The Ministry of National Defense widely solicited comments from organizations and individuals, continued to revise and complete the draft Circular guiding the implementation of policies and regimes for officers, professional soldiers, defense workers and civil servants, and people working in cryptography with salaries similar to those of military personnel in the implementation of restructuring and streamlining the military apparatus.

The subjects of application of this circular include: officers, professional soldiers, defense workers and civil servants; people working in cryptography receiving salaries as military personnel; relevant agencies, units, organizations and individuals.

Subjects not yet considered for application of policies and regimes include: officers, professional soldiers, defense workers and civil servants, and people working in secretarial work receiving salaries as female soldiers who are pregnant, on maternity leave, or raising children under 36 months old (except in cases where conditions are met, individuals voluntarily demobilize, quit their jobs, or retire early).

Officers, professional soldiers, defense workers and civil servants, and people working in secretarial work receiving salaries as military personnel who are under disciplinary review or criminal prosecution or are being inspected or examined due to signs of violations are also not considered for implementation of policies and regimes.

How to determine the time and monthly salary to calculate policy benefits

According to the Ministry of National Defense, the time of decision to reorganize and streamline the apparatus of military agencies and units by competent authorities is the time when the decision on reorganizing and streamlining the apparatus takes effect.

Within 12 months from the effective date of the decision, subjects who are decided by competent authorities to be demobilized, resign or retire before the age of maximum service age (including cases of not taking pre-retirement leave or retiring without completing the pre-retirement leave period as prescribed) shall be entitled to policies and regimes within the first 12 months.

After the above-mentioned deadline, policies and benefits will be applied from the 13th month onwards.

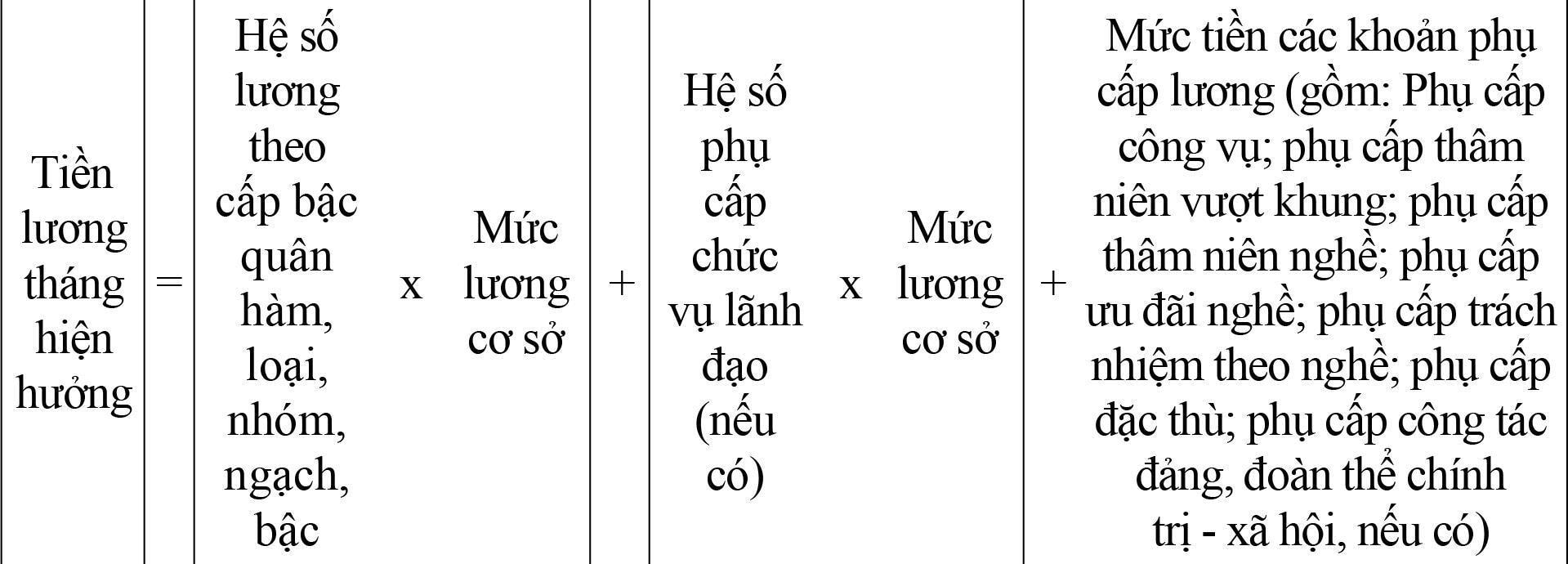

Current monthly salary used to calculate policies and regimes when demobilized, quit work or retire early includes: salary according to military rank, type, group, grade, level plus salary allowances (including: leadership position allowance; public service allowance; seniority allowance exceeding the framework; seniority allowance; career incentive allowance; responsibility allowance according to career; special allowance; allowance for party work, political - social organizations).

Specifically calculated by the formula:

The basic salary used to calculate the current monthly salary mentioned above is the basic salary prescribed by the Government at the time before the month preceding the month of demobilization, resignation or retirement with monthly pension.

The draft regulation stipulates that the number of months of early retirement to calculate the one-time pension benefit is the number of months calculated from the month of the decision to retire and receive monthly pension from the competent authority compared to the highest service age limit as prescribed in the Law amending and supplementing a number of articles of the Law on Officers of the Vietnam People's Army (not exceeding 60 months).

The number of years of early retirement to calculate the benefits for the number of years of early retirement is the number of years calculated from the month of the decision to receive monthly pension by the competent authority compared to the highest age of service as prescribed in the Law amending and supplementing a number of articles of the Law on Officers of the Vietnam People's Army.

The remaining time to calculate the allowance based on the number of years of work with compulsory social insurance contributions is the total working time with compulsory social insurance contributions (according to each person's social insurance book) but has not yet received severance pay, job loss pay, or has not yet received one-time social insurance benefits, or has not yet received demobilization or discharge benefits.

In case the total time to calculate the subsidy has odd months, it will be rounded up according to the principle: from 1 month to 6 months is counted as 5 years; from over 6 months to under 12 months is counted as 1 year.

How to calculate policy benefits for people who retire early

Article 5 of the draft circular stipulates how to calculate policy benefits for cases of early retirement.

The content of this article includes 3 clauses to guide how to calculate one-time retirement benefits for early retirement; early retirement policy based on working time with compulsory social insurance for subjects in the implementation of organizational restructuring and streamlining.

In case of remaining age from 2 years to 5 years to the highest age limit, 3 allowances are entitled.

One is a one-time pension benefit for the number of months of early retirement:

- Retire within the first 12 months from the effective date of the merger decision of the competent authority:

| One-time pension benefit level | = | Current monthly salary | x 1.0 x | Number of months of early retirement |

- Retirement from the 13th month onwards from the effective date of the merger decision of the competent authority:

| One-time pension benefit level | = | Current monthly salary | x 0.5 x | Number of months of early retirement |

Second is the allowance for the number of years of early retirement: for each year of early retirement (12 months), you will receive 5 months of current salary:

| Benefit level for years of early retirement | = | Current monthly salary | x 5 x | Number of years of early retirement |

Third is the allowance based on working time with compulsory social insurance:

| Subsidy level based on working time with compulsory social insurance | = | Current monthly salary | x | 5 (for the first 20 years of work with compulsory social insurance) | + | 0.5 x | Number of years of work with compulsory social insurance from the 21st year onwards |

The draft of the Ministry of National Defense cites a specific example: Mr. Tran Van Long (born in May 1971, enlisted in February 1990), rank of Colonel, position of Assistant at Department A, General Staff Agency. According to regulations, by the end of May 2029, Mr. Long will be 58 years old, the highest age limit according to the rank of Colonel.

In March 2025, Mr. Long's unit merged with another unit; Mr. Long was decided by the competent authority to retire early from June 1, 2025 and receive pension immediately, at the age of 54 (without retirement preparation leave).

Mr. Long is eligible to retire within the first 12 months from the effective date of the merger decision of the competent authority; the early retirement period is 4 years (48 months) and has 35 years and 4 months of service in the Army with compulsory social insurance payment.

Assuming that Mr. Long's current monthly salary before retirement (May 2025) is 30,000,000 VND; in addition to enjoying retirement benefits according to the provisions of the law on social insurance, Mr. Long is also entitled to the following benefits:

One-time pension benefit for the number of months of early retirement is: VND 30,000,000 x 1.0 month x 48 months of early retirement = VND 1,440,000,000

One-time allowance for years of early retirement is: 30,000,000 VND x 5 months x 4 years of early retirement = 600,000,000 VND

One-time allowance for the number of years of work with compulsory social insurance payment is: 30,000,000 VND x {05 months + (0.5 x 15.5 years)} = 382,500,000 VND

Thus, the total subsidy amount Mr. Long receives is: 2,422,500,000 VND

In case of remaining age of more than 5 years but reaching 10 years of the highest age limit, they are entitled to 3 allowances.

One is a one-time pension benefit for the number of months of early retirement:

- Retire within the first 12 months from the effective date of the merger decision of the competent authority:

| One-time pension benefit level | = | Current monthly salary | x 0.9 x | 60 months |

- Retirement from the 13th month onwards from the effective date of the merger decision of the competent authority:

| One-time pension benefit level | = | Current monthly salary | x 0.45 x | 60 months |

Second is the allowance for the number of years of early retirement: for each year of early retirement (full 12 months), 4 months of current salary are received.

| Benefit level for years of early retirement | = | Current monthly salary | x 4 x | Number of years of early retirement |

Third is the allowance based on working time with compulsory social insurance:

| The allowance level is calculated based on the working time with compulsory social insurance. | = | Current monthly salary | x | 5 (for the first 20 years of work with compulsory social insurance) | + | 0.5 x | Number of working years with compulsory social insurance remaining from the 21st year onwards |

The draft of the Ministry of National Defense cites a specific example: Mr. Hoang Van Manh (born July 1976, enlisted in September 1995), rank of Lieutenant Colonel, position of Political Commissar of the Military Command of District C. According to regulations, by July 2032, Mr. Manh will be 56 years old, the highest age limit according to the rank of Lieutenant Colonel.

In April 2025, Mr. Manh's unit merged with another unit; Mr. Manh was decided by the competent authority to retire early from August 1, 2025 and receive pension immediately, at the age of 49 (without retirement preparation leave).

Mr. Manh is eligible to retire within the first 12 months from the effective date of the merger decision of the competent authority; the early retirement period is 7 years (84 months) and has 29 years and 11 months of service in the Army with compulsory social insurance.

Assuming that Mr. Manh's current monthly salary before retirement (July 2025) is 25,500,000 VND; in addition to enjoying retirement benefits according to the provisions of the law on social insurance, Mr. Manh also enjoys the following benefits:

One-time pension benefit for the number of months of early retirement is: VND 25,500,000 x 0.9 months x 60 months of early retirement = VND 1,377,000,000

One-time allowance for years of early retirement is: 25,500,000 VND x 4 months x 7 years of early retirement = 714,000,000 VND

One-time allowance for the number of years of work with compulsory social insurance payment is: 25,500,000 VND x {05 months + (0.5 x 10 years)} = 255,000,000 VND

Thus, the total subsidy amount that Mr. Manh receives is: 2,346,000,000 VND

In case of less than 2 years of age until retirement age, they will receive a one-time pension benefit for the number of months of early retirement; the method of calculating the one-time pension benefit is the same as the method of calculating retirement within the first 12 months from the effective date of the merger decision of the competent authority.

The draft of the Ministry of National Defense cites a specific example: Mr. Le Minh Quan (born April 1973, enlisted in February 1992), rank of Lieutenant Colonel, position of Assistant to the Military Command of District B. According to regulations, by the end of April 2027, Mr. Quan will be 54 years old, the highest age limit for service according to the rank of Lieutenant Colonel.

In March 2025, Mr. Quan's unit merged with another unit; Mr. Quan was decided by the competent authority to retire before the age limit, with a 12-month retirement period, from May 1, 2025 to April 30, 2026, receiving a monthly pension from May 1, 2026 (53 years old).

Mr. Quan is eligible to retire from the 13th month onwards from the effective date of the merger decision of the competent authority; the early retirement period is 1 year (12 months) and has 34 years and 3 months of service in the Army with compulsory social insurance.

Assuming that Mr. Quan's current monthly salary before retirement (April 2026) is 22,000,000 VND; in addition to enjoying retirement benefits according to the provisions of the law on social insurance, Mr. Quan is also entitled to the following benefits:

One-time pension benefit for the number of months of early retirement is: 22,000,000 VND x 0.5 months x 12 months of early retirement = 132,000,000 VND

University (according to VTC News)Source: https://baohaiduong.vn/de-xuat-chinh-sach-cho-nguoi-nghi-truoc-tuoi-khi-tinh-gon-bo-may-trong-quan-doi-405205.html

![[Photo] Prime Minister Pham Minh Chinh meets with representatives of outstanding teachers](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/11/15/1763215934276_dsc-0578-jpg.webp)

![[Photo] General Secretary To Lam receives Vice President of Luxshare-ICT Group (China)](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/11/15/1763211137119_a1-bnd-7809-8939-jpg.webp)

![[Photo] Panorama of the 2025 Community Action Awards Final Round](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/11/15/1763206932975_chi-7868-jpg.webp)

Comment (0)