sustainable development goals in Vietnam, especially in implementing Vietnam's commitments at COP26, the Ministry of Finance proposes to study and add to the list of tax exemptions for income from the transfer of emission reduction certificates and the first transfer of carbon credits after issuance by individuals who are granted emission reduction certificates and carbon credits.

Income from interest on green bonds; income from the initial transfer of green bonds after issuance should also be considered for tax exemption.

This can be done similarly to the experience that countries around the world are applying.

Currently, the draft Law on Corporate Income Tax (amended) is also proposing to supplement the provisions on corporate income tax exemption for income from these activities. At the same time, the Government is assigned to specify and guide the implementation of tax-exempt income to suit the actual situation.

Source: https://vietnamnet.vn/de-xuat-mien-thue-voi-thu-nhap-tu-ban-tin-chi-carbon-2345478.html

![[Photo] New-era Party members in the "Green Industrial Park"](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/30/1761789456888_1-dsc-5556-jpg.webp)

![[Photo] Fall Fair 2025 - An attractive experience](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/30/1761791564603_1761738410688-jpg.webp)

![[Photo] Standing member of the Secretariat Tran Cam Tu visits and encourages people in the flooded areas of Da Nang](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/30/1761808671991_bt4-jpg.webp)

Comment (0)