Up to now, 100% of enterprises have participated in using electronic tax declaration services, 99% of enterprises have registered to use electronic tax payment services with tax authorities, and 99% of operating enterprises have participated in electronic tax refunds.

Up to now, 100% of enterprises have participated in using electronic tax declaration services, 99% of enterprises have registered to use electronic tax payment services with tax authorities, and 99% of operating enterprises have participated in electronic tax refunds.

Total State Budget revenue in 2024 managed by tax authorities is estimated to exceed 16.5% of the estimate.

With an increase of 13.7% over the same period in 2023; this is the first year that the tax revenue management sector has exceeded the mark of over 1.7 million billion VND.

Thus, from 2021 to the end of 2024, the total state budget revenue is estimated to reach about 7.2 million billion VND, reaching 86.5% of the target for the 2021-2025 period of 8.3 million billion VND, of which the total state budget revenue managed by the tax authority accumulated in the 2021-2024 period is estimated to reach about 6.1 million billion VND, equal to 119% of the estimate, with an average growth rate of about 8.6%/year.

2021 - 2024 is also the period when businesses are affected by the Covid-19 pandemic and global geopolitical fluctuations. Maintaining a balance between tax policies and support policies for people and businesses implemented by the Government, the tax sector and relevant agencies has worked together to solve and bring positive results.

During the 2021 - 2024 period, the tax sector has exempted, reduced, and extended payment for nearly 3.7 million taxpayers with 8 types of taxes and 36 types of fees with a total amount of nearly 730,000 billion VND.

These are the figures announced at the Workshop "Tax and a healthy financial system for sustainable development" chaired by the Ministry of Finance , the General Department of Taxation in coordination with Lao Dong Newspaper organized on December 18, 2024.

At the workshop, Mr. Mai Son - Deputy General Director of the General Department of Taxation - Ministry of Finance said that in the period of 2021-2024, the Tax sector has exempted, reduced, and extended tax payments for nearly 3.7 million taxpayers with 8 types of taxes and 36 types of fees including: Environmental Protection Tax, Value Added Tax, Corporate Income Tax, Special Consumption Tax, Personal Income Tax, Land Rent, Registration Fee, Fees - Charges with the total amount of taxes, fees, charges, and land rents exempted, reduced, and extended at nearly 730 trillion VND.

|

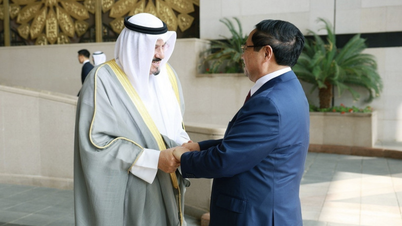

| Mr. Mai Son - Deputy General Director of the General Department of Taxation - Ministry of Finance |

After 4 years of implementing policies on tax exemption, reduction, and extension, the financial burden on people and businesses has been reduced in a challenging period, activating the internal production and business capacity of people and businesses, creating momentum for recovery and promoting economic growth, positively impacting the State budget revenue, contributing to ensuring the "dual goal" of both well implementing the State's fiscal support policies for businesses and people, and contributing to ensuring the budget revenue plan target in the period 2021-2025.

The Deputy General Director of the General Department of Taxation also said that, in parallel with the above policies, the Ministry of Finance has also directed the Tax sector to focus on implementing solutions to support businesses and people through promoting administrative procedure reform, increasing digitalization, and modernizing budget collection management.

From 2021 to present, the Tax sector has implemented the simplification of administrative procedures from 304 to 235 procedures, saving nearly 600 billion VND in tax administrative procedure compliance costs for taxpayers, integrating 122/235 administrative procedures into the National Public Service Portal.

Up to now, 100% of enterprises have participated in using the electronic tax declaration service, 99% of enterprises have registered to use the electronic tax payment service with the tax authority, 99% of operating enterprises have participated in electronic tax refund. The deployment of the Electronic Tax service for individuals for property leasing activities, electronic registration fee declaration for cars and motorbikes has reached nearly 50% of the total number of declarations.

The application of eTax Mobile application, electronic invoice application, application of Big Data and AI to manage invoices, quickly detect and prevent invoice fraud, tax fraud... are the efforts of the tax industry in the digitalization process.

Continue to promote digitalization in tax management

Mr. Hoang Quang Phong - Vice President of the Vietnam Federation of Commerce and Industry ( VCCI) highly appreciated the results achieved by the tax sector in recent times when there were many timely support policies for businesses in difficult times.

In addition, the Vice President of VCCI said that many businesses are still facing difficulties in carrying out tax procedures. According to the latest survey on the business environment conducted by VCCI in 2024, up to 31% of businesses still face difficulties in carrying out tax administrative procedures, especially micro, small and medium enterprises.

For example, despite many improvements, the process of tax declaration, payment, refund and tax settlement is still complicated, causing time and costs for businesses. Some tax regulations have not been interpreted or applied consistently between central and local management agencies, leading to a lack of transparency and unpredictability for businesses. In addition, although the tax sector has strongly transformed digitally, not all businesses, especially micro, small and medium enterprises, have enough resources and capacity to adapt.

In that context, VCCI has made a number of proposals to facilitate taxpayers to fulfill their tax obligations, including the proposal to promote digitalization in tax management. Improve technology platforms and increase support for businesses in using these systems. For example, build user-friendly portals, integrate artificial intelligence (AI) to answer questions quickly and accurately.

VCCI representative also proposed that there should be specific instructions, detailed, easy-to-understand and unified guidance documents on the implementation of tax policies; Research, amend and implement simple and stable tax policies, simplify declaration forms, minimize overlapping taxes and fees, and maintain policy stability so that businesses can confidently make long-term plans; Support micro, small and medium enterprises (SMEs) , for these businesses, there should be specific policies such as tax exemptions and reductions, support for tax compliance training, or direct consultation; Strengthen dialogue and consultation , tax authorities need to maintain regular dialogue channels with businesses to listen to feedback, as well as update practical issues in policy implementation.

Source: https://baodautu.vn/day-manh-so-hoa-trong-quan-ly-thue-d232938.html

![[Photo] General Secretary To Lam and National Assembly Chairman Tran Thanh Man attend the 80th Anniversary of the Traditional Day of the Vietnamese Inspection Sector](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/11/17/1763356362984_a2-bnd-7940-3561-jpg.webp)

Comment (0)