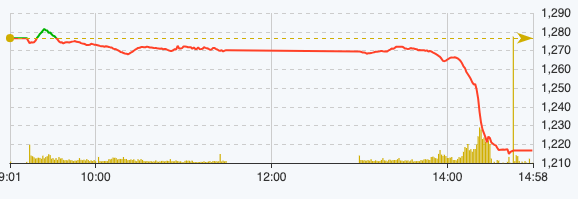

Following a strong rally at the end of last week, the market opened this week in a volatile state with persistent selling pressure.

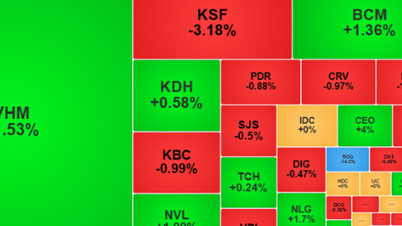

Most sectors were in the red, with the only bright spot being the plastics and chemicals sector bucking the market trend and rising. Another highlight wasSHB shares, which briefly hit the ceiling price before closing the morning session up 4.9%. VCB, BID, MBB, and CTG in the banking sector also saw slight increases.

At the close of the morning trading session on April 15th, the VN-Index fell 6.43 points, or 0.5%, to 1,270.17 points. Across the entire exchange, there were 107 gainers and 354 losers.

VN-Index performance on April 15 (Source: FireAnt).

Entering the afternoon session, the market continued to fluctuate slightly below the reference level before pessimistic sentiment prevailed, causing the VN-Index to plummet to 1,210 points.

At the close of trading on April 15th, the VN-Index fell 59.99 points, or 4.7%, to 1,216.5 points. Only 40 stocks rose, while 475 declined and 30 remained unchanged.

The HNX-Index fell 11.62 points to 229.71 points. Across the entire exchange, there were 35 gainers, 172 losers, and 35 stocks unchanged. The UPCoM-Index decreased 2.32 points to 88.89 points. Within the VN30 basket, 29 stocks declined.

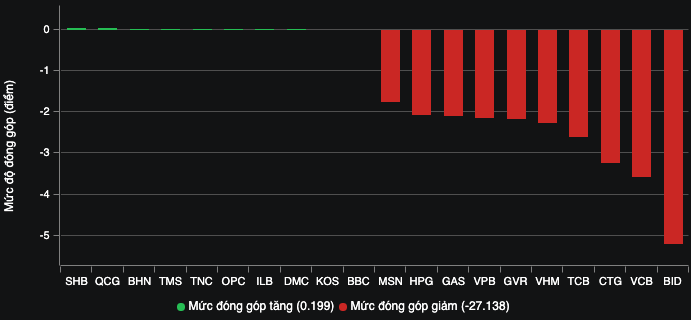

Large-cap stocks were the main culprits behind the sharp market decline, with the top 10 companies accounting for over 27 points off the overall index. The banking sector was particularly strong, with four stocks – BID, VCB, CTG, and TCB – leading the decline and collectively dragging down the index by 14.6 points, with BID alone contributing 5.2 points. VPB was also among the top 10 contributors to the market's decline, removing 2.15 points.

The remaining 5 stocks in the top 10 that weighed heavily on the index were VHM with nearly 2.3 points, GVR and GAS with 2.1 points, HPG with over 2 points, and MSN with 1.76 points.

Negative sentiment also permeated the stock market, with 16 out of 36 stocks hitting their lower limit, including VIX, SSI, VND, HCM, VCI, AGR, CTS, ORS, FTS, APS, VDS, BVS, BSI, VIG, and TVB. The remaining stocks mostly declined, with only a few remaining unchanged.

The entire market was dominated by shades of blue and red. Only a few stocks managed to buck the trend with slight gains: SHB, QCG, BHN, TMS, TNC, OPC, ILB, and KOS, but their combined contribution was only about 0.2 points.

These stocks influence the market.

The total value of matched orders in today's session reached VND 38,218 billion, a 45% increase compared to yesterday, of which the value of matched orders on the HoSE exchange reached VND 24,069 billion. In the VN30 group, liquidity reached VND 33,567 billion.

Foreign investors continued their net selling streak for the second consecutive session, with a net selling value of VND 1,238 billion today, including VND 1,841 billion in inflows and VND 3,079 billion in sales.

Stocks that experienced significant selling pressure included VHM (279 billion VND), CTG (207 billion VND), SSI (84 billion VND), VCI (77 billion VND), VNM (75 billion VND), etc. Conversely, stocks that were mainly bought up included MWG (106 billion VND), SGN (36 billion VND), SHB (32 billion VND), TCH (30 billion VND), IDC (25 billion VND), etc.

Source

![[Photo] Prime Minister Pham Minh Chinh attends the Conference summarizing and implementing tasks of the judicial sector.](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F13%2F1765616082148_dsc-5565-jpg.webp&w=3840&q=75)

Comment (0)