Specifically, Nam Long Investment Joint Stock Company (stock code: NLG) said that recently, many images and information related to the official cooperation between this enterprise and Aeon Mall have been spread.

However, this information is "not entirely accurate," NLG said.

"We would like to confirm that any information about cooperation between us and our partners, if any, will be officially announced through Nam Long Group's official communication channels," said an NLG representative.

Information about NLG transferring land to Aeon spread - Photo: NLG

Previously, some information spread that NLG expected to complete the transfer of 8.9 hectares of land to Aeon Group this year. This deal is expected to bring NLG more than 50 million USD in revenue, recorded in late 2025 or early 2026.

Accordingly, the land sold to Aeon is located in An Thanh commune, Ben Luc district, Long An, on Ring Road 4, part of the new urban area project of Vam Co Dong, invested by Nam Long's subsidiary, Nam Long VCD.

The information that was circulated also mentioned that Aeon plans to build a hypermarket at the Southgate project, thereby promoting the residential development of this area.

After the above information appeared, NLG stock price increased from 39,700 VND/share on August 19 to 40,700 VND on August 21. After NLG denied the information, the stock price coincidentally had a slight adjustment.

Regarding business results, the recently released audited financial report shows that in the first 6 months of this year, Nam Long achieved net revenue of 457 billion VND, down 62% compared to the same period.

After deducting expenses and taxes, Nam Long's net profit in the first half of this year was VND94.8 billion, down nearly 62% over the same period last year.

Mr. Lucas Ignatius Loh Jen Yuh - General Director of NLG - said that revenue decreased sharply because it was not yet time to record revenue from products under construction (mainly projects Akari, Izumi, Waterpoint phase 1 and Can Tho).

According to him, the projects are expected to be completed and recorded in the following quarters according to accounting standards.

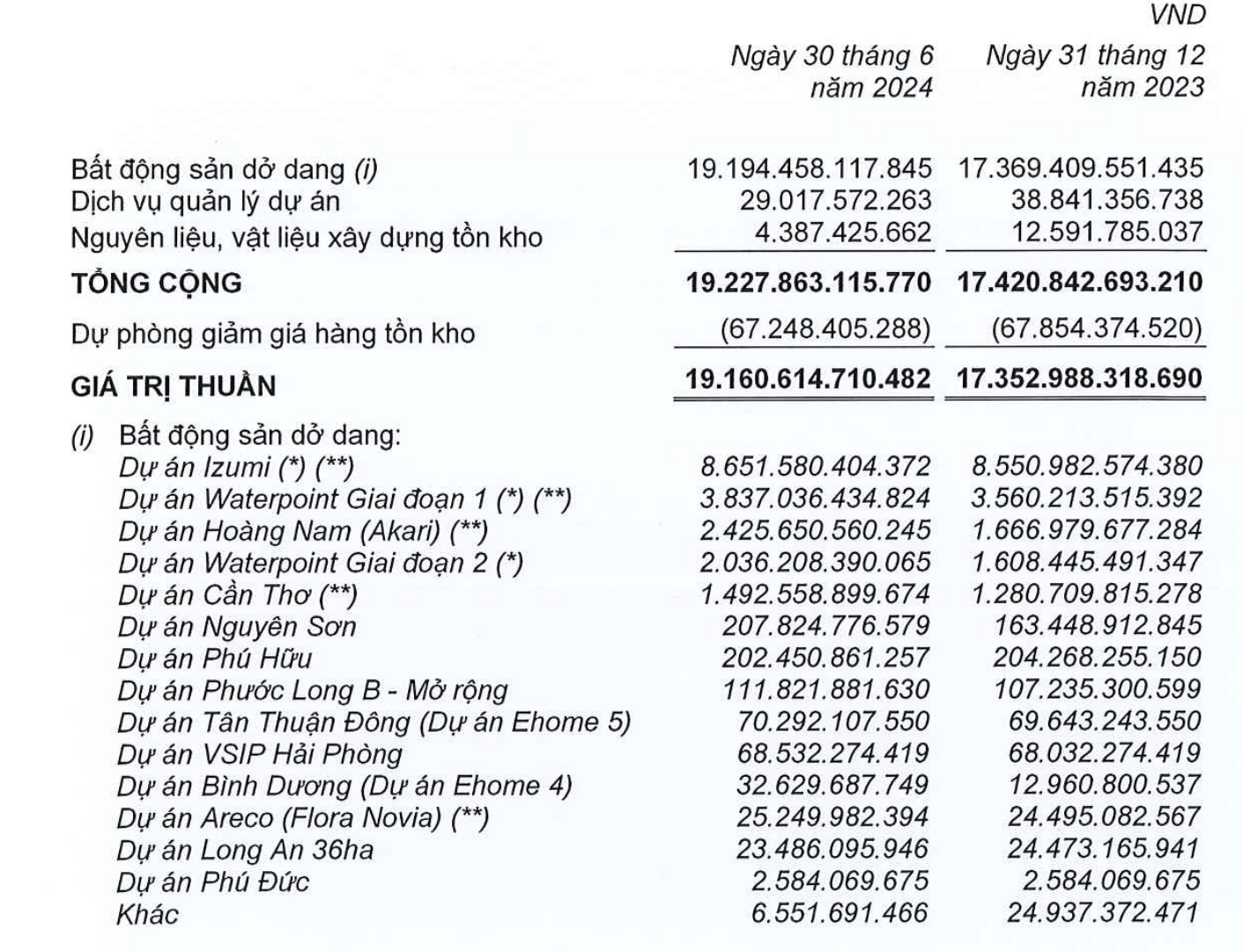

NLG's inventory value - Photo: Financial statements

So how is NLG's land fund and projects? The financial report recorded that at the end of June 2024, Nam Long's inventory reached VND 19,227 billion, an increase of more than 10% compared to the beginning of this year. The structure of Nam Long's inventory is mostly unfinished real estate.

Of which, the Izumi project has the largest value with 8,651 billion VND, followed by the Waterpoint project phase 1 with a value of 3,837 billion VND, the Hoang Nam project (Akari) with an inventory value of 2,425 billion VND, Waterpoint phase 2 with 2,036 billion VND...

In addition, Nam Long's financial report also explains in detail that the land use rights for project implementation in Long Hung commune, Bien Hoa Dong city and An Thanh commune, Ben Luc district, Long An are all used as collateral for loans of the group of companies.

Source: https://tuoitre.vn/dai-gia-bat-dong-san-bac-tin-ban-dat-cho-aeon-thu-ve-chuc-trieu-usd-20240823105434311.htm

![[Photo] Prime Minister Pham Minh Chinh receives Mr. Tomas Heidar, Chief Justice of the International Tribunal for the Law of the Sea (ITLOS)](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/6/58ba7a6773444e17bd987187397e4a1b)

![[Photo] Prime Minister Pham Minh Chinh chairs the regular Government meeting in April 2025](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/6/48eb0c5318914cc49ff858e81c924e65)

![[Photo] Prime Minister Pham Minh Chinh chairs meeting to review preparations for trade negotiations with the United States](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/6/1edc3a9bab5e48db95318758f019b99b)

Comment (0)