On the afternoon of November 27, the National Assembly discussed in the hall the draft Law on Special Consumption Tax (amended).

Concerned about the special consumption tax on gasoline, National Assembly delegate Ha Sy Dong ( Quang Tri province delegation) admitted that many countries tax gasoline. However, the delegate said that countries usually only tax special consumption tax or environmental protection tax.

"I cannot find any country that imposes both special consumption tax and environmental protection tax on gasoline like Vietnam," said Mr. Ha Sy Dong.

According to the Quang Tri delegation, gasoline is currently subject to two taxes with the same nature of restricting consumption: special consumption tax and environmental protection tax. Gasoline is not a luxury item, so the special consumption tax on gasoline is also aimed at protecting the environment. Therefore, the delegate proposed to study the removal of special consumption tax on gasoline. If necessary, adjust the environmental protection tax to match the objectives of this tax.

National Assembly Delegate Ha Sy Dong. (Photo: quochoi.vn)

Regarding the deduction and refund of tax for specialized cars, Mr. Ha Sy Dong said that currently, the production of specialized cars such as ambulances, money transport vehicles, prisoner transport vehicles and other specialized cars still faces many difficulties in special consumption tax policy.

The delegate used the example of ambulances to illustrate the problem. To produce ambulances, businesses must use 9-seat or 12-seat vehicles without interiors as input. These input vehicles are subject to special consumption tax with a tax rate of up to 50%. When purchasing these input materials, manufacturers must pay tax through the purchase price of the vehicle.

After converting this commercial vehicle into an ambulance for sale, the ambulance is not subject to special consumption tax. Enterprises are not allowed to deduct or refund input special consumption tax. In other words, the input is taxable, but the output is not deductible.

"The above situation leads to the consequence that the production cost of ambulances in Vietnam increases from 30 to 40%. With about 2,000 ambulances nationwide, we collect about 500 - 600 billion VND. This cost is ultimately passed on to the patients," said delegate Ha Sy Dong.

The delegate emphasized that this increases medical costs, reduces patients' access to services, and also makes domestic enterprises unable to compete with imported goods; causing great damage to the mechanical and application industries. Therefore, there must be a mechanism to deduct and refund special consumption tax for enterprises using commercial vehicles to produce specialized vehicles.

Source: https://vtcnews.vn/dbqh-chua-thay-nuoc-nao-cung-luc-danh-hai-loai-thue-voi-xang-nhu-viet-nam-ar909971.html

![[Photo] General Secretary To Lam received the delegation attending the international conference on Vietnam studies](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/26/1761456527874_a1-bnd-5260-7947-jpg.webp)

![[Photo] Nhan Dan Newspaper displays and solicits comments on the Draft Documents of the 14th National Party Congress](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/26/1761470328996_ndo_br_bao-long-171-8916-jpg.webp)

![[Photo] Enjoy the Liuyang Fireworks Festival in Hunan, China](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/26/1761463428882_ndo_br_02-1-my-1-jpg.webp)

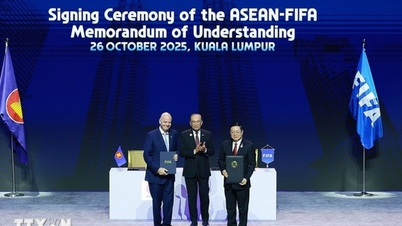

![[Photo] Prime Minister Pham Minh Chinh attends the opening of the 47th ASEAN Summit](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/26/1761452925332_c2a-jpg.webp)

Comment (0)