The takeover could land Kakao’s founder and senior executives in jail for stock manipulation, according to industry officials. Kakao rose to prominence thanks to the popularity of KakaoTalk , its instant messaging app. The company has been under investigation by a special judicial police force — including prosecutors and finance officials — since April.

Investigators suspect Kakao intentionally inflated SM Entertainment's stock price before the acquisition in February to prevent SM from selling to another potential buyer, HYBE, the management company of boy band BTS.

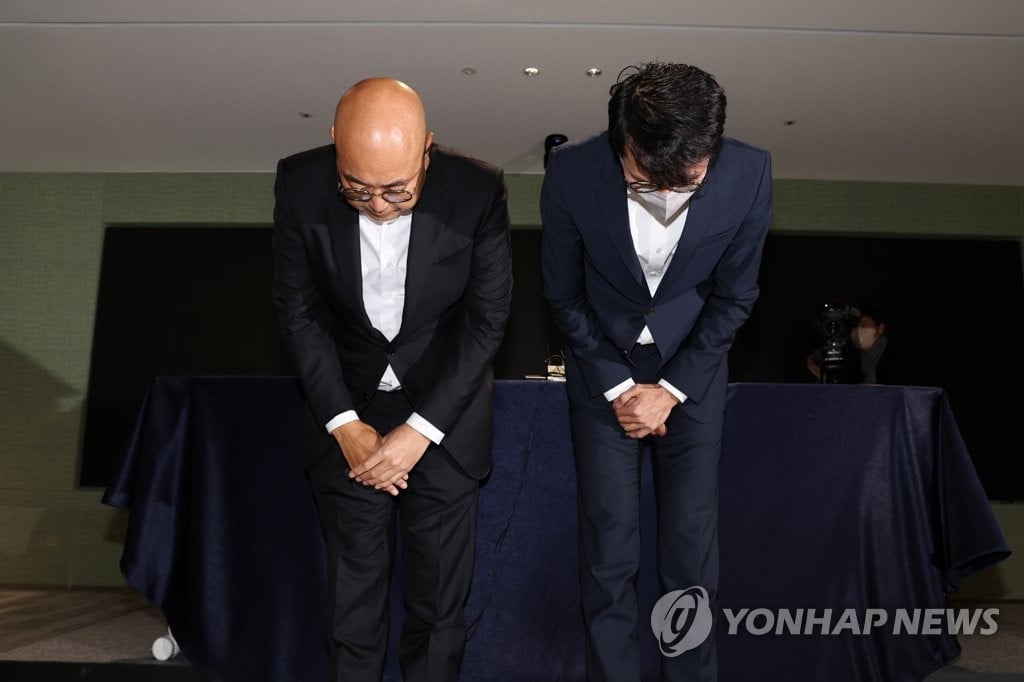

After months of investigation, judicial police arrested Kakao Chief Investment Officer (CIO) Bae Jae Hyun on October 19, affecting the group's investments in new business areas such as artificial intelligence (AI) and healthcare. Following the arrest of the CIO, the Financial Supervisory Service (FSS) summoned Kakao founder Kim Beom Su on October 23, Kakao CEO Hong Eun Taek and Kakao Entertainment CEO Kim Sung Su on October 24 for questioning over their involvement in stock price manipulation.

FSS Governor Lee Bok-hyun told reporters on October 24 that authorities were considering punishing Kakao and its executives. “Once we send the case to prosecutors this weekend, we can clarify our stance,” he said, speaking to reporters after serving as a prosecutor for two decades before becoming head of the FSS. “The latest incident has had a serious impact on the market, so we will take strict action against those responsible.”

If Kakao is fined or punished more severely, it could be forced to divest 17% of its 27% stake in KakaoBank, giving up its status as the internet bank's largest shareholder.

Depending on the results of the investigation, the Fair Trade Commission (FTC) may ban Kakao from acquiring SM Entertainment. However, the FTC explained that the investigation does not affect its evaluation of the merger because it only considers whether the deal would help Kakao monopolize the entertainment market.

Stock analysts warn investors against buying Kakao shares as lawsuits and investigations fragment the company's management team.

Prosecutors are also investigating allegations of embezzlement of KLAY cryptocurrency by Kakao's founder and CEO. Kakao's subsidiary has also been embroiled in a controversy over technology copyright infringement by smaller rivals.

Kakao is still cautious about commenting on the series of controversies because an apology or restructuring could be seen as an admission of guilt. A Kakao official said the situation will be explained through the investigation.

(According to Korea Times)

Source

![[Photo] National Assembly Chairman Tran Thanh Man chairs the meeting of the Subcommittee on Documents of the First National Assembly Party Congress](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/72b19a73d94a4affab411fd8c87f4f8d)

![[Photo] General Secretary concludes visit to Azerbaijan, departs for visit to Russian Federation](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/7a135ad280314b66917ad278ce0e26fa)

![[Photo] General Secretary To Lam begins official visit to Russia and attends the 80th Anniversary of Victory over Fascism](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/5d2566d7f67d4a1e9b88bc677831ec9d)

![[Photo] President Luong Cuong presents the decision to appoint Deputy Head of the Office of the President](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/501f8ee192f3476ab9f7579c57b423ad)

![[Photo] Prime Minister Pham Minh Chinh meets with the Policy Advisory Council on Private Economic Development](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/387da60b85cc489ab2aed8442fc3b14a)

![[Photo] Prime Minister Pham Minh Chinh talks on the phone with Singaporean Prime Minister Lawrence Wong](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/5/8/e2eab082d9bc4fc4a360b28fa0ab94de)

Comment (0)