In the context of the Fourth Industrial Revolution taking place strongly on a global scale, digital transformation is not only a trend but has become an objective necessity for every country and in every field. In the current period, businesses around the world are having a clear change in their perception of digital transformation. Especially after the Covid-19 pandemic, digital transformation is gradually becoming a familiar concept and an inevitable trend for businesses to develop and survive.

|

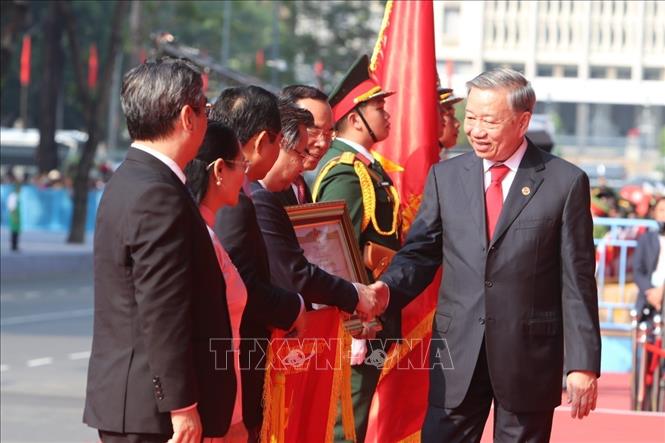

| Vietcombank Party Committee always identifies technology and digitalization as key factors that determine maintaining competitiveness. |

The key factor determining maintaining competitiveness

In Vietnam, digital transformation is highly valued by the Party and State and is considered one of the key and top priority tasks. The documents of the 13th National Party Congress mentioned digital transformation in the goals, development perspectives and strategic breakthroughs, affirming that it is necessary to "resolutely implement digital transformation, build a digital economy and digital society".

To adapt to the new situation and take advantage of the opportunities brought by the fourth industrial revolution, on September 27, 2019, the Central Executive Committee issued Resolution No. 52-NQ/TW on a number of policies and strategies to proactively participate in the fourth industrial revolution, emphasizing the urgent need to accelerate the digital transformation process. On June 3, 2020, the Prime Minister signed Decision No. 749/QD-TTg approving the national digital transformation program to 2025, with a vision to 2030. 2020 is an important pivotal year, opening a new development stage of the country. This is the milestone year of the National Digital Transformation Program, the year shaping the vision for the development of the Information and Communications industry in the next 10 years.

The Governor of the State Bank of Vietnam (SBV) issued Decision 810/QD-NHNN dated May 11, 2021, establishing the Steering Committee and the Banking Sector Digital Transformation Working Group to implement the tasks and solutions of the banking sector on digital transformation; and at the same time, May 11 was chosen as Banking Sector Digital Transformation Day. In particular, the goal for the Government and SBV is to strive to implement 100% of integrated public services on the National Public Service Portal and 90% of SBV records are processed and stored electronically. The goals for credit institutions are specified as follows:

From very early on, the Party Committee of the Joint Stock Commercial Bank for Foreign Trade of Vietnam (Vietcombank) has always identified technology and digitalization as key factors that determine the maintenance of competitiveness.

Recognizing the importance of digital transformation in the banking industry, the journey to bring great experiences to customers, since 2018, Vietcombank Party Committee has proactively assessed the impact of Digital Transformation on the banking and financial business environment, developed and issued the Digital Transformation Project in Vietcombank's operations (according to Resolution No. 369/NQ-VCB-HDQT dated August 2, 2018). In 2019, Vietcombank approved the Project to develop Digital Banking activities until 2025 (according to Resolution No. 555/NQ-VCB-HDQT dated November 28, 2019), established the Digital Transformation Steering Committee, Digital Banking Center to centrally manage, promote digital transformation strategy and digital banking culture throughout the bank. Vietcombank has strongly implemented 52 transformation programs and projects, mainly information technology projects, to lay the foundation for digital development in providing banking services.

In 2020, Vietcombank approved the initial project for Digital Banking Transformation (according to Resolution No. 80/NQ-VCB-HĐQT dated February 25, 2020).

Closely following the orientation of the Party Committee of the Central Enterprises Bloc (DNTW) according to Resolution No. 02-NQ/ĐUK dated June 7, 2021 on "Implementing digital transformation at enterprises and units in the DNTW by 2025, with a vision to 2030"; and the Digital Transformation Plan of the Banking Industry by 2025, with a vision to 2030 issued under Decision No. 810/QD-NHNN dated May 11, 2021 of the Governor of the State Bank; on the basis of inheriting the contents of the previous Project on developing digital banking activities, the Executive Committee of the Vietcombank Party Committee issued Resolution No. 339-NQ/ĐU dated July 1, 2021 on digital transformation in the context of the Fourth Industrial Revolution.

On that basis, the Board of Directors (BOD) of Vietcombank has issued: (i) Vietcombank's digital transformation action plan to 2025, with a vision to 2030 (according to Resolution No. 363/VCB-HĐQT dated July 7, 2021); and (ii) Vietcombank's digital transformation action plan to 2025, with a vision to 2030 (according to Resolution 608/VCB-HĐQT dated December 3, 2021). Vietcombank has developed a digital transformation action plan to 2025, with a vision to 2030, specifically:

- Comprehensive digital transformation based on the application and effective exploitation of new technology;

- Leading in digital transformation in the banking industry and fully meeting the digital transformation criteria of the State Bank and the Central Enterprise Party Committee;

- Achieve digital transformation maturity in leading ASEAN banks.

|

| The Party cells at Vietcombank Branch have built many specific action programs to bring digital products to customers. |

Promoting digital banking products at Ho Chi Minh City Branch

Grasping the orientation of the Party Committee of the Block and the Board of Directors of Vietcombank, the Party Committee and Board of Directors of Vietcombank Ho Chi Minh City Branch have identified the task of deploying digital banking products as a key task that needs to be promoted. Party cells at the Branch have developed many specific action programs to bring digital products to customers such as seminars introducing Vietcombank Cashup, digibiz, VCBCC (Online Trade Finance Services), focused Digibank issuance programs, etc.

Along with that, raising awareness of employees is also focused on. In 2022, the Branch regularly organizes many training sessions and communicates about new products directly at customer company headquarters, universities, etc. And sales inspection work is continuously carried out to promptly overcome and propose solutions for effective implementation.

Some key targets set out in the digital transformation program at Vietcombank Ho Chi Minh City Branch: - Number of banking transactions that customers can perform entirely in a digital environment: 70%; - Number of customers using services on electronic channels, including IB, MB, Ecom cards (excluding ATM, physical POS): 75%; - Percentage of customer transactions on digital channels compared to total customer transactions: 70%; - Minimum rate of digitalized business processes: 80%; - Minimum percentage of customer and internal records received, processed and stored electronically: 70%; - Revenue proportion from digital channels 35%; - No. 1 in the number of customers using online banking digital banking products (IB/MB), estimated to reach 18 million customers by 2025, with an average growth of 19.2%/year; - Transaction turnover reaches over 341 billion USD by 2025; - Digital banking service fee revenue grows by an average of 30%/year, reaching 4,000 billion VND in 2025. |

With the close guidance and direction of the Party Committee and the Branch's Board of Directors, the business customer departments at the Branch have implemented specific sales to each customer segment and have achieved encouraging successes, demonstrated through telling numbers.

As of August 31, 2023, the total number of digital bank issuances of the Branch's wholesale block reached more than 309 customers registered to use the service, and more than 100,000 transactions were conducted on the digital banking system with a total turnover of nearly 10,500 billion VND; in addition, the total number of digital bank issuances of the Branch's retail block reached 3,050 customers; and the total number of digibank issuances of the entire Branch reached more than 30,000 newly opened digibanks. The general goal is to bring all customer transactions to the digital channel to reduce the volume of manual document processing, free up the labor and resources of service departments to focus on implementing business targets in the most effective way.

In addition, for public administrative services, Vietcombank is the only bank commended by the Prime Minister as the first bank to connect directly with the National Public Service Portal to provide online payment solutions using the Single Sign On method between the National Public Service Portal and the Vietcombank system to help people have a completely new and convenient experience when accessing the National Public Service Portal to use level 4 public services, with 3 initial types of services: payment of traffic violation fines, personal taxes, and car/motorbike registration fees.

Vietcombank is also the leading bank in expanding partnerships in the public sector such as social insurance payments, seaports, state treasury, hospitals, transportation, logistics, etc. Up to now, Vietcombank is the only bank in Vietnam: (i) Cooperating with the General Department of Taxation to provide electronic tax payment services to foreign suppliers; (ii) Providing bilateral electronic payment solutions with Vietnam Social Security.

Over the years, Vietcombank has always maintained its position as a leading commercial bank in the country, striving to overcome all difficulties and challenges, pioneering innovation, excellently completing assigned tasks, taking the lead in strictly complying with and effectively implementing the Party's policies, the directions of the Government, the State Bank and the Party Committee of the Central Enterprises Bloc, making positive and important contributions to the common achievements of the banking industry and the development of the country.

For many consecutive years, Vietcombank has led the banking system in terms of quality and operational efficiency, maintaining its leading position in the industry in terms of state budget contribution (2019: VND 8,970 billion, 2020: VND 8,689 billion, 2021: VND 11,270 billion and 2022: VND 8,200 billion).

Vietcombank's total assets are approximately VND 1.8 million billion, outstanding credit balance is over VND 1.2 million billion. Consolidated pre-tax profit in 2022 is VND 29,919 billion. Vietcombank is currently the listed credit institution with the largest market capitalization.

In order to unanimously implement the topics set forth by the Party Committee of the Central Enterprises Bloc, it is necessary and indispensable to have the strong direction of the Party Committee, the Branch Board of Directors, together with the determination of the Party cells, all cadres, Party members, and employees of the corporate customer sector, believing that the goal of Vietcombank's digital transformation program by 2025 as set forth by the Vietcombank Party Committee will be completed.

Thus, through the systematic planning of digital transformation strategy, with the direct involvement of the highest-level leaders; at the same time, proposing a scientific and specific action plan with a clear implementation roadmap, with a mechanism to closely monitor and control progress, along with prioritizing resources and boldly applying the mechanism to attract personnel with specialized skills; Vietcombank's Party Committee and Board of Directors are approaching and implementing the digital transformation roadmap in a consistent and systematic manner; with a long-term vision and strategy based on closely following the orientations of the Party, Government and State Bank.

Source

![[Photo] Mass parade to celebrate 50 years of national reunification](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/30/825e459ee2f54d85b3a134cdcda46e0d)

![[Photo] "King Cobra" Su-30MK2 completed its glorious mission on April 30](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/30/5724b5c99b7a40db81aa7c418523defe)

![[Photo] Panorama of the parade celebrating the 50th anniversary of the Liberation of the South and National Reunification](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/30/affbd72e439d4362962babbf222ffb8b)

Comment (0)