Editor's note: 50 years after the country's reunification, Ho Chi Minh City has transformed itself into the most dynamic economic center in the country. Here, the flow of innovation is constantly penetrating every field - from infrastructure, technology to the way people live, work and connect with the world.

However, rapid development also brings with it difficult-to-solve problems: population pressure, overloaded infrastructure, climate change, development gap between inner cities and suburbs...

In the context that the Party and State are implementing many major policies to create new positions and strengths for the country, Ho Chi Minh City - as a locomotive - also needs to quickly "solve" its own problems with a long-term, comprehensive and practical vision.

VietNamNet introduces the series of articles “ HCMC: Removing bottlenecks to reach out in the future ”. This is a collection of proposals and strategic advice from experts who have worked for many years in developed countries, have a global perspective but are always concerned about the future of the city. All share the same desire: HCMC will become a smart, livable city, in harmony with nature, with its own identity in the flow of globalization.

Dr. Bui Man is a senior engineer and Director of GTC Soil Analysis Services Laboratory in Dubai (United Arab Emirates). He is an expert in soil characterization research with over 20 years of experience.

He used to be a bridge and road lecturer at Ho Chi Minh City University of Technology, working for many large-scale infrastructure projects of the world's leading consulting companies based in the UK such as Fugro, WS Atkins, Amec Foster Wheeler.

VietNamNet respectfully introduces an article by Dr. Bui Man on issues that Ho Chi Minh City can learn from Dubai when aiming to build an international financial center.

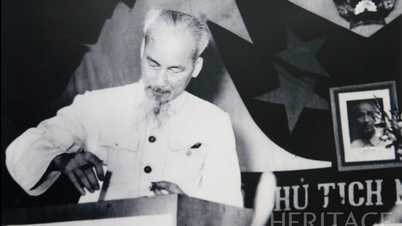

Ho Chi Minh City after 50 years of national reunification. Photo: Nguyen Hue

In the context of increasingly deep globalization and increasingly fierce competition between major cities in the world, building Ho Chi Minh City into an international financial center is a strategic step for sustainable development, demonstrating the aspiration to rise up and raise the national position.

To realize that vision, the first important thing is that we need to establish a “specific international financial center model”, a clear, competitive organizational entity with a professional mechanism, a separate legal framework, and effectively operated in the specific conditions of Vietnam.

From that model, if operated consistently and methodically, over time, Ho Chi Minh City will deeply integrate with the global financial network and become an attractive destination for international capital, human resources and financial innovation.

4 foundational pillars

A typical reference model is the Dubai International Financial Centre (DIFC).

Established in 2004, DIFC is a 110-hectare special economic zone located in the heart of Dubai, north of Burj Khalifa, on Sheikh Zayed Road. DIFC plays a pivotal role as a global financial centre for the Middle East, Africa and South Asia (MEASA) region.

The success of DIFC not only created a strong driving force for transformation in Dubai itself but also became a model for many financial centers around the world to refer to. This model is operated based on 4 fundamental pillars.

Dubai International Financial Centre was established in 2004, is a 110ha special economic zone. Photo: TL

First is its own legal framework. DIFC operates under a separate legal and judicial system, based on English common law, completely separate from the legal systems of Dubai and the UAE. DIFC laws and regulations are drafted in English, with judges from common law countries such as England, Singapore and Hong Kong. DIFC has an independent court system to resolve civil and commercial disputes, ensuring transparency, objectivity and professionalism.

Second is the favorable business environment. Foreign companies registered in DIFC can own 100% of the capital, without the need for a local partner. They are exempt from corporate income and profit tax for 50 years, and are guaranteed no personal income tax. There are no restrictions on the transfer of capital, foreign exchange and profits into and out of the UAE. This creates a transparent, stable and attractive business environment for global investors.

Third is modern facilities. DIFC provides international standard workspace and advanced data centers. There are 4 large-scale data centers serving thousands of international financial companies, ensuring strong connectivity and high security in transactions.

Fourth is the independent regulatory body. DIFC is governed by the DIFC Council, which is responsible for strategic planning and oversight of the centre's operations, together with the Dubai Financial Services Authority (DFSA), which acts as a regulatory body, closely monitoring financial activities according to international standards.

Unlike conventional financial districts, DIFC can be likened to an “international airport” where all capital, human resources, financial, legal and technological services can circulate freely while remaining within the political and geographical space of Dubai.

These four pillars have brought about enormous benefits. DIFC attracts the presence of leading companies from around the world. Currently, more than 6,920 international financial companies with 46,000 financial professionals are operating here.

Ho Chi Minh City is aiming to build an international financial center to enhance its economic position and attract global investment. Photo: Hoang Ha

Dubai welcomes an influx of high-end capital, talent and financial services, making it one of the top 20 global financial centres, driving growth, innovation and global integration.

High-quality financial, legal, auditing and consulting services have been “exported” to the entire Middle East, Africa and South Asia. This is an “invisible export” but of great and sustainable value.

Attracting experts and wealthy businessmen to work and settle down

With hundreds of financial and ancillary service companies, Dubai has a closed financial services cluster: from banking, asset management to insurance, fintech, law and technology. This ecosystem brings great synergy value, helping Dubai reduce its dependence on real estate, oil and gas and tourism. The financial sector contributes increasingly to Dubai's GDP, while reducing risks during global crises.

Transparency and efficiency in management contribute to improving credit reputation, investment environment and standardizing legal and administrative procedures according to international practices.

The international training center and incubator (called FinTech Hive) enhances human resources and promotes financial technology. The presence of tens of thousands of international experts creates a strong knowledge spillover effect. This also creates high-quality, low-risk jobs, raises standards and workplace culture, and promotes green financial services and sustainable finance.

Not only a workplace, DIFC is also a high-class urban area with living space, art, cuisine and classy amenities, attracting experts and wealthy businessmen to work and settle.

DIFC is a prime example of an “international institutional oasis” located within a city to promote growth. Like an international airport connecting the world, DIFC helps Dubai become a leading financial center while maintaining a stable institutional structure. This is the model we aim for, especially in a context where global competition for capital, human resources and prestige is fiercer than ever.

For Ho Chi Minh City, the DIFC model is a lesson in financial development and a strategic reference for building flexible institutional spaces where the city can experiment with reforms, attract international resources, and strive to become a regional hub in the 21st century.

Next article: Saigon River planning: It's time for HCMC to exploit the 'gold mine'

Vietnamnet.vn

Source: https://vietnamnet.vn/de-tphcm-tro-thanh-trung-tam-tai-chinh-quoc-te-hoi-tu-gioi-sieu-giau-nhu-dubai-2386690.html

![[Photo] Close-up of Tang Long Bridge, Thu Duc City after repairing rutting](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/19/086736d9d11f43198f5bd8d78df9bd41)

![[Photo] General Secretary To Lam attends the conference to review 10 years of implementing Directive No. 05 of the Politburo and evaluate the results of implementing Regulation No. 09 of the Central Public Security Party Committee.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/19/2f44458c655a4403acd7929dbbfa5039)

![[Photo] President Luong Cuong presents the 40-year Party membership badge to Chief of the Office of the President Le Khanh Hai](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/19/a22bc55dd7bf4a2ab7e3958d32282c15)

![[Photo] Panorama of the Opening Ceremony of the 43rd Nhan Dan Newspaper National Table Tennis Championship](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/19/5e22950340b941309280448198bcf1d9)

![[Photo] Prime Minister Pham Minh Chinh inspects the progress of the National Exhibition and Fair Center project](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/19/35189ac8807140d897ad2b7d2583fbae)

![[VIDEO] - Enhancing the value of Quang Nam OCOP products through trade connections](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/5/17/5be5b5fff1f14914986fad159097a677)

Comment (0)