TTC Land: Revenue diversification helps gross profit margin increase slightly in 2023

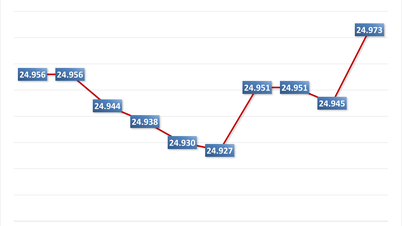

According to the 2023 consolidated financial statements, the net revenue of Saigon Thuong Tin Real Estate JSC (TTC Land, Code: SCR) recorded more than VND 371 billion. Gross profit margin improved slightly by 1.7%, reaching 28.9% compared to 27.2% in 2022.

In which, revenue from leasing and real estate services is still the main source of revenue and has grown steadily from projects such as TTC Plaza Binh Thanh, Charmington La Pointe, TTC Plaza Duc Trong, Belleza... Revenue from leasing reached nearly 111.5 billion VND, accounting for 30% of total revenue and increasing by 2.2% over the same period. Revenue from real estate services, the revenue reached over 154 billion, increasing by 66.1%, and accounting for 41.5% of the company's net revenue.

As of December 31, 2023, TTC Land's total assets reached more than VND 10,631 billion, an increase of nearly VND 940 billion, equivalent to 9.7% compared to last year. In the capital structure, total liabilities were more than VND 5,506 billion and equity reached nearly VND 5,125 billion.

In the real estate sector, from 2024, TTC Land will implement key projects. For example, the TTC Plaza Da Nang project has a prime location right in the coastal city, with the advantage of 4 facades. The project has received capital funding from My Dinh Bank branch, and the contractor Coteccons is the general contractor. In early January 2024, TTC Land signed a memorandum of understanding (MOU) with AeonMall Vietnam to implement Aeon Mall right at this project. Thereby, TTC Plaza Da Nang is expected to bring a stable source of revenue to the Company in the near future.

According to TTC Land, the TTC Land Da Nang project is one of the projects that shows the change in the company's business strategy through promoting leasing activities and operational management services to diversify business types, thereby contributing to the strategic cyclical expansion orientation to ensure stable and sustainable development in the general context of the real estate market.

Source

![[Photo] Prime Minister Pham Minh Chinh receives Swedish Minister of International Development Cooperation and Foreign Trade](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/12/ae50d0bb57584fd1bbe1cd77d9ad6d97)

![[Photo] Prime Minister Pham Minh Chinh works with the Standing Committee of Thai Binh Provincial Party Committee](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/12/f514ab990c544e05a446f77bba59c7d1)

Comment (0)