Individuals with high incomes will have to pay taxes according to State regulations. However, there are some types of income that are not subject to tax.

According to the Personal Income Tax Law 2007, income exempt from personal income tax includes:

1. Wages for night work and overtime are paid higher than for daytime work or work within hours as prescribed by law.

2. Income from salaries and wages of Vietnamese crew members working for foreign shipping companies or Vietnamese shipping companies operating internationally.

3. Income from real estate transfers between husband and wife; biological father, biological mother and biological child; adoptive father, adoptive mother and adopted child; father-in-law, mother-in-law and daughter-in-law; father-in-law, mother-in-law and son-in-law; paternal grandfather, paternal grandmother and grandson; maternal grandfather, maternal grandmother and granddaughter; siblings.

4. Income from transfer of residential houses, land use rights and assets attached to residential land of individuals in cases where individuals have only one residential house or land.

5. Income from the value of land use rights of individuals to whom the State allocates land.

6. Income from inheritance or gifts of real estate between husband and wife; biological father, biological mother and biological child; adoptive father, adoptive mother and adopted child; father-in-law, mother-in-law and daughter-in-law; father-in-law, mother-in-law and son-in-law; paternal grandfather, paternal grandmother and grandson; maternal grandfather, maternal grandmother and granddaughter; siblings.

7. Income of households and individuals directly engaged in agricultural production, forestry, salt making, aquaculture, and fishing that have not been processed into other products or have only undergone conventional preliminary processing.

8. Income from conversion of agricultural land of households and individuals assigned by the State for production.

9. Income from interest on deposits at credit institutions, interest from life insurance contracts.

10. Income from remittances.

11. Pension paid by Social Insurance.

12. Income from scholarships, including:

+ Scholarships received from the State budget;

+ Scholarships received from domestic and foreign organizations under the organization's scholarship support program.

13. Income from life and non-life insurance contract compensation, occupational accident compensation, state compensation and other compensation as prescribed by law.

14. Income received from charitable funds permitted to be established or recognized by competent state agencies, operating for charitable and humanitarian purposes, not for profit.

15. Income received from foreign aid for charitable and humanitarian purposes in the form of government and non-government approved by competent state agencies.

16. Income of individuals who are ship owners, individuals who have the right to use ships and individuals who work on ships from activities of providing goods and services directly serving offshore fishing and exploitation activities.

Taxpayers facing difficulties due to natural disasters, fires, accidents, or serious illnesses that affect their ability to pay taxes will be considered for tax reduction corresponding to the level of damage but not exceeding the amount of tax payable.

(Article 4, Article 5 of the Law on Personal Income Tax 2007 (amended and supplemented in 2014)

How to determine personal income tax incomeTo pay the full amount of personal income tax, it is necessary to correctly determine taxable income and the personal income tax calculation formula applicable to the type of income for which you must pay tax.

Individual income tax declarers and payers determine taxable income according to the following procedure:

Step 1: Determine the personal income tax filing period.

Step 2: Determine income subject to personal income tax.

Step 3: Determine taxable income that is exempted or reduced when paying personal income tax.

Step 4: Determine personal income taxable income according to the formula

Personal income taxable income = Personal income taxable income - Exemptions and reductions in taxable income.

According to Law & Readers

Source

![[Photo] Bus station begins to get crowded welcoming people returning to the capital after 5 days of holiday](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/5/4/c3b37b336a0a450a983a0b09188c2fe6)

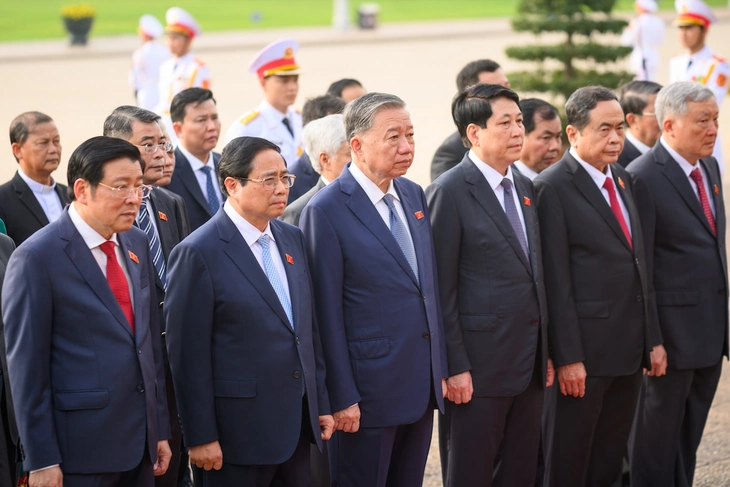

![[Photo] National Assembly delegates visit President Ho Chi Minh's Mausoleum](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/5/5/9c1b8b0a0c264b84a43b60d30df48f75)

![[Photo] Vietnam shines at Paris International Fair 2025 with cultural and culinary colors](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/5/4/74b16c2a197a42eb97597414009d4eb8)

![[Photo] General Secretary To Lam receives Sri Lankan President Anura Kumara Dissanayaka](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/5/4/75feee4ea0c14825819a8b7ad25518d8)

![[Video]. Building OCOP products based on local strengths](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/5/3/61677e8b3a364110b271e7b15ed91b3f)

Comment (0)