Hung Thinh Land Joint Stock Company (Hung Thinh Land) has just announced periodic information on its semi-annual financial situation in 2023. The company's main field of operation is real estate with a charter capital of VND 9,852.8 billion according to information from the Hanoi Stock Exchange (HNX).

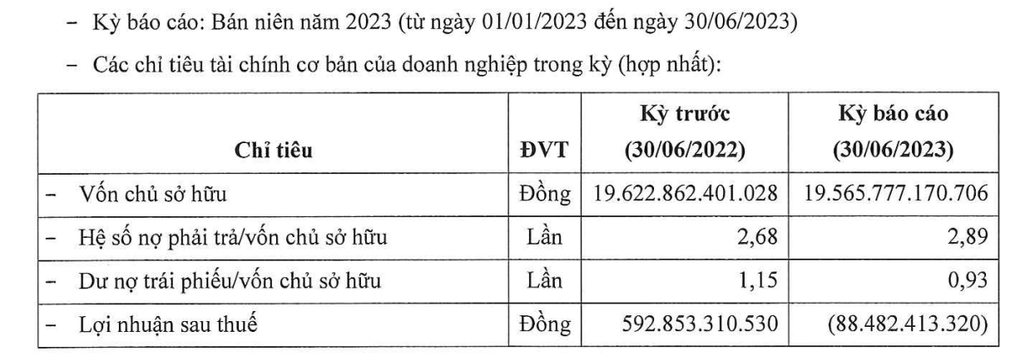

In the first half of the year, the company recorded a loss after tax of nearly VND88.5 billion, while in the same period last year, it made a profit of nearly VND593 billion.

As of June 30, the company's equity was VND19,566 billion, almost unchanged from the same period last year.

Hung Thinh Land's business results in the first half of 2023 (Source: HNX).

Outstanding bonds as of June 30 were about VND18,196 billion, down 19% year-on-year. As a result, total assets reached VND76,111 billion (about USD3.1 billion).

Compared with other listed companies on the stock exchange, Hung Thinh's total assets are only behind Vinhomes Joint Stock Company (Vinhomes - stock code: VHM) and No Va Real Estate Investment Group Joint Stock Company ( Novaland - stock code: NVL).

The size of this company is even about 3 times the total assets of Nam Long Investment Joint Stock Company (stock code: NVL) and Khang Dien Housing Investment and Trading Joint Stock Company (stock code: KDH).

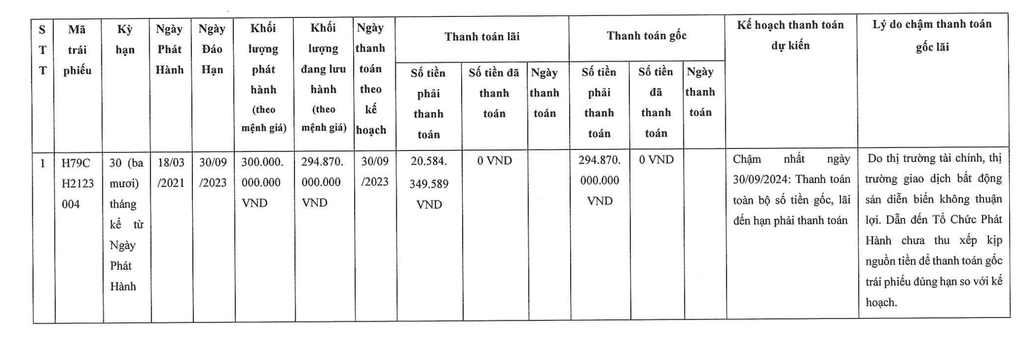

In the document announcing unusual information sent to HNX on September 30, the company said it was late in paying the principal and interest of the bond code H79CH2123004. This bond lot was issued on August 30, 2021, the maturity date is September 30, 2023, the issuance volume is 300 billion VND.

The interest payable is nearly 20.6 billion VND. The amount payable is 294.87 billion VND. However, due to the financial situation, the real estate transaction market is not favorable. As a result, the enterprise has not arranged the money source in time to pay the bond principal on time compared to the plan.

Information on late payment of principal and interest on corporate bonds (Source: HNX).

Previously, on September 23, the company announced that it had successfully extended two bond lots H79CH2124018 and H79CH2124019.

Bond lot H79CH2124018 has a total issuance value of VND 1,500 billion, interest rate of 11%/year. Bond lot H79CH2124019 has a total issuance value of VND 1,800 billion, interest rate of 11%/year.

Before the adjustment, these two bonds will mature in July and August 2024. The maturity dates after the adjustment are July and August 2026.

According to the self-introduction, this enterprise was established in 2022 under the name Dong Tien Investment Consulting Service Trading Company Limited. The main business line is real estate brokerage and distribution.

Currently Hung Thinh Land is a core member of Hung Thinh Corporation.

This enterprise currently owns and develops 59 projects nationwide, with a land fund of more than 3,300 hectares. Some of the projects of this enterprise include Lavita Charm apartment complex (Thu Duc City, Ho Chi Minh City), Q7 Boulevard apartment complex (District 7, Ho Chi Minh City), SaigonMia (Binh Chanh District, Ho Chi Minh City), Moonlight Residences (Thu Duc City, Ho Chi Minh City) ...

Source

![[Photo] Prime Minister Pham Minh Chinh chairs a meeting on the implementation of the Lao Cai-Hanoi-Hai Phong railway project.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/20/0fa4c9864f63456ebc0eb504c09c7e26)

Comment (0)