According to information from the General Department of Taxation, as of the end of September 2023, the tax authority had issued 12,721 value-added tax refund decisions with a total refund amount of VND 98,606 billion, equal to 53% of the value-added tax refund estimate for 2023 approved by the National Assembly and equal to 93% compared to the same period in 2022.

Mr. Mai Xuan Thanh - General Director of the General Department of Taxation emphasized that in the coming time, he will continue to direct local tax departments to review and speed up the progress of handling value added tax refunds.

Accordingly, eligible dossiers must be refunded immediately. Ineligible dossiers must be notified immediately to the enterprise and the reason for not refunding must be clearly stated.

In the last months of 2023, the General Department of Taxation will promote the application of information technology in the management of value-added tax refunds, promptly develop and promulgate a set of risk criteria in classifying tax refund dossiers and upgrade the application to automatically classify tax refund dossiers subject to pre-inspection to ensure implementation deadlines.

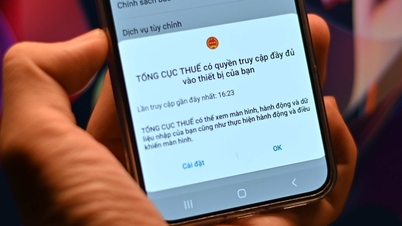

In addition, the Tax sector continues to strengthen the reform and modernization of the tax system, simplify tax administrative procedures, maintain electronic tax declaration, payment and refund services, and ensure a 24/7 technology system to support electronic tax refunds without having to go directly to the tax authority.

Risk management in VAT refund applied to exported goods and services.

Recently, the General Department of Taxation issued Decision No. 1388 on applying risk management in classifying value-added tax refund dossiers and selecting taxpayers to develop post-refund inspection and audit plans.

This Decision regulates the application of risk management in value-added tax refund work to analyze, evaluate, and rank taxpayers who are enterprises and organizations with dossiers requesting value-added tax refund.

Risk management in value added tax refund will be applied to investment project tax refund dossiers and tax refunds for exported goods and services.

Along with that, the results of the assessment and risk ranking for taxpayers with VAT refund applications are the basis for deciding to conduct pre-refund inspections and post-refund inspections for VAT refund applications of taxpayers with high risk ratings. This is the basis for developing a post-refund inspection and audit plan for VAT refund applications subject to pre-refund and post-inspection according to the taxpayer's risk ranking level .

Source

![[Photo] Prime Minister Pham Minh Chinh chairs the second meeting of the Steering Committee on private economic development.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/11/01/1762006716873_dsc-9145-jpg.webp)

Comment (0)