On the morning of November 10, continuing the program of the 6th Session of the 15th National Assembly , presenting the Report on explanation, acceptance and revision of the draft Resolution on the state budget estimate for 2024, Member of the National Assembly Standing Committee, Chairman of the National Assembly's Finance and Budget Committee Le Quang Manh said: Regarding the assessment of the implementation of the state budget in 2023, some opinions suggested carefully assessing the mobilization rate into the state budget because it only reached 15.7% of GDP, lower than the requirement prescribed in the Resolution of the National Assembly on the national 5-year financial plan and lower than in 2022.

According to the Chairman of the Finance and Budget Committee, in the two years 2022-2023, the economy will face difficulties due to the impact of the pandemic, economic growth will not be as planned, businesses will face many difficulties... The National Assembly and the Government have issued a number of tax policies in the direction of tax exemption, extension, and reduction to support businesses and people to restore production and business on a large scale. Accordingly, the tax policy system cannot be adjusted in the direction of increasing the mobilization rate to the State budget, exploiting the revenue potential, expanding and preventing tax base erosion as required in Resolution No. 23/2021/QH15. Accordingly, it has directly affected the mobilization rate to the State budget in 2023 as the National Assembly Delegate stated.

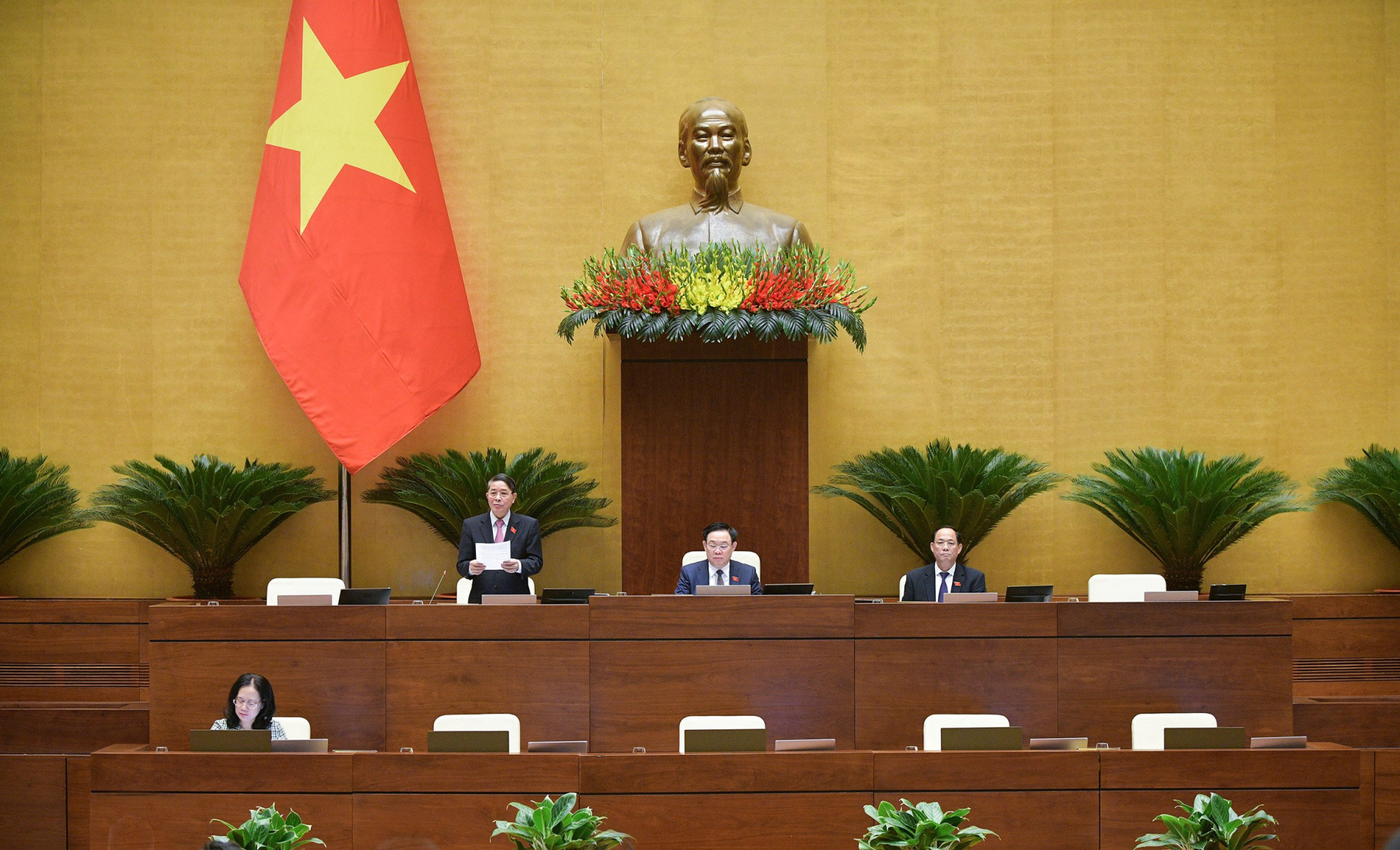

Vice Chairman of the National Assembly Nguyen Duc Hai chaired the meeting.

In the coming time, the National Assembly Standing Committee requests the Government to continue to fully, drastically and effectively implement the tasks and solutions set out in the Resolution of the National Assembly and the National Assembly Standing Committee to promote economic recovery; strictly manage revenue sources, collect correctly and fully, prevent revenue losses, contribute to increasing revenue for the State budget, and ensure the balance of revenue and expenditure of the State budget. At the same time, direct ministries, branches and localities to continue researching and proposing solutions to support and restore production and business, stabilize the macro-economy, create sustainable revenue sources for the State budget to strive to achieve the highest level according to the objectives set out in Resolution No. 23/2021/QH15.

Many opinions suggested to soon concretize Resolution No. 18-NQ/TW dated September 16, 2022 of the Party Central Committee, have a mechanism to reasonably and effectively regulate revenue from land use fees and land rents between the Central and local levels and readjust some tax revenues to contribute to increasing resources for the central budget.

Regarding this issue, the Standing Committee of the National Assembly believes that, as stated by the National Assembly Deputies, the review of adjusting land revenue into revenue to be divided between the central budget and local budgets is one of the tasks stipulated in Resolution 18-NQ/TW dated June 16, 2022 of the Party Central Committee.

Chairman of the National Assembly's Finance and Budget Committee Le Quang Manh presented a report explaining, accepting and revising the draft Resolution on the state budget estimate for 2024.

To institutionalize Resolution No. 18-NQ/TW, contributing to enhancing the leading role of the central budget, the National Assembly Standing Committee proposed that the Government continue to study to perfect the financial law on land, have a mechanism to reasonably regulate revenue from land use fees and land rents between the central and local levels, contributing to increasing the central budget revenue. This content has been shown in Clause 2, Article 4 of the Draft Resolution.

Some opinions suggested reporting specifically on the situation of equitization and divestment of state capital in enterprises and having solutions to speed up the equitization progress of state-owned enterprises, but at the same time ensuring efficiency and strictness, avoiding loss of capital and state assets in enterprises.

Overview of the meeting.

The Chairman of the Finance and Budget Committee said that in recent years, revenue from equitization and divestment of State capital in enterprises has been low, and has not met the estimate for many years. The estimate for 2023 is quite cautious (VND 3 trillion). Although the implementation in 8 months is estimated at VND 7.4 trillion, equal to 246.7% of the estimate, the estimated revenue for the whole year is equal to the revenue in 8 months, mainly due to the increase in budget revenue from divestment in local enterprises from previous years. This shows that the situation of equitization and divestment of State capital in enterprises in 2023 has not improved and is still inadequate. The Government estimates that in the 2021 - 2025 period, only about VND 26 - 27 trillion will be collected, greatly affecting the balance of resources for development investment according to Resolution 23.

Accordingly, accepting the opinions of the National Assembly Deputies, the National Assembly Standing Committee requested the Government to have a specific and clear report on the situation of equitization and divestment of State capital in enterprises to send to the National Assembly Deputies. At the same time, promptly have solutions to accelerate the progress of equitization and divestment of State capital in enterprises, ensuring efficiency, strictness, avoiding loss of State capital and assets in enterprises as stipulated in Clause 2, Article 4 of the Draft Resolution.

Source

Comment (0)